Propane prices defy inventory trend

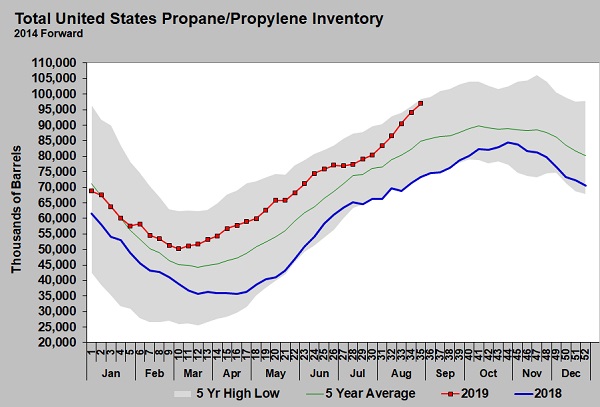

U.S. propane inventory is very close to breaking its five-year highs. Those inventory highs were set in 2015 and 2016.

During July, it looked as if inventory was trending toward the five-year average and getting just a little closer to the comparatively low level of inventory last year. That trend definitely changed in August as inventory gains became above average.

That trend continued through Aug. 30, which is the latest data available from the U.S. Energy Information Administration (EIA). As of that date, U.S. propane inventory was at 97.019 million barrels, putting it 23.615 million barrels higher than last year and 12.163 million barrels higher than the five-year average.

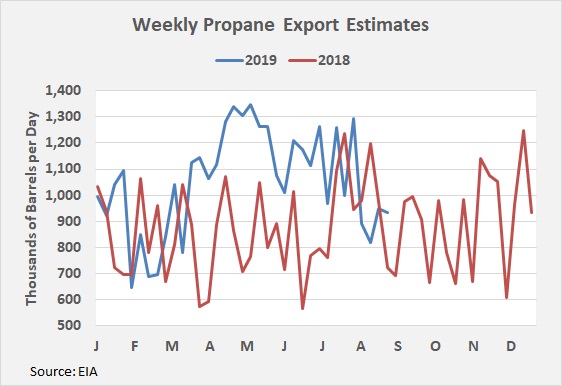

Propane production has been very high, necessitating a high number of exports to manage inventory levels. Exports had been very strong through June, but they started slipping in July and August.

Exports peaked in May at 1.294 million barrels per day (bpd). Many would consider that rate the maximum operable export capacity. Some use 1.25 million bpd as the maximum sustainable export capacity.

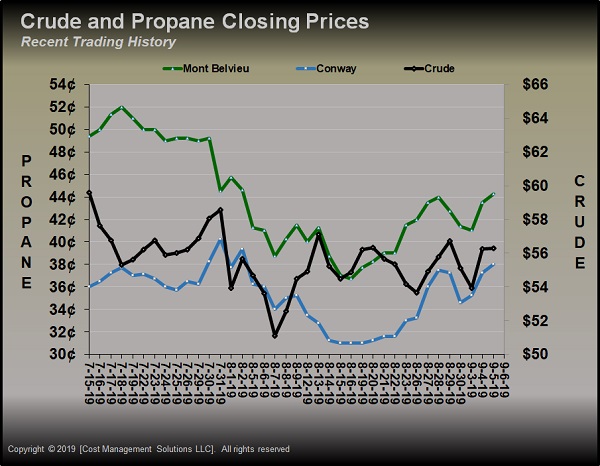

The export rate slowed in June and July to around 1.119 million bpd. Through that period, inventory builds had been held reasonably in check. But in August, the export rate fell to 978,000 bpd, or 316,000 bpd less than the May peak, leading to the above-average builds in inventory throughout the month. Interestingly though, propane prices went on a bit of an uptrend, even as the inventory gains strengthened in August.

Propane prices were in a downtrend until mid-August when they turned. An improvement in crude prices was partly responsible, but there have been plenty of days during the upturn in prices where propane posted a higher percentage gain than crude.

We presume it is a combination of seasonal influences and the fact that prices became appealing enough to interest buyers despite the less-than-supportive fundamentals. Sellers could also be tightening things up a bit on the prospects that the additional export capacity expected by the end of this month could slow the inventory build and perhaps even contribute to an above-average draw on inventory this fall.

We have to be a bit cautious on that thinking, though, given exports have been running below operable capacity over the past three months.

Call Cost Management Solutions today for more information about how Client Services can enhance your business at (888) 441-3338 or drop us an email at info@propanecost.com.