Winter preview: Disruptive conditions persist

Ray Energy completed an expansion of its propane rail and transport facility on the border of New York and Vermont to meet the increased demand of its Northeastern customers. (Photo courtesy of Ray Energy)

As Halloween approached, propane retailers were busy trying to avoid being spooked by looming challenges that threatened to bubble over into the heating season.

The prospect of spiking prices and widespread product shortages of just about everything – most importantly new tanks, bobtails and propane itself – has the industry casting a wary eye on what winter may bring.

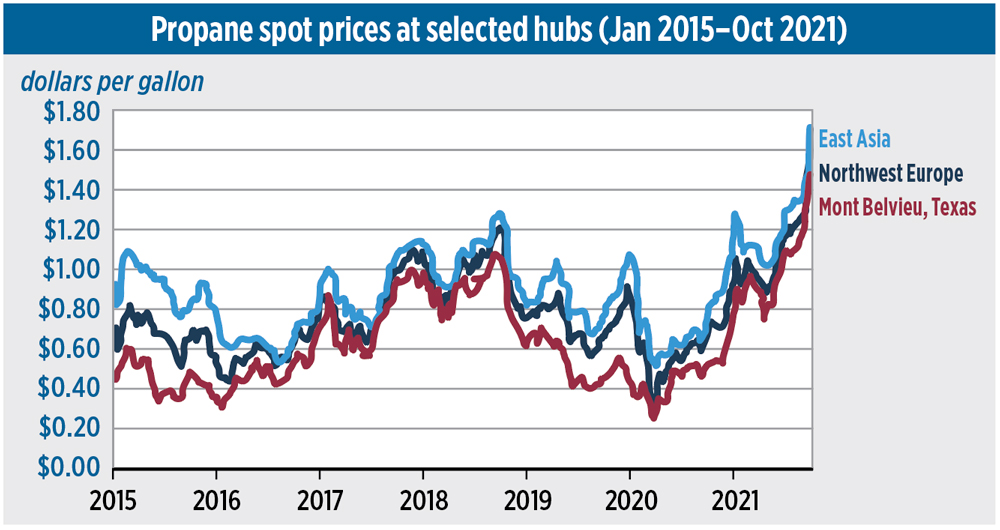

Propane exports are particularly robust, especially to Asia, with Mexico, Europe and other overseas markets also presenting thriving demand. Two new export terminals on Canada’s west coast are also having an impact.

Steel and vehicle components such as semiconductor chips are just some of the much-needed commodities that remain stalled and adrift amid a logjam of ships off California’s coast.

Preventative maintenance of bobtails and other existing equipment should be a top priority for propane marketers, says DD Alexander, the president of Global Gas, who serves on the National Propane Gas Association’s (NPGA) Executive Committee and its Propane Supply and Logistics Committee.

Given the steel shortages, keeping tanks in service and refurbishing any LPG vessels languishing in storage can benefit marketers and their industry colleagues throughout their local marketplace, Alexander says.

Compared to last year’s heating costs, the U.S. Energy Information Administration (EIA) predicts that propane expenditures will rise by 54 percent (with heating oil up by 43 percent, natural gas by 30 percent and electricity by 6 percent).

The EIA forecasts that average household expenditures for all major home heating fuels will increase significantly this winter primarily because of higher expected fuel costs as well as more consumption of energy due to a colder winter. Average heating degree-days are expected to be 3 percent higher than last winter.

For the second year in a row, La Nina conditions are expected in the Pacific Ocean and across other areas impacting North America, according to the National Oceanic and Atmospheric Administration (NOAA). As a colder counterpart of El Nino, this “double dip” La Nina could result in cooler and wetter weather in the Ohio Valley and northern Plains. La Nina winters also tend to shift snowstorms to a more northerly position.

