Propane inventory draws go against expectations

Propane inventory declines as winter approaches

The last two Weekly Petroleum Status Reports from the Energy Information Administration (EIA) have shown a decline in total U.S. propane inventory.

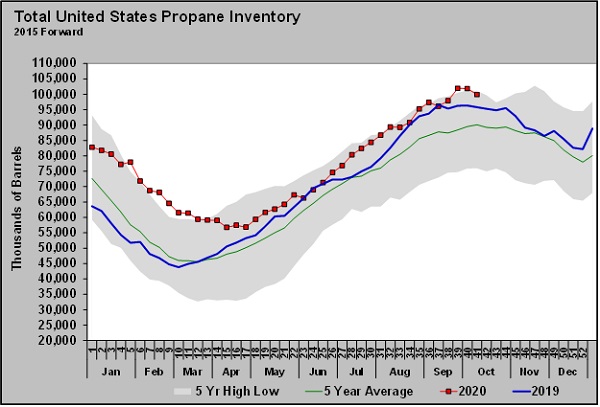

As propane retailers, should we be concerned about these declines? For the week ending Oct. 2, the inventory decline was a modest 177,000 barrels, but the draw for the week of Oct. 9 jumped to 1.945 million barrels. These draws came as industry analysts were expecting inventory builds. They also came in weeks that have averaged builds in the last five years.

Perhaps our analysis should go back a little further. For the week ending Sept. 25, the EIA reported an inventory build of 4.069 million barrels. That was an unusually high build for that time of year. In the two weeks prior to that, there had been an unusually large draw followed by a build that more than negated that draw.

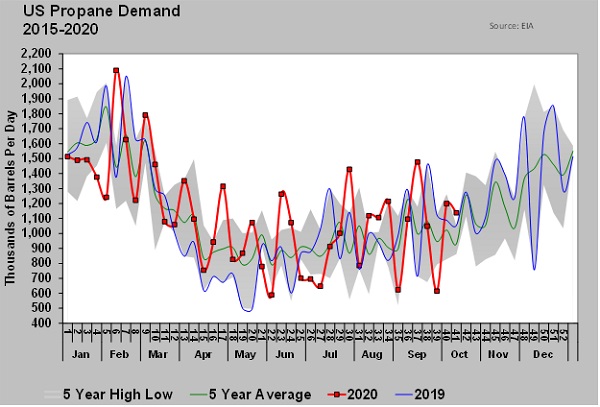

During this period, there were some extreme moves in domestic propane demand.

As the chart shows, U.S. domestic demand is historically very volatile. As we have recently discussed, domestic demand is a calculated number. The EIA gets reports on imports, exports, production and inventory changes. It takes what it gets from those reports and then calculates what domestic demand must have been to yield those results. The EIA data is only as good as the reports it receives. Is it really logical to think that domestic demand went from setting a five-year high to two weeks later setting a five-year low? We certainly can’t say that is impossible, but it seems to be improbable. Yet, we see that occurring regularly with domestic demand.

Now let’s consider what was going on during this September and October stretch that could have impacted the data the EIA received from its various sources. Tropical storm activity was very high, with multiple storms hitting directly in the areas where much of the EIA data would originate.

These storms were impacting at least three of the data inputs: exports, production and inventory levels. With so much disruption, it is easy to see how reporting could be off in any or all of these areas. Again, any error in reporting in one area is going to cause an error in reporting of domestic demand. We have to be careful not to overreact to one week’s data and focus on the overall trend. Even with last week’s large draw, U.S. propane inventory is 4.103 million barrels — 4.3 percent higher than last year and 11.6 percent higher than the five-year average. It is also just 2.907 million barrels below the all-time high of 102.804 million barrels.

The Midwest is the only area of the country where inventory is below last year at this time. Midwest inventory is 1.505 million barrels, 5.5 percent below last year. The multi-year trend has been to reduce Midwest inventory while holding more inventory on the East Coast. The Midwest is oversupplied, which explains why less inventory is needed and why producers are moving propane to the coasts instead of holding it in the Midwest. We have chronicled recently our concerns about local supply market shortages this winter, especially in the Midwest.

But even in this case, it is not the overall inventory level that is the concern. The concern is more around infrastructure limitation in getting supply where it needs to be. The EIA is predicting 14 percent more domestic propane demand this year than last. Even with this increase, we aren’t really concerned with inventory at the hubs holding up. We think there is more than enough inventory in place, even if the EIA prediction is correct. But that increased demand will almost certainly cause issues from time to time with getting propane where it needs to be.

With that said, we do see scenarios where we could come out of this winter with less inventory. If propane production remains reduced through next summer, we may find conditions that will put more upward pressure on prices to start the winter of 2021-22. Look for opportunities to put some baseline price protection in for next winter using financial swaps.

Call Cost Management Solutions today for more information about how Client Services can enhance your business at (888) 441-3338 or drop us an email at info@propanecost.com.