US propane reflective of crude’s prices vs. fundamentals

Adequate propane production and supply is keeping propane prices heavily tied to the fortunes of crude’s price.

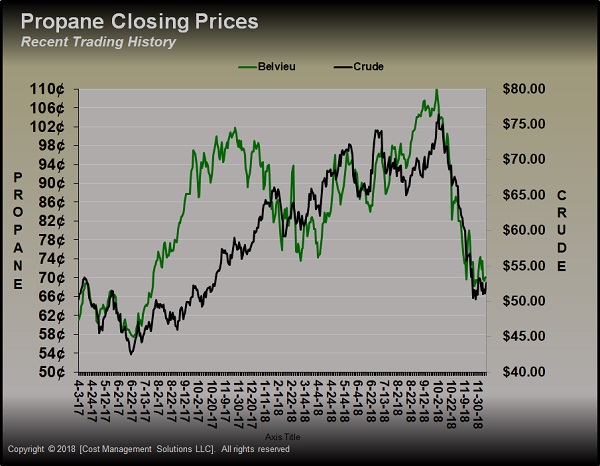

The chart above plots Mont Belvieu LST propane’s price in cents per gallon (green line) and WTI crude’s price in dollars per barrel (black line).

July through November 2017, propane separated from crude due to strong exports, which limited inventory builds and provided concerns for winter supply. During this period, Mont Belvieu propane averaged 70 percent of WTI crude’s price.

Propane gained value relative to crude during that period because traders were still assuming exports would equal or exceed what they had done from December 2016 through March 2017. It was a sound assumption because propane exports had shown a solid pattern of increasing each winter.

Also during July-November 2017, U.S. propane inventory averaged more than 23 million barrels less than it did during the same period in 2016. That created a very bullish market, which helped promote propane gains in relative value to crude.

After November 2017, U.S. propane exports cooled down. From December 2017 through March 2018, the U.S. Energy Information Administration (EIA) weekly estimates show propane exports were at 828,000 barrels per day (bpd). From December 2016 through March 2017, exports averaged 992,000 bpd. That marked the first time since the U.S. had become a net exporter of propane that export rates during the winter months were below the previous year.

As the chart above shows, propane prices reacted to the export rate drop after November with a sharp fall that continued through March – until propane was caught up in rising crude prices.

From April 2018 to now, Mont Belvieu LST propane is averaging less than 57 percent of WTI crude, a 13 percent decline from the period of separation during July through November 2017.

There is no reason for propane to separate. Going into last winter, inventory had only reached a high of 82 million barrels. It had reached 104 million barrels ahead of the previous winter.

Traders then learned that 82 million was more than enough inventory, even with good winter demand. It was enough because propane exports fell and propane supply grew rapidly.

Then, this summer, U.S. exports did not increase as quickly as U.S. propane production, which allowed propane inventory to rise going into this winter. This year, inventory reached 84.528 million barrels before starting to decline.

While Mont Belvieu LST propane has reached 60 percent of WTI crude a few times this winter, it simply can’t find a reason to go any higher. This past week, propane was relatively weak. It had reached 59 percent of crude the previous week after three weeks of exports exceeding 1 million bpd. This past week, the EIA reported an export rate drop. It appears the slower export rate has allowed propane to fall back to its longer-term 57 percent relative valuation to WTI crude.

It has become clear traders are comfortable with propane trading at a relative value of about 57 percent of WTI crude. As long as that comfort remains, any upward movement in propane’s value is going to be largely tied to crude.

For now, it appears traders are betting export rates will moderate again this winter if propane moves up much in relative value to crude. Traders also believe increases in propane supply will offset good winter heating demand, which will allow inventories to remain more than adequate.

Last week, we looked at several paths that show propane prices could move back into the 90s before the end of this winter. The most likely path to be taken to reach that price point is for propane to follow rising crude prices. A path where propane separates from crude is seeming less likely based on the signals the market is providing.

We were a little more bullish on propane fundamentals last week. We are still seeing above-average propane inventory draws, but last week showed us traders aren’t worried. Propane prices fell after the EIA reported a 3.2-million-barrel draw in inventory, more than doubling industry expectations. Propane fundamentals aren’t carrying much weight in this environment. It’s a crude trade for now.

Call Cost Management Solutions today for more information about how Client Services can enhance your business at (888) 441-3338 or drop us an email at info@propanecost.com.