“Our scientists have been tracking the potential development of a La Nina since this summer, and it was a factor in the above-normal hurricane season forecast, which we have seen unfold,” says Mike Halpert, deputy director of NOAA’s Climate Prediction Center. “La Nina also influences weather across the country during the winter, and it will influence our upcoming temperature and precipitation outlooks.”

During last year’s La Nina, the Atlantic region set a record with 30 named storms. Already this year, prior to La Nina’s arrival, NOAA reports that the hurricane season has still been busier than normal with 20 named storms.

California will remain drought-stricken, but for the southern third of the country and especially the Southwest, a La Nina frequently brings drier and warmer weather.

Halpert says for the Northwest – Washington, Oregon and perhaps parts of Idaho and Montana – La Nina means a good chance of welcome rain and drought relief.

Having a plan

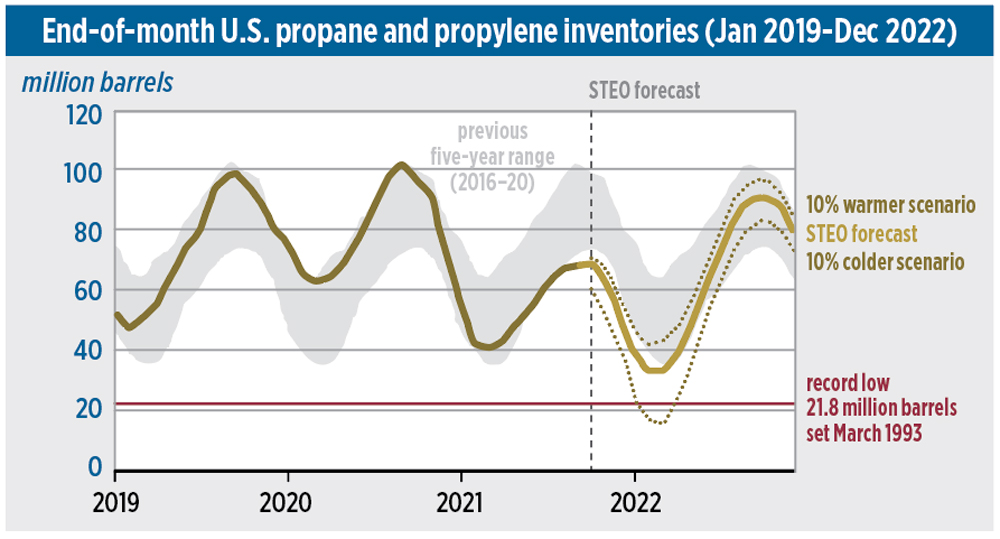

Inventories are at a five-year low and prices are at a five-year high, says Greg Noll, executive vice president of the Propane Marketers Association of Kansas.

A winter of catastrophic conditions could be quite troublesome, Noll notes, although he is quick to add that “we can’t predict what will happen next week, let alone two months from now.”

He urges marketers to communicate with their suppliers to ensure that they’re adequately prepared. “Have a plan,” says Noll, “and don’t abandon that plan.”

“We are in constant contact and discussions with our suppliers,” says retailer David Gable, president of Hocon Gas, headquartered in Shelton, Connecticut. The company serves more than 35,000 customers throughout Connecticut and New York out of six locations, and is in the process of opening a seventh branch.

“Supply is the three-legged stool,” says Gable: “Supply, supply, supply.”

Pipelines, rail, shipping terminals and refineries all play critical operational roles, he explains, expressing heightened concerns over the thriving export market coupled with the consequences of maintaining adequate domestic propane flow should the mercury fall to lower-than-usual levels. “Production in this country is being shipped overseas to people who will pay anything for it,” Gable laments.

“We haven’t seen this much disruption in the supply chain – ever,” he continues. Deliveries of new bobtails have been significantly delayed, and everyone’s waiting for repair parts.

And in an industry where worker recruitment has always been a challenge, this year has rendered an even tougher employment and retention environment amid the nationwide pandemic.

