Propane prices are riding the crude wave

Propane is now valued at the same price level it reached at its peak last winter, which is concerning because we remain in the throes of a hot summer with winter demand just ahead. In this Trader’s Corner, we disclose that you can place much of the blame on the rise in crude prices.

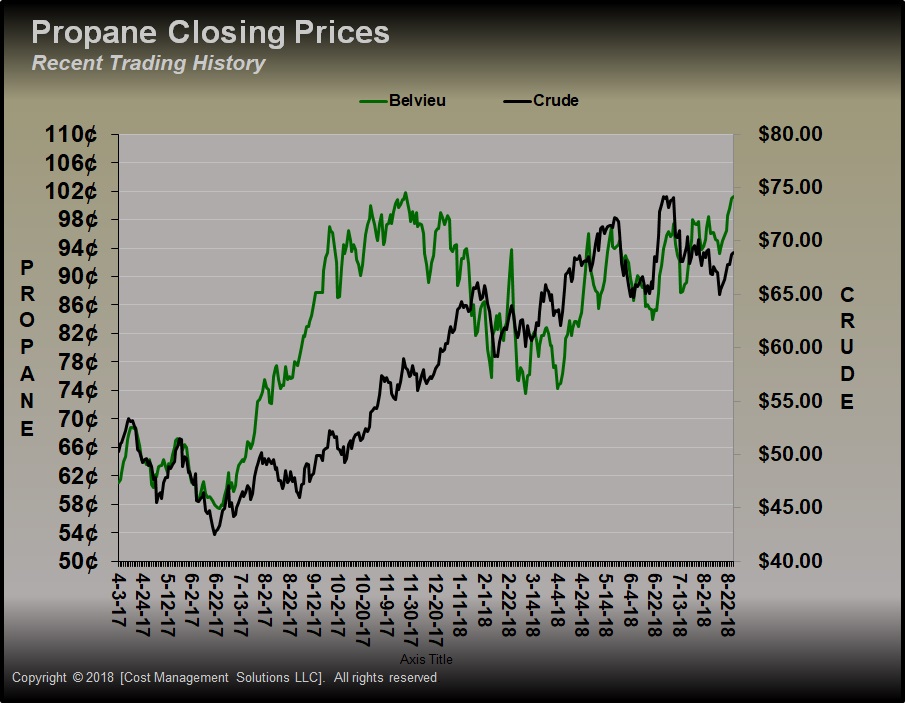

The chart above plots Mont Belvieu LST propane and WTI crude prices since the end of the 2016-17 winter. Propane’s price bottomed out in June 2017 and increased sharply through the summer as traders worried inventory was not increasing adequately.

The rally continued through the end of November until higher prices sank propane export volumes. Pressured by the lower export volumes, Mont Belvieu LST propane prices fell quickly. The fall in propane prices ended when rapidly rising crude prices helped establish a price floor.

Note that Mont Belvieu LST propane has been swept along with crude since April. There have been a few periods of separation, but the chart clearly shows Mont Belvieu LST tracking crude closely.

All of the gain in propane’s value this year can be attributed to the stronger pricing environment for crude. In fact, one could argue propane fundamentals are having less influence now than they did a year ago, despite less inventory. At this time last year, Mont Belvieu LST propane was trading at 67 percent of crude, while today it only is at 62 percent. If traders were seeing propane fundamentals more supportive this year, it is highly likely that propane’s value relative to crude would be higher.

The outlook for crude remains bullish, with many predicting tighter supplies by the end of the year. U.S. sanctions against Iran could take 1 million barrels per day of supply off the global market. Venezuela’s crude production is already half of what it was at its peak due to the country’s economic and political issues. This week, the International Energy Agency said it expects Venezuela’s production to continue to erode.

The biggest obstacle is the trade war between the U.S. and China that could derail the global economy, adversely affecting crude demand. If the trade wars are resolved, and the sanctions against Iran are successful, we should expect crude and propane to remain in an uptrend.

If propane prices separate from crude and move lower, as they did last December, it will likely be for the same reason: a decline in propane exports.

Call Cost Management Solutions today for more information about how Client Services can enhance your business at (888) 441-3338 or drop us an email at info@propanecost.com.