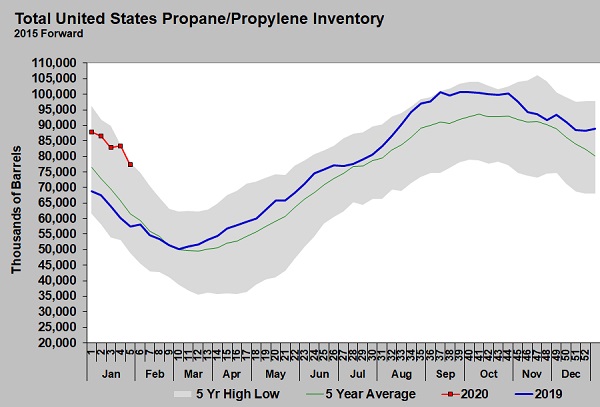

US propane inventory unaffected by above-average draw

| U.S. propane inventory remains near five-year highs, despite an above-average 6.172 million-barrel draw on propane inventory for the week ending Feb. 7.

We suspect the unusually large draw was the result of an inventory reporting error by a Gulf Coast storage operator the prior week, when propane inventories had an equally unusual January inventory build. Despite solid propane exports this year and some slowing of propane production, U.S. propane inventory is not coming down enough to support prices. At the low point coming out of last winter, inventory fell to 50.159 million barrels. Currently, inventory is on track to finish this winter at around 70 million barrels, assuming the same rate of decline as last year. If that occurs, it would be a new record-high inventory position coming out of winter. Propane inventory reached a high of 100.773 million barrels ahead of this winter. That was a gain of 50.614 million barrels through the summer months. Should inventory end this winter at 70 million barrels and increase at the same rate as last summer, it would exceed 120 million barrels by the start of next winter, easily shattering the previous high. The previous high inventory position was 106.202 million barrels in 2015. Such a high level of inventory would obviously be bearish for propane prices. If traders see inventory trending in that direction, it is hard to imagine a bullish case for propane prices in 2020. The entire exercise of the summer will be to see if propane fundamentals are changing in a way that would avoid such a massive inventory position. It is hard to imagine the needle is going to move much on domestic demand. There might be an increase in propane consumption by petrochemicals, but much cheaper ethane is their preferred choice as a feedstock. Non-TET purity ethane has averaged 13.75 cents this month. Domestic retail demand is unlikely to increase enough to make much difference in this equation. That leaves export volumes as the key metric to watch on the demand side. Exports have been setting record highs every week in 2020, never falling below 1.2 million barrels per day. That kind of export rate, and likely more, will have to occur on a consistent basis this summer to offset production and limit inventory growth. On the supply side, propane production has fallen in 2020 from its recent highs. However, that is not unusual as winter weather usually impacts natural gas and crude production, which causes a corresponding decrease in propane production. We will grant that the decline in the first few weeks of 2020 have been more than the typical winter decline. Frankly, that has been a little surprising given record-high natural gas and crude production. We are watching this trend with a lot of interest. U.S. refinery throughput has been down, and that impacts propane supplies, though crude refining only accounts for 20 percent of U.S. propane supply. The United States is exporting more of its crude. So really it is refining throughput that is the key metric to watch. Refining activity should pick up this summer with the U.S. economy booming, which would provide more propane supply. Propane imports have also slipped recently. It is possible 2020 will see more Canadian production being exported to Asia and less to the United States, but Canadian producers have been activating more drilling rigs recently, so we are not sure we should count on less propane coming from Canada at this point. Natural gas, crude and propane prices are screaming for less production of all three, but the juggernaut of supply just keeps growing. Expectations are that natural gas and crude production will be setting more records this year, which means propane supply will do the same. The growth is already slowing, and the low-price environment could decelerate growth even more. That could give export capacity and perhaps export demand time to catch up to supply and change the inventory trend this summer. But, as we stand at the base of a mountain of propane inventory, it appears the summit is rising and forces that could erode it seem woefully inadequate. ANNOUNCING HEDGING SEMINAR: Please note that Cost Management Solutions will be conducting a two-day hedging seminar on March 19-20 at the Houston Airport Marriott. This seminar will provide tools and strategies for helping propane retailers navigate the changes in propane pricing in the coming months. Please contact Dale Delay at 888-441-3338 for more details. Call Cost Management Solutions today for more information about how Client Services can enhance your business at (888) 441-3338 or drop us an email at info@propanecost.com. |