Propane’s relative value to crude diminishes despite higher price

As propane traders know, the price of crude has a major impact on propane’s value. Following propane’s relative value to West Texas Intermediate (WTI) crude is an excellent way to determine if the rise or fall in propane prices is due to propane’s own fundamentals or simply a reflection of the changes in crude’s value.

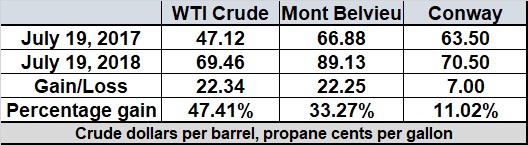

On July 19, 2017, WTI crude closed at $47.12 per barrel, Mont Belvieu (MB) propane closed at 66.875 cents per gallon and Conway closed at 63.5 cents per gallon. On July 19, 2018, WTI crude closed at $69.46 per barrel, MB propane closed at 89.125 cents per gallon and Conway propane closed at 70.5 cents per gallon.

As the table shows, crude’s value is up 47.41 percent since last year. Propane is lagging that percentage gain, especially in Conway.

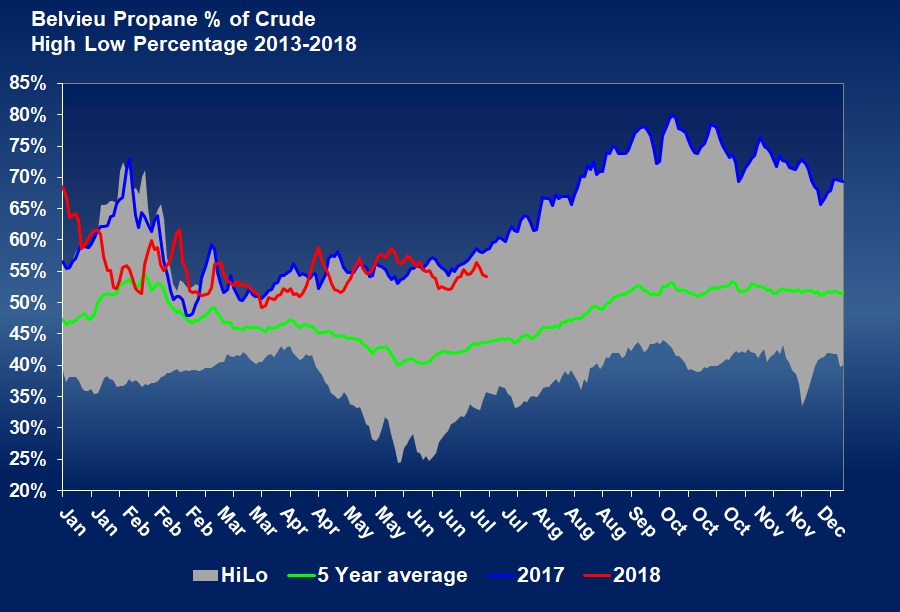

The chart above shows the relative value between MB propane and WTI crude. A year ago, MB propane was trading at 58 percent of WTI crude, and today, it is trading at 54 percent. The chart below provides the same comparison for Conway propane.

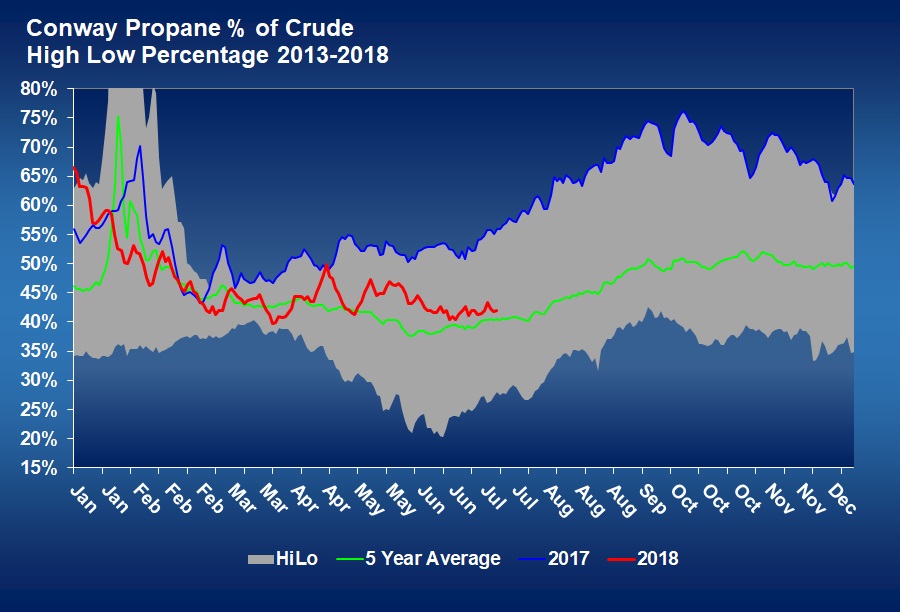

Currently, Conway is valued at 42 percent of WTI crude’s value compared to 56 percent at this point last year.

Understanding these relationships is important for propane retailers to understand in regards to propane price movement. The change in relative valuation between propane and crude suggests traders feel propane’s fundamentals are less supportive of its price than they did a year ago.

If traders believe propane’s supply or inventory levels are less adequate for meeting demand than last year, then propane’s relative value to crude would likely have risen instead of fallen.

Over the last year, propane has been pulled higher by rising crude prices since propane’s relative value is not keeping up with the rise in crude’s price.

Therefore, propane buyers should mostly be concerned with formulating opinions about the price direction of crude in establishing price-risk management plans. Propane retailers could consider using crude as a hedge against rising propane prices. The current trend suggests crude is likely to rise more than propane. Since crude is more widely traded, the bid/offer spread – which affects in and out costs on the trade – is far less on crude than it is on propane.

Though crude price movement is the focus currently, it does not mean the relative value shouldn’t be monitored for potential changes. If propane’s relative value to crude starts improving, it could mean traders are seeing propane’s own fundamentals become more supportive.

Many analysts predict crude prices will be higher by this winter. If propane fundamentals become more supportive as indicated by a higher propane-to-crude relationship, and crude’s price is also rising, it could result in a substantial rise in propane prices that will support the need for more price protection.

That is especially true for Conway, given the relative price to both crude and MB propane is extremely low. If some of the oversupply/logistical issues get resolved in the Midwest, Conway propane’s value could move up quite rapidly. If you are a Conway buyer, be sure to watch for improvement in Conway’s value relative to MB’s value. If the spread narrows, it could mean the issues that have Conway depressed have been resolved.

Call Cost Management Solutions today for more information about how Client Services can enhance your business at (888) 441-3338 or drop us an email at info@propanecost.com.