Propane prices fall mid-winter

It is the middle of winter, yet propane prices are falling even as crude prices rise.

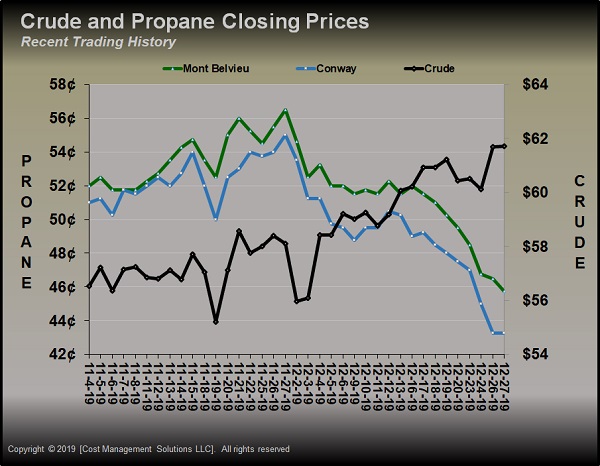

As the chart above shows, West Texas Intermediate (WTI) crude has been on a general uptrend over the past two months. Through November, propane prices were generally following crude higher. But, in December, crude and propane prices have diverged.

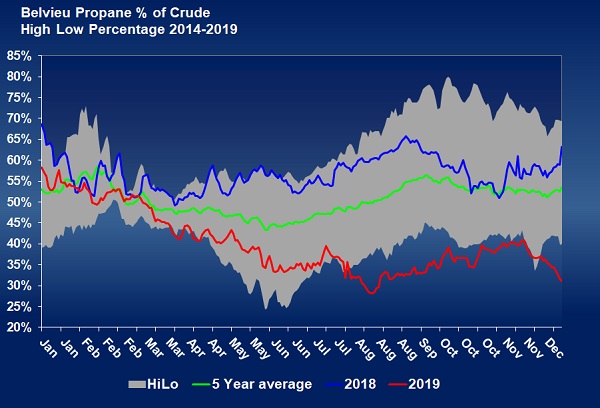

With the divergence, propane is trading at a five-year low value relative to WTI for this point in the year. Mont Belvieu LST finished Dec. 27 trading at just 31 percent of the value of WTI crude, and Conway was at just 29 percent. Mont Belvieu propane has not quite fallen to the historical low of 24 percent set in mid-2015, but it is certainly trending rapidly in that direction.

In 2016, with inventories high, Mont Belvieu propane fell to just 30.125 cents. Conway tumbled to 27 cents that year. Those lows happened in mid-January in 2016. Propane’s value hasn’t quite reached those levels, but at the rate it is currently falling, it may not be too far by mid-January 2020.

Propane’s values were collapsing in 2015 and 2016 for the same reason they’re falling now. Record-high production was overwhelming domestic demand, and at the time, there simply wasn’t enough export capacity to deal with the excess. The result was a massive buildup in inventory levels. Inventory reached a historic high of 106.202 million barrels ahead of the 2015-16 winter. It then built again to 104 million barrels ahead of the 2016-17 winter. Winter demand simply couldn’t bring those inventory levels down, resulting in high end-of- winter inventory positions that kept the propane values depressed.

Currently, U.S. propane inventory is 16.179 million barrels higher than at this point last year. If that amount of inventory overhang holds, we could end this winter with 66.338 million barrels of inventory, which would eclipse the high end-of-winter position set in 2016.

After 2015-16, new export capacity and strong global demand for U.S. propane exports resulted in the massive inventory positions being reduced. That development caused propane values to improve over the past few years. Eventually, ongoing record-high production overwhelmed export capacity again. The end-of-winter inventory position increased between 2018 and 2019.

By the start of this winter, propane inventory had reached 100.773 million barrels. Through this winter, propane production has continued to grow at a rapid pace. For the week ending Dec. 20, U.S. propane production was 2.383 million barrels per day (bpd). That was an astounding 326,000 bpd higher than the same week last year. Meanwhile, exports were 1.033 million bpd, 213,000 bpd less than the same week last year. Domestic demand and exports simply aren’t keeping up with supply.

At the beginning of this winter, new export capacity was added. The growth in new export capacity in 2016 exceeded the growth in supply. There was enough global demand to use that export capacity, thus the drawdown in inventory. But that hasn’t been the case this time around. In fact, actual exports are struggling to maintain a rate high enough to use available capacity before this year’s expansion.

Until the growth in exports exceeds the growth in production, U.S. inventories are going to remain high and propane values are going to remain low. A resolution in the trade war between the United States and China could increase the demand for U.S. propane exports. So would an improvement in global manufacturing activity should that improve. A continuing deterioration in the value of natural gas could result in a slowdown in natural gas drilling and natural gas production that leads to a slowdown in propane supply.

So far, those things simply remain possibilities. Until they become reality, it’s hard to paint a bullish case for propane prices.

Call Cost Management Solutions today for more information about how Client Services can enhance your business at (888) 441-3338 or drop us an email at info@propanecost.com.