The outlook for U.S. propane markets offers a bit more optimism heading into the winter season than buyers faced one year ago.

The outlook for U.S. propane markets offers a bit more optimism heading into the winter season than buyers faced one year ago.

In fall of 2021, U.S. propane inventories were at the lowest levels seen in the previous five years, ending the year with just 76 million barrels. Weak domestic demand conditions from fall through early January enabled inventories to moderate, preventing widespread supply challenges during peak demand season. But 2022 has brought steadily climbing inventories, notes Ben Lyden, CHS director of trading and risk. “At the end of September of this year, U.S. inventories were at 84.3 million barrels, which is almost 8 million barrels more than one year ago. It’s actually been a bit of a surprise to see how rapidly inventories have built.”

That’s due, in part, to reduced domestic demand, he says. “Last year was an average winter. The long-range forecast through year-end 2022 calls for above-normal temperatures in most of the country, and if that would occur, it would help to further build domestic inventories.” Those forecasts can change quickly and is something to monitor moving forward.

With drier-than-average weather conditions across many parts of the Corn Belt this past season, propane demand for grain drying is expected to be below average, adds Lyden. “We’re not likely to have that fall demand surge.”

With drier-than-average weather conditions across many parts of the Corn Belt this past season, propane demand for grain drying is expected to be below average, adds Lyden. “We’re not likely to have that fall demand surge.”

Inventory levels in all but one U.S. region are now above the five-year average, he says. “The Upper Midwest is still at below-average inventory levels due to a July explosion and fire at a Midwest gas plant that reduced the number of gallons in the region, as well as more exports to Canada reducing supply as a result, inventories could be a little tighter there going into winter.”

Production up, exports up

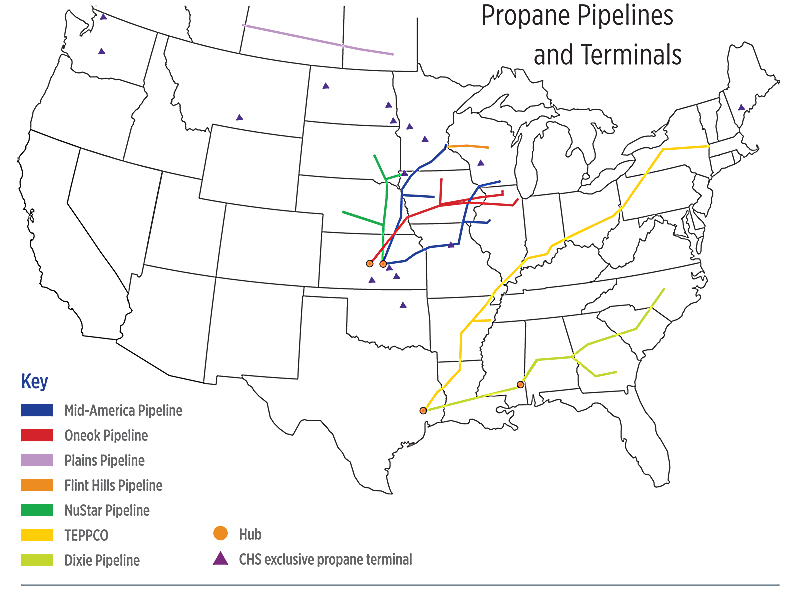

U.S. propane production has been on a steady increase over the past decade, nearly doubling from 1.25 million barrels per day (bpd) in 2012 to 2.4 million bpd this year. The recent investments in U.S. propane infrastructure, including new pipelines and export terminals, provides added capacity to move much more product than was possible four years ago, says Lyden.

Additional pipelines from North Dakota’s Bakken oil and gas fields south to the Conway underground storage facility in Kansas and on to the Mont Belvieu facilities in Texas have made it easier to move more propane to the Gulf Coast for export. The current U.S. infrastructure has the capacity to export up to 75% of the nation’s domestic production. In 2021, exports averaged 52% of total U.S. production.

Additional pipelines from North Dakota’s Bakken oil and gas fields south to the Conway underground storage facility in Kansas and on to the Mont Belvieu facilities in Texas have made it easier to move more propane to the Gulf Coast for export. The current U.S. infrastructure has the capacity to export up to 75% of the nation’s domestic production. In 2021, exports averaged 52% of total U.S. production.

“This year exports have continued to be robust,” Lyden says. “We’ve seen exports spike from an average of 1.3 million barrels per day to a record high of 1.7 million barrels this summer. That’s despite economic downturns in major global markets including several Asian countries.”

Increased plastics use has triggered exponential growth in propane demand, he adds. “The need for plastic packaging grew during the pandemic, so demand spiked from petrochemical producers who use resin from natural gas products like propane to make plastics. China is expected to open more petrochemical plants in the next few years.”

While there are plenty of global unknowns that could impact export demand in the year ahead, including inflation, developments in the Russia/Ukraine war and Europe’s natural gas shortages, Lyden says most indicators point to continued strength in export markets moving forward.

Positioned to compete

No one can predict the full effects of so many global and domestic factors on the propane market but building a supply plan can help you hedge against both price and supply risk.

“Working with propane experts to plan ahead and strategize about buying options and additional tank storage can provide protection against volatile supply and price swings,” says Mark Porth, CHS senior account manager.

“If you haven’t already done so, have a serious conversation with your wholesaler about monthly nominations for this winter,” he recommends. “We take that information to the supplier to try and lock in those volumes.”

Where possible, consider using multiple terminals, including pipeline, rail and gas plants, he says. “Planning ahead is key. Railcars require 45 to 60 days of lead time. And truck capacity is likely to be a major limiting factor again this season, as the truck driver shortage continues to impact transportation across the country.”

“Identifying multiple carrier options, from several terminals will help build flexibility into your supply plan,” he adds. “Maintain good relationships with carriers and include transportation considerations in your plan. The gallons could be there at the terminal but if there’s no truck to haul them, it won’t matter.”

Additional storage can also reduce supply risk during crunch times and allow you to lock in low prices at optimal buying times, says Porth. “Quite a few of my accounts in the southern Plains and northern Delta have added storage in the past year and already feel more secure because of it.”

CHS Propane experts can help with your supply planning and propane needs and CHS Energy Equipment can assist in determining how much storage is enough. To begin partnering with CHS Propane, visit CHSPropaneInsights.com or call 800-852-8184.

All images provided by CHS

This page was produced by North Coast Media’s content marketing staff in collaboration with CHS Propane. NCM Content Marketing connects marketers to audiences and delivers industry trends, business tips and product information. The LP Gas editorial staff did not create this content.