Hedging your position

According to Alexander at Global Gas and the NPGA, the U.S. industry should be able to handle brief cold snaps, but it could be “Katie, bar the door” should a sustained freeze take hold. “If we get a cold winter, we can see some real price spikes.”

With all of the overseas demand, don’t expect the spot market to be a viable alternative this winter. Alexander suggests that marketers “buy what you sell and sell what you buy – hedge your position, but don’t speculate.”

“I’ve locked in most of my supply,” reports Judy Taranovich, president and owner of Proctor Gas in Proctor, Vermont. She contacted two suppliers to ensure adequate stocks are in hand. “They’ve assured me that they’re in good shape. This is not the year to leave a lot out there for spot pricing,” she advises.

Taranovich expresses wariness over the electricity sector’s outreach to solicit additional customers for its heating hookups; the competition’s efforts in favor of electrical furnaces have been made more effective as propane’s pricing eases upward, she says.

“At this point, prices are higher than they got all of last winter,” says consultant Mark Rachal of Cost Management Solutions, speaking with LP Gas prior to a single snowflake falling to the ground. “Obviously pricing is going to be a big problem for everybody – the retailers and their customers.”

Nationwide propane inventories on Oct. 1 stood at 72.3 million barrels, which was 29 percent lower than the inventory levels posted at the same time last fall.

“We have been exporting more propane and consuming more propane domestically,” Rachal explains, also pointing out that with the pandemic more people are staying home from work and consuming a higher load of propane.

Local eateries are also using more propane as patio heaters are lit to warm patrons who are observing social distancing by dining outside.

A longer-term plus for propane cited by Rachal is a burgeoning trend of people moving from downtown to the suburbs: With more of the public now working from home, he notes, there is less need for them to live closer to their jobs in a more-expensive urban area.

“You tell everyone to work from home,” says Rachal. “Why should they pay more to live in the city? The need to be in the central business district is not as great.”

Higher numbers of people are moving to all areas of the Lone Star State as well, according to Bill Van Hoy, executive director of the Texas Propane Gas Association.

Demand for new homes and accompanying propane tanks is high.

Propane-powered electrical generators, both portable models and permanently installed units, are selling well after last year’s major power outages created significant disruptions to the population’s standard of living.

“It’s become much more common as an option in new-home building,” Van Hoy says. “A generator is an excellent investment when buying a new home. Here in Texas, it’s not just winter-related. We get storms all the time, and power goes out year-round.”

‘Pins and needles’

One of the root causes for the current global energy shortage is strong natural gas demand for electric power generation as countries and companies reduce coal consumption but can’t fill the void with renewable energy sources, according to Stephen Heffron, vice president of marketing at Ray Energy.

“There’s no question that countries in the Northern Hemisphere are heading into winter on pins and needles,” he observes.

Since the worst part of the pandemic receded over a year ago, says Heffron, demand for energy has returned much faster than the production of energy.

In addition, oil-producing countries and companies have been licking their wounds from the demand destruction in early 2020, which sent crude prices into negative territory and well counts plummeting, forcing some companies into bankruptcy, he explains.

They’ve shown remarkable capital discipline during the recovery mostly for the benefit of their shareholders but also in response to lower future prices, OPEC restraint and the current political climate regarding fossil-free energy policies.

On top of everything else, there’s a labor and materials shortage, so it hasn’t been easy to ramp up, he says.

All of this has created significant inventory deficits around the world. Storage levels in some places (especially natural gas in Europe) have reached historically low levels, which makes folks wonder: “If things are this bad now, what will they be like in December or January?”

As for concerns over U.S. propane inventory levels, it’s not quite “much ado about nothing,” since national inventory levels are about 20 percent behind the five-year average, but “much of the conversation about a propane shortage seems overblown to me,” according to Heffron.

After all, he says, the bulk of the U.S. supply deficit is in the Gulf Coast, where most of the propane is earmarked for exports or as a feedstock for domestic petrochemical demand.