What low Canadian inventory tells us about product flow

The latest data from the National Energy Board (NEB) of Canada shows propane inventory posting a new five-year low for June.

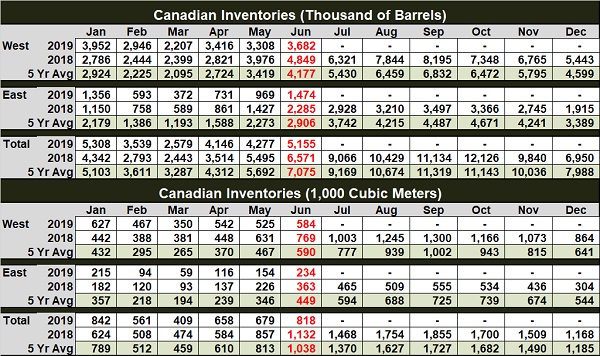

June inventory was at 5.155 million barrels. Last year inventory was at 6.571 million barrels in June, and the five-year average for June has been 7.075 million barrels.

The tables above show the breakdown by region. The red numbers highlight the latest data. Total inventory is 27 percent below the five-year average. West inventory at 3.682 million barrels is 12 percent below the five-year average. East inventory at 1.474 million barrels is 49 percent below the five-year average.

Canadian producers are exporting more of their production and storing less. The latest export data is through May. Through May 2019, producers exported 2.262 million barrels more to the United States than through May last year. In addition, producers exported 1.8 million barrels more to non-U.S. destinations.

Prior to 2017, all Canadian exports were to the United States. But in March 2017, Canadians started bypassing the U.S. market with rail shipments directly to Mexico. As of May, the Canadians have another mode of transportation available to them. The waterborne export facility on the Canadian west coast began shipping product, which will open up additional markets. We should start seeing that reflected in the export numbers in the coming months.

There is no doubt that Canadian producers want to improve their netback on propane. Shipping to the U.S. Midwest is fairly brutal for them with Edmonton (western Canada) averaging just 16.8576 cents this month. Edmonton traded down to 12.125 cents on July 9 but had moved to 21.125 cents by July 25. At the beginning of the month, the price spread between Edmonton and Conway was 21.5 cents. By July 25, the spread had dropped to 13.5 cents. The spread may be coming together due to the impacts of the waterborne export option.

It should be interesting to watch how Canadian exports move in the coming months and how that affects both inventory levels and price differential with the U.S. market. If less product is shipped to the U.S. Midwest, it could apply upward pressure to Conway propane prices.

Call Cost Management Solutions today for more information about how Client Services can enhance your business at (888) 441-3338 or drop us an email at info@propanecost.com.