Steel shortage curtails propane tank supplies

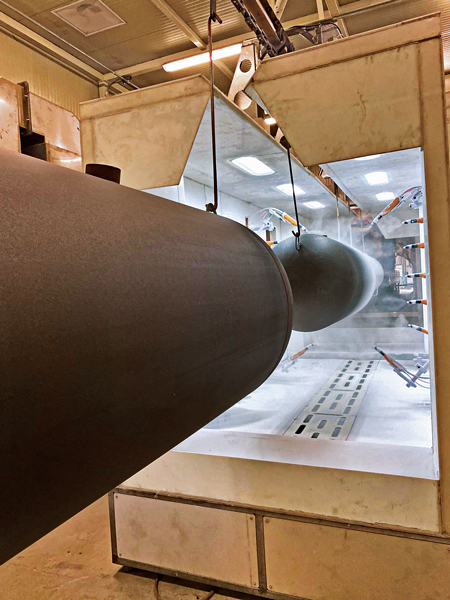

Tank manufacturer Metsa has fielded requests for a more diverse range of tank sizes, particularly more 120-gallon and 250-gallon tanks. Photo courtesy of Metsa

Marketers are being advised to order customer-bound propane tanks as soon as possible due to a shortage of steel and other key commodities.

Supply tightness also encompasses high demand for brass, copper, gauges, valves and paint that has delayed the flow of tank-related components – plus there remains a paucity of available manufacturing workers, installation personnel and bobtail drivers amid continued high demand relating to economic inflation, COVID-19 and other factors.

“There’s a backlog, but eventually people will get their tanks,” reports Jeff Vandemark, president of Industrial Propane Service Inc., based in Byron, Michigan.

“There’s volatility in the pricing,” he adds. “You get a price quote today, and it may be different tomorrow.”

OPD valve availability is also delayed.

“We can’t even get a date as to when we’ll be getting those again,” says Vandemark in June.

Immediate orders for tank deliveries are likely to arrive in late 2021 to early 2022, according to an industry notice issued in June by the National Propane Gas Association (NPGA).

“Incredible demands on propane tank production” have resulted in lead times averaging 23 weeks for tanks of all sizes, NPGA reports. High demand for grilling tanks during the typically slower offseason was hindering adequate cylinder manufacturing that has traditionally been necessary to build desired summertime inventory levels.

A major factor is an extremely high global demand for steel across all sectors, with the correlated pricing more than doubling from two years ago, impacting the procurement and manufacture of containers of all sizes, says NPGA. Steel mills have been operating at 77 percent capacity, about 10 percent below pre-COVID-19 production levels.

The current market conditions for steel, brass, copper and other raw materials may extend to spring 2022, and NPGA officials suggest that propane marketers “consider attentive management” of assets through heightened equipment maintenance procedures and vigorous refurbishment efforts.

Increased demand for tanks has created longer waiting periods for finished products. Photo courtesy of Metsa

Marketers operating commercial cylinder exchange programs for industries like hospitality and forklifts may want to explore alternatives such as composites for tank requirements, says NPGA, which gained input from its manufacturers and distributors sections of the board.

Several strategic initiatives to increase manufacturing and shipping efficiencies have been implemented at Quality Steel Corp., based in Cleveland, Mississippi.

“Having multiple plants and vendor resources has helped us to continue production,” says Jim Alderman, director of corporate accounts.

The company has been experiencing increased tank demand for the past 14 months, and it “has been diligently working” with suppliers to procure the raw materials needed to produce its line of tanks.

Purchases of refurbished tanks are on the rise, Alderman says, as lead times are shorter than for new tanks, and customers have been taking advantage of the refurbishing services offered through its affiliate, LP Cylinder Service.

By closely communicating with its vendors, the company is made aware of any potential shipping delays and is able to plan accordingly.

A commitment to lean manufacturing remains in place with a focus on continuous improvement and consistent updates to its manufacturing equipment, he says.

“The steel shortage has challenged our procurement department to maintain the flow of raw materials to our facilities,” says Alderman.

Industries such as housing and appliances have created added strains on the overall steel supply.

“To date, we have been successful in procuring all components to produce tanks at our plants.”

The increased tank demand has created longer waiting periods for finished product, he says, pointing out that the sales team works to communicate lead times and delivery schedule updates with the customers.

“Of course, the long lead times are frustrating to customers,” Alderman notes, adding that “by keeping customers informed of lead times and delivery schedule changes, they are better prepared to schedule and order tanks.”

