US distillate inventory recovers

U.S. distillate inventory made a major jump last week that helped significantly reduce the shortfall in inventory levels.

For the week ending Sept. 7, the Energy Information Administration (EIA) reported a 6.163-million-barrel build in U.S. distillate inventory, which is just 5.3 million barrels below last year.

Distillate inventory includes both diesel and heating oil inventory. Since refineries had to reconfigure their processes to meet low-sulfur diesel standards several years ago, traditional “heating oil” inventory became more irrelevant. Distillates with more than 500 parts per million sulfur content are considered heating oil.

With the new standards, less of that product is being produced, even for non-highway uses. Basically, lower sulfur distillates are being used to fulfill home heat requirements that used to be reserved for the higher-sulfur-content product. With the new requirements, refineries aren’t making the higher-sulfur-content product. Prior to 2011, high sulfur inventory was generally about 60 million barrels leading into winter. Currently, inventory is just 8.5 million barrels, so following that particular category of distillate is of little help in understanding the overall supply picture.

In today’s world, we have to look at total distillates to understand the status of product to meet the winter heating demand. In the past, when higher sulfur content distillates were almost exclusively used for that purpose it was easier to understand where the home heat market stood going into winter. Today, we must recognize the home heat market is competing with transportation and other market segments for the available supply.

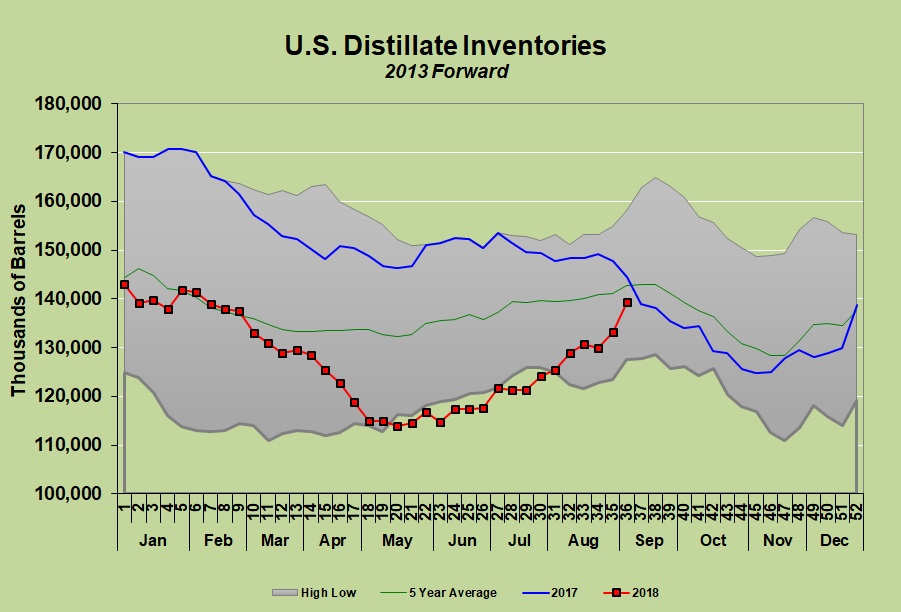

Throughout most of the summer, total distillate inventory was setting new five-year lows. As the chart above shows, there has been a surge in distillate inventory since Aug. 1, but now is the time of year when inventory should start to decline. That could very well happen next week, as we suspect a major rebound in distillate demand.

In its latest report, the EIA reported distillate demand at just 3.288 million barrels per day (bpd) – a 23 percent or 1 million-barrel decline from the previous week, which is highly unusual. With such low demand, the inventory build would have been even more unusual had it not been for a 236,000-bpd drop in distillate imports. Distillate imports fell to just 50,000 bpd for the week ending Sept. 7.

Like propane, distillate prices have been in a strong uptrend as rising crude values pull liquids’ values higher. “Heating oil” has consistently been trading above $2 per gallon since April, and highs have hit $2.30 per gallon. Even with the surge in distillate inventory over the last month and a half, heating oil is trading around $2.21 per gallon. When equating to propane Btu, it is 146 cents per gallon compared to propane’s 106 cents per gallon.

If distillate inventory continues to climb like it has over the last six weeks, its value relative to propane could come down. Having said that, we would not be surprised if inventory is very close to the highwater mark for the year. We base that statement on the probability of a major jump in demand next week.

Call Cost Management Solutions today for more information about how Client Services can enhance your business at (888) 441-3338 or drop us an email at info@propanecost.com.