Propane marketers endure another mostly mild winter

The winter heating season amounted to too little cold for too many propane marketers. Photo: iStock.com/RealCreation

This winter’s heating season brought some dramatic weather extremes and an assortment of localized logistical challenges for propane deliveries, but an overall lack of consistent cold resulted in lackluster load – again.

Frigid-enough winters are sure to come, yet this trending meteorological mediocrity of too much warmth further emphasizes the need for business owners to actively pursue additional avenues of propane sales, as with propane appliances, autogas and agriculture.

“You can’t worry about the weather because you have no control over it. The main thing is to grow your gallons,” says D.D. Alexander, the president and owner of propane supplier Global Gas, who also serves on the National Propane Gas Association’s (NPGA) Supply and Infrastructure Task Force.

A stepping up of efforts to convert fuel oil customers to propane while also pushing other potential revenue sources is a necessary addition to marketers’ business models. Expanded efforts include increased usage of LP gas-fired hot water heaters, dryers and other appliances around the house; vehicles, especially school buses and other municipal and commercial fleets; and lawn mowers, irrigation pumps and the like.

“I don’t get too worried about the warm winters – even though we’ve had two in a row – because they move in cycles,” Alexander says. “The cold weather will still come.”

However, Alexander explains, “marketers are going to have to be more aggressive than they have in the past” to offset the installation of more-efficient furnaces and appliances along with better-insulated newer homes.

This year marked the U.S.’ sixth-warmest winter in the 123 years that records have been kept, according to the National Oceanic and Atmospheric Administration.

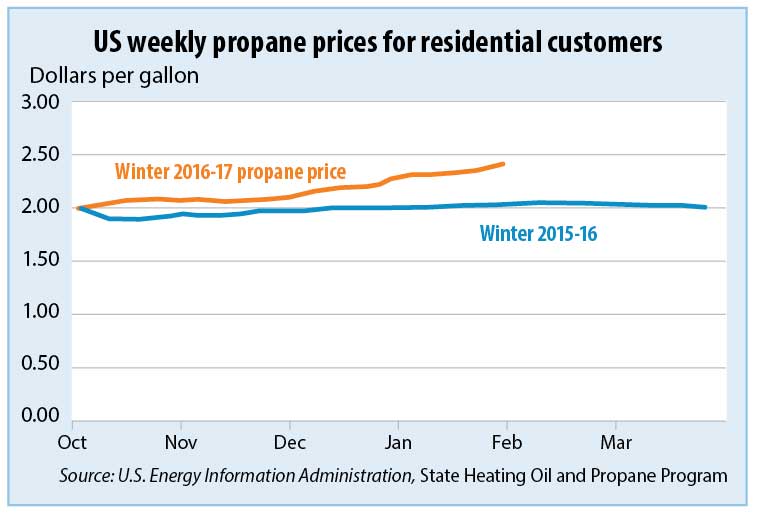

U.S. residential propane prices trended higher this winter, up 37 cents a gallon compared with the same time last year, to $2.39 a gallon Jan. 30, 2017. Click to enlarge.

An especially warm February, followed by a huge and harsh March weather system, combined to threaten the famous cherry blossom blooms in Washington, D.C. The widespread storm impacted about 120 million Americans, inducing many of them to stay home, hunker down and crank up the heat amid the late-season freeze. Nashville, Tennessee, and Atlanta experienced temperatures in the teens, and more than 6,000 flights were canceled across the country.

But for many propane marketers, the heating season mainly amounted to too little cold that was too late in coming.

“There’s no way to make up for this winter,” says Alexander, reflecting on the major March nor’easter that swept through New England and points west and south, even covering the Carolinas in an unseasonable blanket of snow.

Multiple power outages occurred in the Northeast, driven by 60-mph winds and near-hurricane-force gusts; 41 in. of snow buried Bridgewater, New York, while the 31 in. that fell on Binghamton, New York, amounted to the highest amount ever experienced by the town.

“It’s always nice to start out with a healthy first quarter,” Alexander says of the Northeast’s March madness. “That’s going to make a cruddy beginning of the year a bit better, but it won’t erase the warm winter we’ve had.”

Assessing alternatives

New England experienced a cold December, but temperatures turned mild in January and February, says Leslie Anderson, the new president and CEO of the Propane Gas Association of New England.

“It’s going to be tough for some of the marketers because the volumes aren’t as much as we’d like them to be,” she says. “It’s another mild season on top of a mild winter last year, which does make it tough for some of the members.”

Alternatives going forward are gaining heightened attention, according to Anderson.