High demand for steel and other commodities has tightened propane tank supplies. Photo courtesy of Quality Steel Corporation

Flooded with orders

“The tank shortage has put a lot of pressure on us to put out as much product as possible in a much quicker time frame,” explains Robert Kenney, general manager at Metsa, headquartered in McAllen, Texas, with operations additionally based in Nuevo León, Mexico. “We have had to up our capacity, bring on more help, and invest in the line to increase output.”

A more diverse selection of products is being requested. The company usually sells many more tanks in the 500-gallon to 1,000-gallon range, but this year, it is seeing a huge increase in 120-gallon to 250-gallon tank purchases, according to Kenney.

“People are taking us into account for products they usually do not buy from us because of the shortage from other main suppliers,” he says.

Kenney reports he’s been told by his suppliers that the steel shortage is primarily due to “the stoppage of automotive plants during the peak of the pandemic, which resulted in a massive dip in demand. As a result, many of the mills idled their furnaces so as to not create excess inventory – and many furloughed employees.

“Once production came back online, the mills were flooded with orders, and lead times and prices began to skyrocket,” he notes.

Another factor, says Kenney, is that Section 232 tariffs “have disincentivized service centers and manufacturers from importing, which has further complicated the situation.”

Metsa’s supply chain for other tank components has remained stable, he says, although Mexico is also experiencing steel shortages; lead times are currently around 16 weeks, up four to six weeks from the same point last year.

“We have had to delay shipments because of lack of steel to build tanks and heads,” Kenney says.

“We are investing in inventory,” he continues. “We adjusted our ordering points for 20 weeks delivery and padded our projections to make sure we would not suffer because of steel issues.”

The increased inventory deliveries commenced during the May and June time frame.

“Metsa is continually growing to reach more customers, and we have extended our reach from Canada to South America,” Kenney observes.

“I think pressure is rising considerably for action on behalf of the mills to increase output as well as on the government to revisit Section 232 to allow for imports at a reasonable cost,” says Kenney. “That being said, I do not see this issue fixing itself this year.”

Price increases might begin to slow by the end of the year and stabilize as lead times begin to drop, Kenney forecasts.

“But I believe steel procurement issues will continue for the time being.”

Manufacturers are having to adjust to keep products in the pipeline for their customers. Photo courtesy of Quality Steel Corporation

‘In the same boat’

Buyers and sellers alike have been hit by the material-shortage situations, according to Glenn Buck, vice president of business development at Pro-Par, based in Sherbrooke, Quebec, Canada.

“People in the industry are aware of the issues. We’re all kind of in the same boat; we need them and they need us,” he points out.

“We’ve had to stretch deliveries,” Buck reports. “We try to manage how many tanks we send to one customer at one time.”

Buck keeps close tabs on the commodities necessary for his business, and he saw how steel and brass supplies were going to be tight.

“I knew it was coming,” he notes, and OPD valve purchases were expedited.

“We ordered extra so we have more in stock, but we’re starting to run down. We’re good for the next 45 to 60 days, but that doesn’t carry very long,” he says.

Manufacturers have invested in more capacity and line improvements to increase output. Photo courtesy of Quality Steel Corporation

Pro-Par suppliers have reached out in an effort to accommodate the company’s needs.

Nonetheless, Buck says, “the fall is making us very nervous – we usually have a lot more tanks sitting on the ground in our yard.”

Dave Bertelsen, national product manager at Matheson, cites a highly concerning tank shortage – especially with the 120-gallon sizes – caused in part by “the Texas fiasco” when the Lone Star State was walloped by widespread power outages over the winter.

Numerous propane generators were fired up to keep households functioning, and, as the grilling season starts heating up, it’s becoming apparent that people have been hoarding their cylinder stocks in preparation for potential future calamities.

Normal wait times of a month to six weeks have given way to deliveries being scheduled for January and February of 2022.

The challenges in obtaining newly manufactured tanks mark a new development in Bertelsen’s 42-year career, calling it “a bit of a black eye” for the propane industry.

He describes “sending tanks left and right” to refurbishing contractors to fulfill product demand, but they are backed up as well.

Bertelsen floats the idea of getting politicians involved in addressing the nationwide tank shortage, emphasizing that it’s an across-the-board quandary that carries significant importance.

In short, notes Mark Komlosi, sales director at Worthington Industries, people are simply buying additional propane appliances – such as patio heaters, fire pits and the like – for use at their homes.

“In the past, end users may have rotated a propane tank between appliances. Due to increased usage, they have gone out and purchased a tank for each appliance,” he explains.

In addition, people have been holding on to their tanks longer, creating supply issues for some tank exchangers.

“The demand for steel portables stayed strong all year,” says Komlosi, looking back on 2020. “In the past, it was tough to sell steel portable tanks after the Fourth of July.”

Previously the August through January time period was used to build up inventory for the next season.