Propane’s lower value reflects confidence in supply

The October sell-off in propane seems to show that players in the propane market are not worried about supply. On Nov. 1, Mont Belvieu LST propane closed at 82 cents, and Conway propane closed at 69 cents. Last year at this time, Mont Belvieu LST closed at 95.625 cents, and Conway closed at 90 cents.

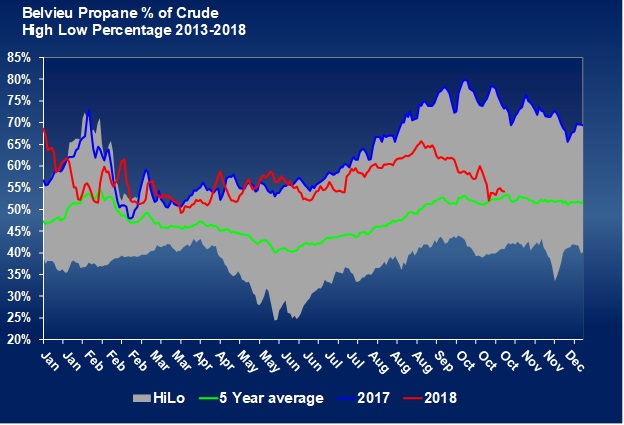

Not only is the nominal value of propane lower year-over-year, so is its relative value. On Nov. 1, Mont Belvieu LST propane was valued at 54 percent of WTI crude. Last year at this time, it was valued at 74 percent.

The chart above shows during the first half of the year Mont Belvieu LST propane set – or was near – five-year high valuations relative to WTI crude. As winter begins, Mont Belvieu LST propane’s relative value is falling. It is almost back to the five-year average, which is a very strong signal that traders see no red flags concerning propane supply. If propane fundamentals are perceived as supportive, then propane’s relative value to crude generally is higher.

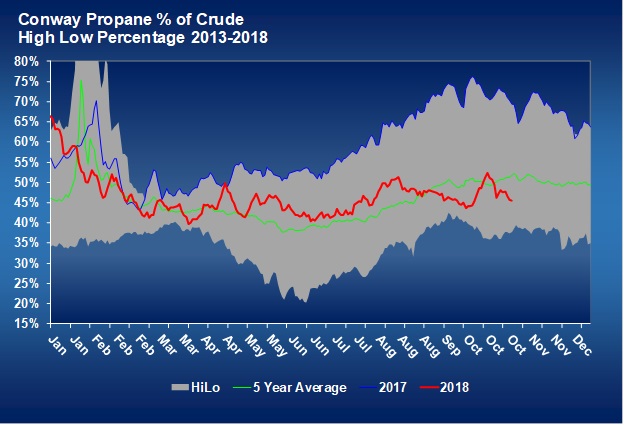

Conway’s relative value to WTI crude has been near the five-year average all year, mostly staying well below 2017. There was an excess of supply in the Midwest, resulting in its relative low valuation compared to crude. During the second half of October, even low-valued Conway propane dropped another leg down in relative value to crude.

U.S. propane inventory is now running ahead of last year. During late summer, traders worried too much inventory was not fractionated, and thus available to the market. Current prices reflect traders are not too worried about a shortage of purity product either – at least right now.

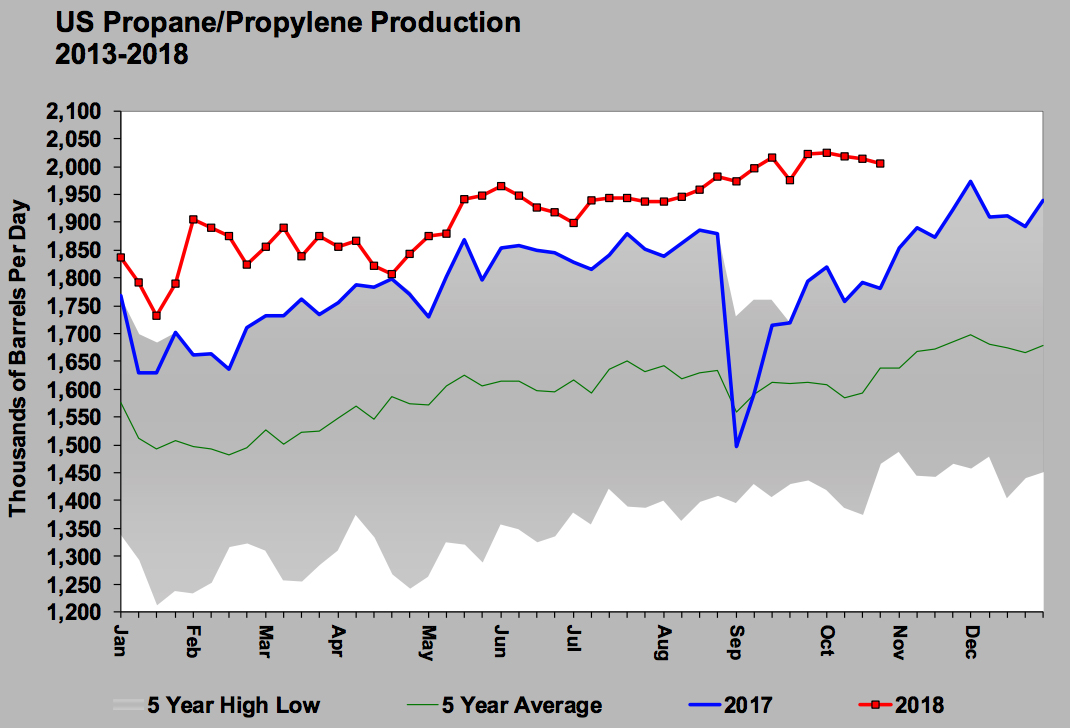

High levels of propane production have kept up with both domestic and export demand.

U.S. propane production set new five-year highs every week this year, according to data provided by the Energy Information Administration. Production is consistently averaging more than 2 million barrels per day.

There was a significant disruption to propane supplies from hurricanes going into last winter. Since that has not happened this year, more inventory has accumulated.

So far, supplies have not been significantly tested. As winter demand increases, there is a chance the lack of adequate fractionation capacity to handle production could become a problem. It is very important to remember a lot of storage used to hold purity products is now being used for Y-grade storage.

It is possible the cushion of purity products to handle demand spikes may not be nearly what overall inventory might suggest, which includes propane trapped in Y-grade mix.

It remains very possible that a shortage of purity propane could still be an issue when winter demand kicks into high gear. If so, a look in the rearview mirror at the end of this winter may show today’s low nominal prices and low relative values for propane were great opportunities for price protection.

Call Cost Management Solutions today for more information about how Client Services can enhance your business at (888) 441-3338 or drop us an email at info@propanecost.com.