Propane price reflects oversupply nationwide

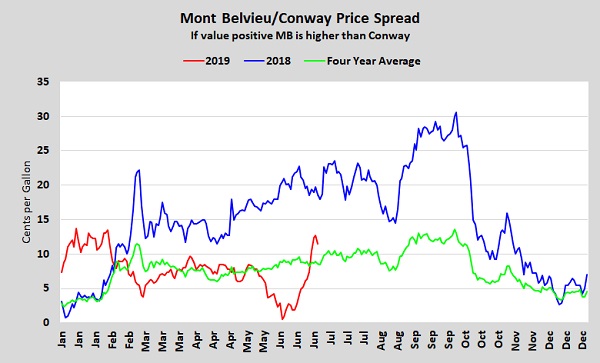

The price spread between Mont Belvieu LST propane and Conway propane ballooned last month. Leading up to June, the difference in prices between the two hubs had been narrowing. Mont Belvieu LST held just a half-cent premium over Conway on June 4.

Slower inventory builds in the Midwest versus the Gulf Coast were encouraging the price spread to narrow. But last month, with domestic demand very low and production in the Midwest high, Conway prices have plunged.

The spread reached 12.75 cents per gallon last Wednesday before closing some by the end of the week. Conway trading about 5 to 7 cents below Mont Belvieu is enough spread to encourage the movement of product to the Gulf Coast. Obviously, the spread has gone well above what’s necessary to cover transportation costs out of the region. The price reflects oversupply nationwide.

With export options and petrochemical demand, the Gulf Coast is generally going to be the highest-priced market. When supply and demand in that region is balanced, supply points upstream simply price to cover the transportation costs to the Gulf Coast. When the Gulf Coast is oversupplied, the price spread in the upstream markets gets wider.

An even more dramatic example is the Edmonton, Canada, market that has historically moved into the U.S. Midwest. Propane there is now valued at just 13 cents, reflecting that it is the furthest point up the supply chain.

Such low prices should discourage propane production. Typically, that is what happens with any commodity. If the commodity gets oversupplied, its price falls, disincentivizing its production. Commodities markets are generally very elastic in that way, quick to respond to over- or undersupply. Propane can be a different kind of animal. Most propane comes from natural gas processing where it is just one of a group of products. Producers look at the economics for the entire group of products, not just propane, when deciding on whether to continue to drill for natural gas.

Propane is also a byproduct of the crude refining process. It is a very small factor in the overall refinery economics. Refiners make their throughput decisions based off the demand for gasoline and distillates, not propane.

In the chart above, the blue line is last year. The price spread was essentially reflecting that propane was oversupplied. But even when the spread reached 30 cents, propane supply kept growing. The spread didn’t come down until demand picked up in the winter months.

With 80 percent of propane supply coming from natural gas, the total economics for natural gas/natural gas liquids production will have to turn negative for a significant change in propane supply to occur. Currently natural gas production is at record highs. Drilling activity remains very close to where it was last year. As of June 21, there were 177 rigs drilling for natural gas in the United States, down just 11 rigs from the same week last year.

Meanwhile, the potential for a global economic slowdown hurts the U.S. export market. There will be another 175,000 barrels per day (bpd) of propane/butane export capacity by the end of the year. Also, we would expect over time more Canadian propane, which has been entering the U.S. Midwest from Edmonton, to move to Asian markets through a new export facility on the Canadian west coast. It will take strong global demand for those expansions to see their full potential.

It seems propane is destined to be oversupplied in the short term. That is good news for propane consumers. At this point, the price pendulum can only swing higher if propane fundamentals improve. That means less supply or more demand. With winter-month propane prices 11 cents higher than front-month prices in Mont Belvieu, and 24 cents higher in Conway, a significant change in fundamental conditions is already priced into the propane market. A lot of market factors have to change for fundamental conditions to improve by winter, making the winter premium ominous.

A spike in crude prices, due to a war between the U.S. and Iran, could pull propane prices higher in the short term, regardless of propane’s overall supply/demand balance. But longer term, supply and demand have to get more balanced for the propane price pendulum to swing higher for a sustained period.

Call Cost Management Solutions today for more information about how Client Services can enhance your business at (888) 441-3338 or drop us an email at info@propanecost.com.