Surprise US propane inventory draw

The Energy Information Administration surprised propane markets on Wednesday by reporting a draw on U.S. propane inventory for the week ending July 5. The draw was a result of an uptick in both domestic demand and exports.

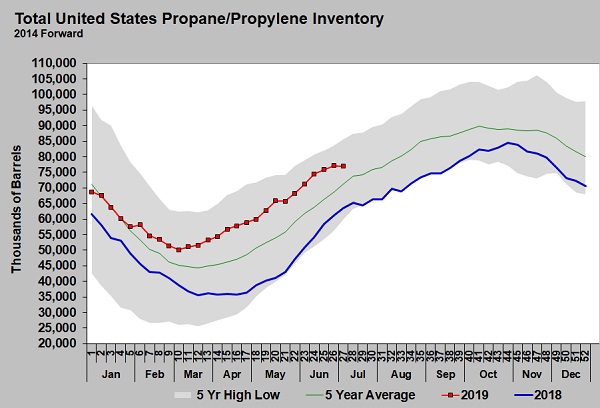

The 241,000-barrel draw brought inventory closer to the five-year average, but inventory still remained 13.341 million barrels, or 21 percent, higher than last year. Week 27 of the year had averaged a 2.550 million-barrel build over the past five years, making the draw very unusual. A survey of industry analysts showed an average expected inventory build of 1.8 million barrels, showing how surprised the market was by the draw.

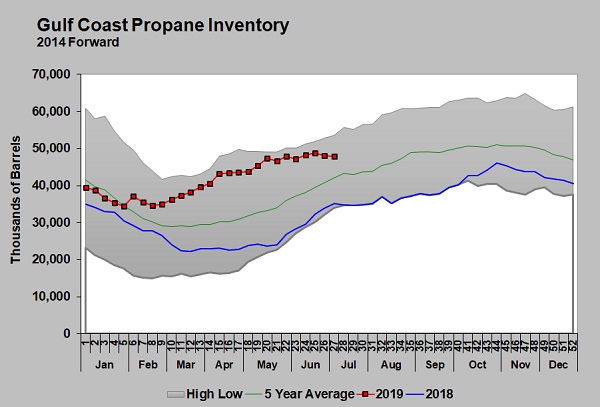

The bulk of U.S. inventory remains on the Gulf Coast, which is where it needs to be for export and to fill petrochemical demand.

Inventory along the U.S. Gulf Coast is at 47.948 million barrels. Inventory there declined 220,000 barrels for the week ending July 5. It was the second week in a row that Gulf Coast inventory declined. Inventory remains 12.764 million barrels, or 36.3 percent, higher than last year.

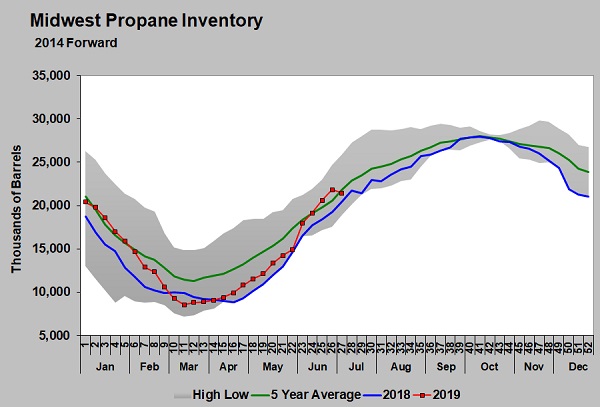

Midwest inventory fell 357,000 barrels last week, dropping below its five-year average but remaining slightly above last year.

But even that much inventory is too much for the Midwest given the high rates of production relative to regional demand potential. That is why Conway values are so beaten up, trading 13.875 cents below Mont Belvieu LST.

At the end of this quarter, Enterprise Products Partners expects to complete a 175,000-bpd LPG (propane and butane) export capacity expansion project. That expansion could slow down the build in inventory and keep it from nearing the record high of 2015 if importers of U.S. propane use the additional capacity. Enterprise has also just announced that it will begin work on another export capacity expansion at its facilities on the Houston Ship Channel.

The new project will increase LPG export capacity by another 260,000 bpd and become operational in the third quarter of 2020. This is in addition to the 175,000-bpd expansion that will be completed by the end of this quarter. When both projects are complete, Enterprise will have raised its LPG export capacity from 660,000 bpd to 1.1 million bpd. Enterprise will also add an eighth dock for crude loading that can accommodate 840,000-barrel Suezmax tankers, increasing its crude export capacity by 40 percent.

Propane production growth greatly outpaced demand several years ago. This resulted in an accumulation of 106 million barrels of propane inventory prior to the 2015-16 winter, driving propane values down to similar levels as today. Export capacity expansions eventually caught up to the growth in propane supply, swinging the price pendulum upward again.

But over the last year, the price pendulum has swung down as supply has exceeded export capacity. Theoretically, the Enterprise projects could swing the price pendulum back up, but much will depend on global demand for the supply.

Call Cost Management Solutions today for more information about how Client Services can enhance your business at (888) 441-3338 or drop us an email at info@propanecost.com.