US propane/propylene production reaches new milestone

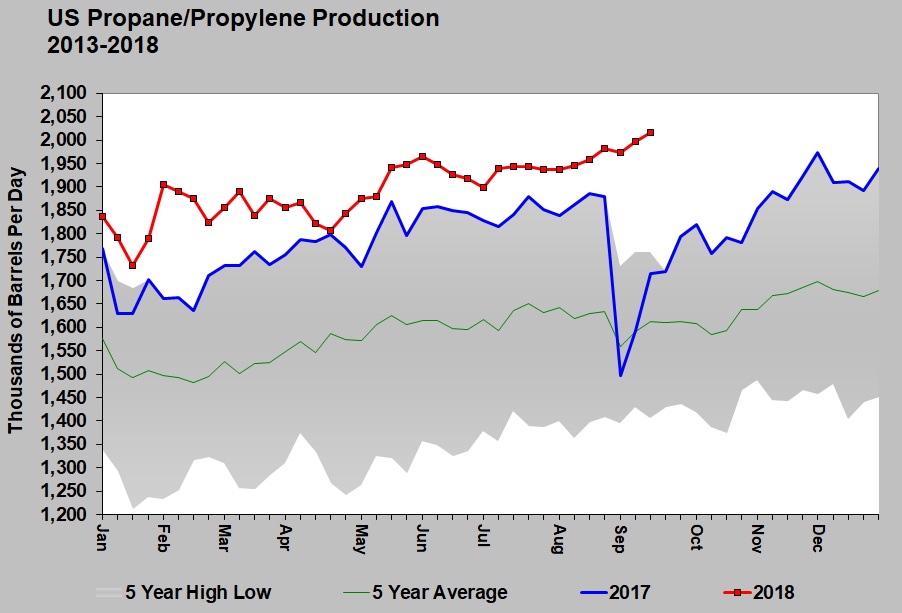

For the week ending Sept. 14, the Energy Information Administration (EIA) reported U.S. propane/propylene production exceeded 2 million barrels per day (bpd) for the first time.

Propane production has been on the rise for years. Nearly all of the growth is due to increased natural gas production. Natural gas processing now contributes 80 percent of U.S. propane supply.

In 2018, propane production set a new five-year high every week. It would take something dramatic, like a hurricane, to see production dip anywhere close to last year’s levels.

All the natural gas drilling has kept methane prices extremely low. Methane is the primary product natural gas utilities sell to their customers. In 2008, methane sold for more than $13 per mmBtu – today it trades under $3 per mmBtu. It is currently valued at the Btu equivalent price of 27 cents per gallon of propane. Producers are trying to improve the value of methane by building liquified natural gas export facilities to expand their market, but it’s a long process.

Despite the low value of methane, favorable values for heavier natural gas liquids (NGLs) have justified natural gas drilling. In fact, wells to be drilled are selected based on their potential for producing high volumes of the heavier liquids. Those wells are referred to as wet natural gas wells. Natural gas drilling is primarily concentrated in formations that produce high quantities of heavier NGLs relative to the methane yield.

During this high production period, the production of the heavier liquids also depressed their prices at times. At one point, propane supplies overwhelmed domestic demand and export facilities were not yet available to deal with the excess. That resulted in huge builds in propane inventory, causing propane prices to fall to 30 cents per gallon in 2016. New export facilities allowed the excess to be dealt with, causing the value of propane to dramatically recover over the last couple years.

With a lack of fractionation capacity to deal with the new production, the market now faces a new logistical challenge. Liquids supply overwhelmed demand a few years ago, prompting the investment in export facilities to open new markets. While the market waited for those facilities to be built, propane prices were depressed. Unfortunately, this new logistical issue is going to cause propane prices to rise in Mont Belvieu until new facilities are built.

Combined domestic and export demand for NGLs has now overwhelmed our fractionation capacity. The U.S. is awash with NGLs that have yet to be fractionated. NGL supply is not the problem. In fact, that production has depressed NGL prices in the Midwest where not enough demand exists to consume them, and not enough infrastructure exists to remove the excess.

On the Gulf Coast, there is plenty of domestic demand from petrochemical companies, and there is plenty of export capacity to remove the excess. Currently, there is enough global demand for those NGLs, but first they need to be separated into their marketable components of ethane, propane, butane and natural gas.

Fractionators are currently running at full capacity, but there is not enough capacity to meet all of the demand for the purity products – or to process all of the new NGL production. Thus, purity product values are rising, and NGL inventories that still need to be fractionated are rising.

This results in purity products inventory pulled lower, and storage space once used for those purity products is being converted to store the unfractionated NGLs, known as Y-grade.

Unfortunately, propane inventory reported to the EIA is a combination of purity product and what is still in Y-grade. We have reached out to the EIA for clarification, and they confirm they have no mechanism for determining how much of the stated inventory is purity and how much is still locked up in Y-grade.

At 74.752 million barrels, U.S. propane inventory is 6 million barrels below last year. With record propane production, one could argue not as much inventory is needed, but that argument would assume all the production is available to the market as a separated purity product. Unfortunately, that isn’t the case.

Because of the lack of fractionation capacity, when a propane retailer, petrochemical company or exporter enters the market to get the purity product they need, there is far less available to them than inventory positions would suggest. The reality is those holding the purity product know it is in short supply and demand a higher price. That will continue until more fractionation capacity is built.

Higher crude prices have been a key reason propane prices are so much higher this year than last year. Now the lack of purity product is causing propane to separate from crude and outpace it at a higher rate. In the period between Aug. 15 and Sept. 18, propane was up 14 percent to crude’s 7 percent. One could conclude half of propane’s gain over that period was directly related to the shortness of purity product.

Crude looks well supported due to the sanctions on Iran, so we must assume it will continue to support higher propane prices. The lack of fractionation capacity won’t get resolved until next year, at the earliest. That means retailers, petrochemical companies and exporters are going to be competing for the available purity product.

Retailers are coming into their high demand period, so they will have limited ability to back off on demand for the next six months or so. That means either petrochemicals or exporters must give way and back out of the market to avoid continued escalation in prices.

Last year, exporters gave in at the end of November – export volumes fell, and so did propane prices. Propane retailers’ hands are largely tied by seasonal demand, so they can only hope that export volumes once again diminish during the peak winter demand period to avoid a considerably higher price environment than last winter.

Call Cost Management Solutions today for more information about how Client Services can enhance your business at (888) 441-3338 or drop us an email at info@propanecost.com.