US challenged to disrupt Iranian crude exports

Aug. 7 began the first phase of U.S. sanctions against Iran. In this week’s Trader’s Corner, we will put the United States’ action into context by looking at Iran’s production compared to world demand and overall Organization of the Petroleum Exporting Countries (OPEC) production.

We also will look at who is buying Iran’s crude and which countries might cooperate with the United States by cutting Iranian imports.

The sanctions imposed Tuesday did not directly impact crude exports. They target Iranian purchases of U.S. dollars, metals trading, coal, industrial software and the automotive sector.

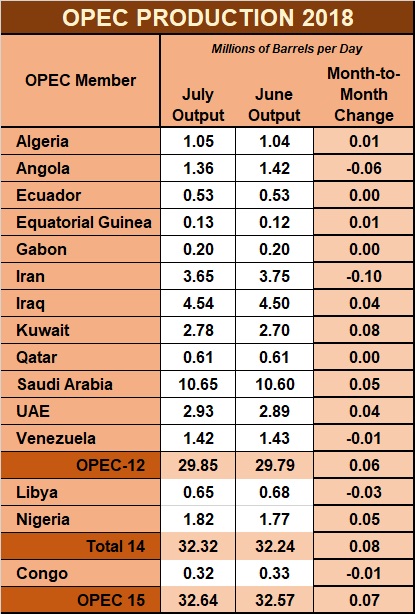

In 2018, global crude demand was at 99.3 million barrels per day (bpd). In July, OPEC provided 32.64 million bpd of that supply – or 33 percent. Iran produced 3.65 million bpd last month, which is 11 percent of OPEC’s total output. Last month, Iran crude production was equal to 4 percent of global demand, as seen in the chart below.

According to data from 2017, Iran exported an average of 2.62 million bpd of crude and condensate. The breakdown showed the country exported about 2.1 million bpd of crude and 490,000 bpd of condensate.

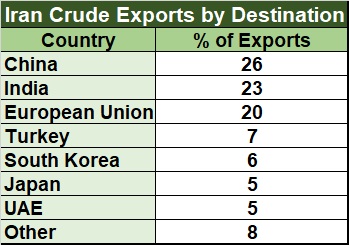

The table below shows which nations are importing Iran’s crude.

On Nov. 4, the United States will implement sanctions against Iran’s oil sector, and its goal is to have the rest of the world import zero Iranian crude. Below is a summary of the likelihood the main importers of Iranian crude will cooperate with the United States:

CHINA: The Chinese government just announced it will not comply with the U.S. request to stop Iranian imports of crude, although it did say it would not increase the amount of crude it receives from Iran. China accounts for 26 percent, or about 675,000 bpd, of Iran’s crude exports.

INDIA: While India initially indicated it would not cooperate with a unilateral action by the United States, it has since prepared to find crude elsewhere. Although, India also is looking at alternative payment methods that will allow it to continue buying from Iran. At this point, we can only say the impact of sanctions on India’s 597,000 bpd of Iranian crude imports is undetermined.

EUROPEAN UNION (EU): The governments of the European Union may have been the most vocal in opposing the U.S. action in Iran, and have said they will do everything possible to keep commerce open. The EU is desperate to keep the Iran nuclear deal intact because it believes there may be a catastrophic ending. The United States rejected French, British and German demands for waivers for its companies that do business with Iran. Individual European companies have taken actions indicating they will stop doing business with Iran, fearing the impact of U.S. sanctions. At this point, it appears every measure will be taken by European governments to keep the 516,000 bpd of Iranian exports coming into the EU; however, actions by European companies are likely to reduce imports to some degree.

TURKEY: Turkey flatly rejected the U.S. request to stop importing Iranian crude. Its 176,000 bpd of Iranian crude imports is likely to continue to flow.

SOUTH KOREA: The South Korean government requested the United States allow its refiners to continue to import Iranian crude. The United States has yet to respond. With so little cooperation elsewhere, we would expect the United States to deny the request. We will expect some of the 286,000 bpd of Iranian imports to be cut, but it may be delayed beyond Nov. 4.

JAPAN: Japan’s government also requested waivers from the U.S. sanctions. The refining industry in Japan is putting a substantial amount of pressure on the government to obtain waivers from the United States. Clearly, Japan’s government and private sector will do what it can to work around the U.S. sanctions.

UNITED ARAB EMIRATES (UAE): The UAE has its own issues with Iran and is already working to replace the 127,000 bpd it receives from them.

Overall, it has been our contention that it would be very hard for the United States to implement unilateral sanctions that would have a tremendous impact on Iranian crude exports. Current positions of Iran’s crude importers would support that belief. Any impact would negatively affect Iran, which already is struggling economically, although it appears much of the crude will continue to flow.

Many will consider this the best of all scenarios. The United States will not be cooperating with a government it believes continues to work on nuclear weapons, supports terrorist groups and sows discord throughout the Middle East and beyond, but it is likely that enough crude will continue to flow to prevent a major global shortfall in supply.

Also, it seems likely that enough crude will flow to allow the EU to keep Iran in the current nuclear deal that the United States exited. EU governments are going to bend over backwards to appease Iran and help it economically. Only time will tell whether the EU appeasement or the United States’ hardline was correct.

Call Cost Management Solutions today for more information about how Client Services can enhance your business at (888) 441-3338 or drop us an email at info@propanecost.com.