“There’s a big interest in autogas among the members. It’s getting more traction than in the past,” she says. “We need more stations for those to have it really take off beyond the fleet market – which is where it is right now.”

New England’s shorter growing season puts some limits on propane’s role as a lawn mower fuel, although Anderson says additional LP gas grass-cutting demonstration projects can assist in attracting the professional mowing industry to propane’s attributes.

“We do have more landscapers branching out into fire pits, and that’s something to put on the list” of categories to pursue, she says. Interest among New Englanders in outdoor kitchens is also heating up.

“You really can’t rely on the heating season anymore in Florida,” says Greg Blazina, director of propane operations at Florida Public Utilities Co., a subsidiary of Chesapeake Utilities Corp. “You really can’t factor it into your gallons. If you get cold, it’s a bonus.”

While the March nor’easter did indeed dip down south, whatever freezing there was stayed in the northern portion of the state where there are few commercial citrus growers, thus extinguishing load prospects from orchard heating units.

Florida’s overall winter was a hot one, with little cooling rain to fill propane sales ledgers. Pricing was upped 10 cents to 15 cents per gallon just to cover margins.

“It’s been nothing but dry. Even the lakes are majorly dry. I’ve never seen a winter this dry,” Blazina says.

“We’re not running fireplaces; we’re having to run the air conditioning nonstop,” Blazina adds. “If it’s in the 50s, you’re running your fireplace and pool heaters.”

Temperatures were barely reaching down to the 50-degree level, which is not the norm.

“We’ve yet to cover any plants this year,” marking the first winter in memory that this task was unnecessary, Blazina says. Of his propane industry colleagues, he says, “A lot of them are moaning and groaning.”

The bulk of Blazina’s business in Florida is residential. Most sales revolve around stoves, hot water heaters, dryers, pool heaters and a more recent trend of supplying autogas for the school bus segment. Fueling forklifts is another source of revenue.

“The nice thing about forklifts is that it’s a yearlong load,” he says. “We used to move millions of gallons out to the nurseries, and then they ran natural gas lines out there and that market went away.”

Drastic measures

Weather drama rumbled through North Dakota when 111 passengers on an eastbound Amtrak Empire Builder were stranded for 14 hours after the train became stuck in a 25-ft.-high, 200-ft.-long snowbank outside Rugby, North Dakota. Named for a village in England, Rugby bills itself as the Geographic Center of North America.

Luckily, the train retained electrical power and the dining car stayed open as rescue crews from the Burlington Northern & Santa Fe Railroad fought to dislodge the immovable cars. Reinforcement locomotives chugged in to push and tug fore and aft, augmented by trackside skid-steer loaders plunging into the giant drift.

Unfortunately, the climate-borne excitement was a bit of a fluke, according to energy manager Keith Dibble at the Rugby-based Envision Cooperative.

“It’s kind of been hit and miss. We’ve had some cold snaps, and then it’s been warm,” he says.

Envision’s sales volumes were up 30 percent over last year – the fall harvest burned a bountiful amount of propane – but last year they were down 25 percent over the previous year, Dibble says.

Crop drying wasn’t lucrative everywhere, however.

“Crop drying was very moderate at best. We had some crop drying, but it was sporadic and short-lived,” says Greg Noll of the Propane Marketers Association of Kansas. “The weather in Kansas is as warm as it can possibly be.”

Winter temperatures in the 70s have created an undesirable business environment, Noll adds.

“We’re 25 percent to 30 percent below our previous two years. Because of our loss of volume, we see that the average price has taken an increase.” Marketers “have been making a few bucks by increasing their margins,” he says.

“Weather is the most important factor for success in the propane industry, and it’s the thing that we have the least control over,” he adds. “It could be a big factor, with some smaller, independent companies deciding to get out of the business.”

Marketers are being forced to take drastic measures to overcome winter challenges, Noll says, with expense management and controls taking hold in Kansas.

“You have to be prepared, have a plan and work that plan,” he adds.

Noll suggests that marketers maximize profits, minimize expenses, charge a fair price and keep tanks filled, even when the heating season is over. Summer pre-buys are being promoted by 80 percent to 90 percent of Kansas retailers.

“That’s certainly a tool in almost every marketer’s toolbox,” says Noll, adding that the strategy shields customers from experiencing overly expensive heating bills when extreme cold eventually comes calling.

“We continue to see a steady flow of propane appliances, and we see a continuation of new appliances that run on propane,” he says.

A government appliance rebate program implemented in 2004 is moving sales and boosting loads.

