Winter preview: Steady as it goes

Although propane retailers may be a little leery of what this year’s winter will bring in the form of challenges and unforeseen circumstances, a feeling of confidence and competence appears to be taking hold as the industry gets down to the business of preparing for another heating season.

Stephen Heffron of Ray Energy encourages propane retailers to assess their supply needs and address gaps before the winter. (Photo by Joe Mulone Photography)

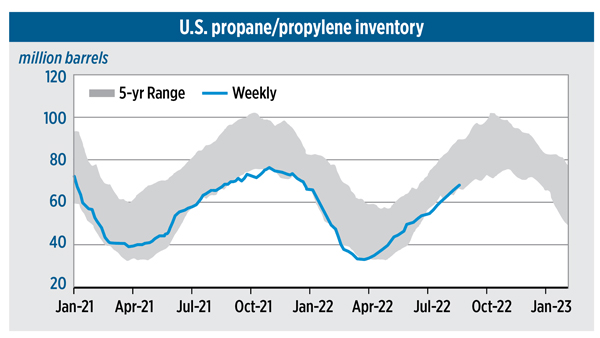

Although overall supply is going to remain tight, “the market is in better shape than we were at this time last year,” says Rusty Braziel, the founder and executive chairman of RBN Energy, who spoke at an August agricultural outlook webinar presented by the National Propane Gas Association (NPGA) with assistance from the Propane Education & Research Council (PERC).

“Things look OK as long as we have a normal winter,” Braziel says, noting that a good portion of any difficulties experienced during the 2021-22 heating season “were mostly last-mile logistical issues.”

Now is the time to get everything in order for winter’s all-too-soon arrival, according to Braziel. “As always, shape up your supply chain and have those barrels in storage in case supply goes haywire.”

“My advice to the retail propane industry is to look at your supply and demand forecast for the upcoming winter months,” adds Stephen Heffron, vice president of marketing at Ray Energy.

“If your business has been growing and you see any supply gaps out there, consider targeting those specific months by adding some winter-only supply now, while things are still relatively quiet.”

Heffron observes that “retailers are a little spooked about this coming winter, which is a good thing. They see or hear about what’s happening in Europe, and it’s starting to sink in that it’s better to prepare now than to scramble later.”

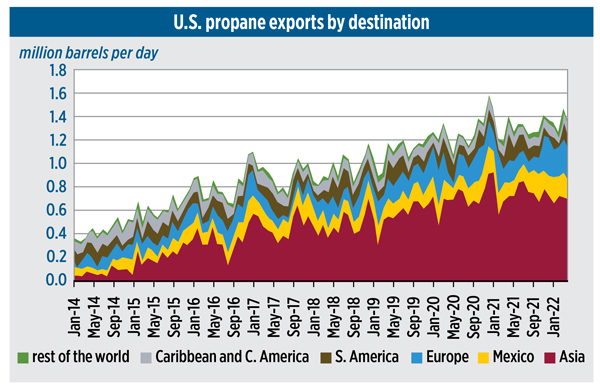

He points out that “we live in a global community where the price and availability of every substantial source of energy, from LNG to LPG, is interconnected with events that happen around the world.”

As a result, “if we have a cold winter, we’ll have to outbid the export market,” says DD Alexander, president of Global Gas and chair of the NPGA Propane Supply & Logistics Committee.

“The western side of Canada is now exporting more propane,” Alexander reports. “There’s going to be a lot less propane coming down to the Upper Midwest and the West Coast from western Canada due to the exports off the west coast of Canada and a new PDH plant due to come online.”

The propane dehydrogenation (PDH) process diverts gas to the manufacturing sector and away from consumer heating consumption.

“Over the last 28 months,” she says, “propane production has only grown 4 percent – not much. Exports are increasing 10 percent more each year.”

Limited transport availability

Considering a strategy of venturing into the spot market to make up any shortfalls is a plan best avoided, says Heffron.

“Facing the prospect of strong export demand and tight transport capacity, this is shaping up to be the kind of winter where it probably doesn’t make sense to go into it knowingly short,” he cautions. “Finding extra propane supply at the last minute and the transports to haul it may be very challenging.”

Next week is hard enough to predict without having to figure out the future of propane, says Greg Noll, executive vice president of the Propane Marketers Association of Kansas.

Uncertainties aside, “plan ahead,” he says. “If you don’t have a plan, you’re going to fail.”

According to Noll, it’s crucial to avoid the lack-of-preparation errors committed last year by some unfortunate retailers who ran afoul of scant supply and transportation limitations.

“We couldn’t get the propane from where it was to where we needed it,” Noll laments.

He says the industry still needs increased on-site storage capabilities, and he encourages retailers to ask customers about storing propane in their backyard tanks by filling them before the snow flies and the mercury drops.

This year, industry leaders have already approached government officials to facilitate quick decision-making pertaining to hours-of-service considerations.

Palmer Gas & Oil begins to plan in early July to ensure it’s prepared for the heating season. (Photo by Kim Martin Photography)

Monitoring metrics

As far as preparing for the winter heating season, Peter Iacobucci, general manager at Palmer Gas & Oil in Atkinson, New Hampshire, considers summer’s end on July 5, when the company begins to plan accordingly for winter’s wrath.

Equipment and tool inventories are thoroughly reviewed to detect any shortfalls – a process made ever more daunting in recent years because of supply chain issues.

Both the propane and fuel oil aspects of the business are successfully operated via a series of time-tested procedures characterized as “a proven method” developed over many years of experience, with special attention directed toward learning from events over the past three to five years.

“We have metrics that we use,” says Iacobucci.

The company, celebrating its 90th year, has acquired tanks that are ready for setting, and staffers remain in constant contact with the supply points to make sure all is well for the upcoming heating season.

Palmer employs a considerable amount of on-site propane storage, recently upped by an additional 120,000 gallons. The enhanced storage was implemented last fall, and it is going to be in full use this year.

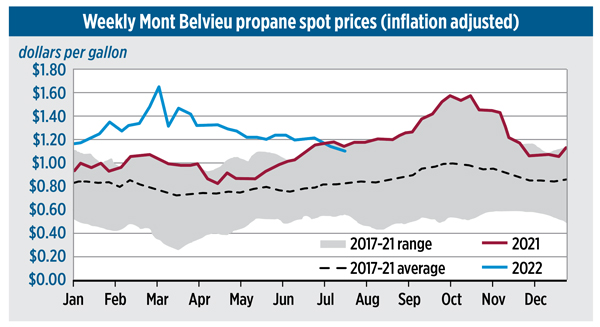

Note: Prices are adjusted for inflation using the Consumer Price Index. (Data source: Thomson Reuters)

Barring any unforeseen circumstances – which can strike at any time, “I’m feeling pretty comfortable” as the heating season approaches, says Judy Taranovich, owner and president of Proctor Gas in Proctor, Vermont.

She recently hired a new bobtail driver and has reached out to her two propane suppliers – receiving assurances that there is enough available gas to meet the needs of her customers.

“I’m a smaller company, so in the grand scheme of things I’m not a big draw on the suppliers,” says Taranovich, who also serves as Vermont’s NPGA state director and has previously garnered nationwide association honors as State Director of the Year.

She is quite confident in the abilities of her two suppliers, Ray Energy and NGL Supply. “In eight years, I’ve never been let down once,” she says.

Facility fires

Currently under industrywide cautionary consideration are two potential challenges presented by a pair of serious summer fires that occurred at the Medford, Oklahoma, fractionator plant and the Freeport, Texas, LNG facility that account for about 17 percent of U.S. export capacity.

Freeport executives expect the plant to be at more than 85 percent functionality by the end of November, with 100 percent capacity achieved by March 2023.

“One possible impact from the Freeport fire is that if less LNG is exported from the U.S., then more diesel and LPG may be exported from the U.S., which could adversely affect domestic propane supplies,” says Heffron.

“Regarding the Medford fire, the fact that Conway prices are near parity with Belvieu prices tells us that the market is trying to keep Conway barrels in the Midwest, not heading to the Gulf Coast,” he reports.

The Medford fractionator being out of commission will increasingly affect Conway’s price the longer it stays down, says Alexander.

“Obviously, if we get a cold winter, this will dramatically affect the price,” she notes. “We could see a complete blowout of the historical Belvieu-Conway spread. The spread between Conway and Mt. Belvieu has already been affected, and the longer it stays down the more effect we will see in the pricing between the hubs.”

In the short term, Alexander adds, other assets in the Conway market will help take the pressure off. But once the capacity is maxed out, she says, the industry will see product move to Mt. Belvieu for fractionation before returning to the Conway market.

“Of course, this will increase the cost of the gas and we may see, with colder weather, the spread get extremely wide between Conway and Mt. Belvieu,” she says. “We will have to wait and see.”

Continuous outreach

The ongoing shortage of workers continues to be a major industry challenge.

“We definitely need more drivers for transports and bobtails,” says Noll. “It’s not getting better – it’s getting worse.”

NPGA, PERC and several other industry entities have been making employee recruitment a priority. The training requirements can be onerous for entry into a propane industry career. “You can’t just walk in the door like it was 20 to 30 years ago and start work tomorrow,” says Noll.

Continuous outreach within retailers’ market area – even when they’re not actively seeking new hires – is necessary to build a list of potential employees. Have interested parties fill out an application if they express interest despite a lack of an immediate opening. “You have to invite them into the business before you actually need them,” according to Noll.

“We’re going to have to be very creative for hiring for all positions,” says Alexander. “Before, it was more drivers and service technicians [that were in short supply]. Now it’s across the board, including office personnel,” she says.

Visit local technical schools and talk to the students, she suggests. Reach out to people from your church and other connections such as your local banks, stores and civic organizations. “Think about the networking that you can do.”

At Palmer Gas & Oil, employee recruitment efforts are ongoing throughout the year, especially when it comes to getting winter drivers on board.

“A lot of companies wait until September or October,” says Iacobucci. “You can wait until October if you want, but by then the positions [at your competitors] are filled” by the limited pool of qualified and willing workers. “Demand drives the market,” he asserts.

Referral bonuses and signing bonuses are among the Palmer recruiting perks.

“The best advertising is word-of-mouth – they see each other in the coffee shops,” ready-made grounds for spreading the word about the benefits of working at the company, Iacobucci says. “We’re family owned and operated, and we like to consider our employees our family.”