“We’re always focused on autogas opportunities,” Noll says. “Kansas is an agricultural state, and people in agriculture have known about propane since the 1940s and 1950s. Now’s the time to promote that.”

Optimizing customers

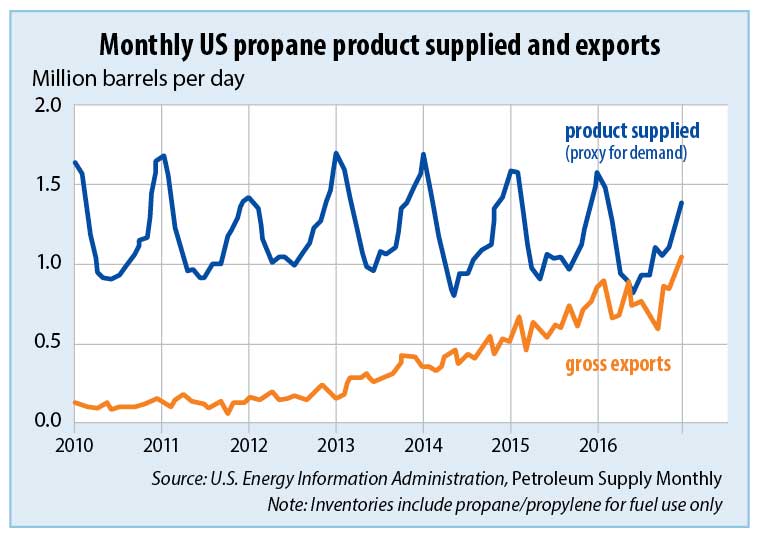

New and expanded U.S. export terminals and a growing shipping fleet have increased the capacity to export propane, especially during winter months. Click to enlarge.

Matheson, which operates in 38 states, is always seeking autogas opportunities, says Dave Bertelsen, its national propane product manager.

School buses and other vehicle applications “could be the saving grace for the industry,” he says.

This is especially true amid winters that lack sufficient heating degree-days, like in 2016-17, though margins at Matheson have been strong.

“Our commercial business is strong and growing,” sparked in part by forklift and warehouse heating accounts, Bertelsen says. “It’s just a matter of optimizing those customers.”

The residential market is struggling because of conservation, degree-days and natural gas expansion, he adds. Matheson’s load was down 25 percent to 30 percent along the East Coast; gallons burned in the Ohio River Valley fell 20 percent.

“We have a pretty significant outside sales force,” Bertelsen says. “We’re adding a couple more bullets into the chamber” to seek additional avenues for propane use.

Matheson’s venture into California’s wine country is reaping success as about 150 vineyards are utilizing propane for utility trailers, warehouses and forklifts.

Also in California, gallons were up 25 percent at the fifth-generation family-owned Sheldon Gas Co.

“We had a very nice heating season compared to the last five years,” says CFO and co-owner Jill Hopkins. “The rain and cold don’t always go together,” but this year the Golden State had plenty of both.

“When it’s raining here, it gives the illusion of winter,” she adds. “It’s been a long time since we’ve had normal rain, then we had huge amounts over a period of time – over and over again.”

And while the intense rainfall alleviated some of California’s lingering drought concerns, it also produced logistical obstacles.

“We had some challenges in our deliveries – mudslides, road washouts and flooding. We drove a lot of miles to keep those customers warm and dry,” Hopkins explains. “We were really busy. We were pushed, but nobody was complaining.”

Because of widespread road closures, Sheldon Gas wasn’t depending on transports to deliver gas; railroad tankers were rolled in instead.

“Residential is the heart of everything for us, but like everyone else we’ve been looking to expand our markets,” Hopkins says. “Our biggest opportunity in this area is agricultural pumps. We live in a big wine production area.”

Walnuts and almonds are commonly grown in addition to grapes, and propane-powered equipment assists farmers in complying with state antipollution regulations pertaining to diesel fumes.

California’s Delta Liquid Energy also endured mudslide-induced traffic detours during a respectable heating season, according to Robert Jacobs, its vice president of business enterprises.

“We had big issues on the Big Sur coastline to get to our customers up there,” he says.

The Northwest experienced one of its coldest and wettest winters, Global Gas’ Alexander says. Snowfalls accumulated, leading to tight availability of transports and tankers in a region not served by pipelines.

“They rely a lot more on trucks and rail than we do elsewhere in the country,” she says.

NPGA’s Supply and Infrastructure Task Force mobilized by sending letters to railroad executives, asking them to make propane shipments a priority – a tactic that Alexander says got traction and helped to ensure a suitable supply flow.