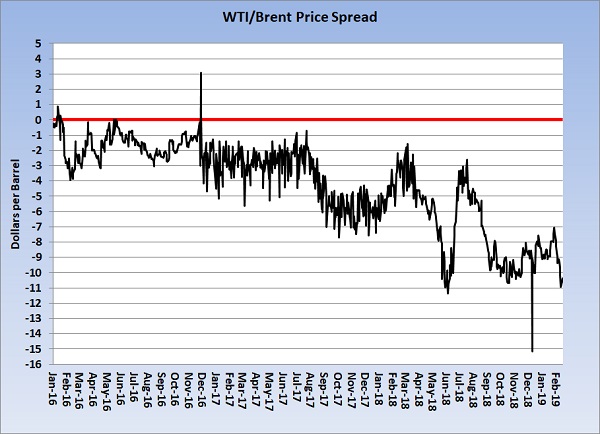

WTI prices remain low compared to Brent, other benchmark crudes

The price difference, or price spread, between U.S. benchmark West Texas Intermediate (WTI) crude and global benchmark Brent crude is increasing. Brent is a reference crude grade for about two-thirds of crude traded worldwide.

Image: Cost Management Solutions

The chart above shows the price spread between WTI and Brent crude at the close of each trading day. WTI currently is trading about $10 per barrel less than Brent.

WTI is a higher-grade crude than Brent because it has a higher API gravity and a lower sulfur content. When refined, higher API gravity crudes yield more high-valued, light products such as gasoline, diesel and other distillates.

Sulfur is a corrosive pollutant refiners must remove to meet environmental standards. Therefore, the higher the sulfur content, the costlier it is to process the crude.

Because WTI crude has a higher API gravity and lower sulfur content than Brent crude, it seems WTI would be the higher valued crude. In fact, it was the higher valued crude until 2011.

Almost all of the new crude production in the United States comes from shale formations. Crude from shale generally has very high API gravity and is very low in sulfur content, which is comparable in quality to WTI, or even better. The United States is awash with very high-quality crude, yet its price is lower than Brent crude and continues to fall.

Most U.S. refineries are set up to run heavier crude. Prior to the shale revolution, most crude produced in the U.S. and imported from Canada, Venezuela and other sources were heavier-grade crudes. At that time, WTI crude was highly desired because U.S. refiners needed to blend it with heavier crude to increase gasoline yield and to ensure high value distillate yield.

In a bizarre twist, in some cases poorer quality and heavier crudes are now more valuable than WTI crude because they are in short supply. The problem was exacerbated when the United States put sanctions on Venezuela that reduced heavy crude supply by another 500,000 barrels per day (bpd).

Until a few years ago, the United States did not allow producers to export U.S. crude. As a result, all of the new light crude production was trapped in a market that was not geared up to use it all.

Consequently, in 2012, WTI was often trading $20 per barrel below Brent, and at one point reached a discount of $25.53 per barrel.

The U.S. government then changed its rules on crude exports, allowing the very desirable light crude to reach other markets that needed it. The spread between WTI and Brent started closing and settled at WTI trading at a $3 to $5 discount to Brent. WTI remained discounted because of the lack of infrastructure to export it.

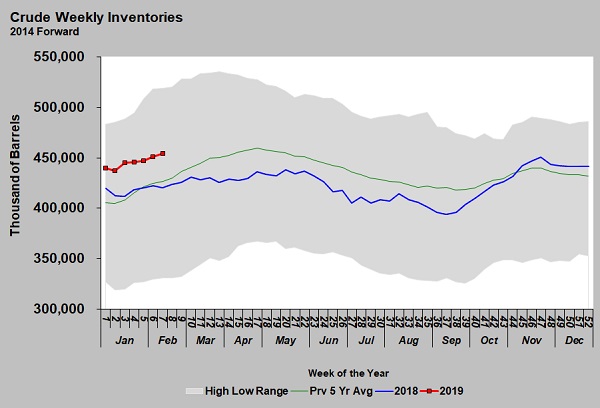

The U.S. pipeline system still doesn’t have enough capacity to move sufficient quantities of crude from production areas to export facilities. Export capacity also remains limited. These are the key reasons WTI crude is currently falling in value relative to Brent. Growing U.S. crude production from shale formations, which is expected to reach a record 8.4 million bpd in March, simply doesn’t have enough infrastructure to move it, causing inventory to rise.

Image: Cost Management Solutions

The industry is working to correct the logistical problems. In the meantime, U.S. shale producers are cutting back on drilling programs until the value of U.S. light crude recovers. Changing U.S. refineries to run a higher percentage of light crude will require billions of dollars in investment, and most refining companies haven’t been willing to make the changes. Total and ExxonMobil have announced plans to make modifications to existing operations to allow them to run a higher percentage of lighter grades, but the projects will take years to complete.

U.S. propane and other natural gas liquids (NGL) values are closely tied to the value of crude. With WTI crude trading at a discount in the global market, U.S. NGL values are competitive globally. However, propane and other NGL supply also is outpacing infrastructure to export it. Most new NGL production is a result of natural gas drilling. Natural gas production is reaching record highs, and natural gas drilling activity remains equal to last year.

Until logistical issues are resolved for crude, WTI is likely to remain relatively low compared to Brent and other benchmark crudes. Also, until logistical issues for propane are resolved, its value is likely to remain relatively low compared to WTI crude.

This creates a supply/demand situation that will likely keep the value of propane subdued. Until there are signs those logistical issues are being resolved, or that production is being reduced, buyers of propane can likely be less aggressive in receiving price protection.

There always is the need for some price protection, and all fixed-price sales should certainly be covered with fixed supply costs. Otherwise, it appears to be a time that one should err on the side of caution by holding a lower percentage of price protection, which leaves more room to buy spot barrels.

If you decide to do that, be sure not to sleep on your supply portfolio. Those conditions have a way of changing quickly, so be sure to closely monitor drilling activity, production rates, export rates and other news that may suggest the domestic supply/demand imbalance for light crude and NGLs is resolving.

Call Cost Management Solutions today for more information about how Client Services can enhance your business at (888) 441-3338 or drop us an email at info@propanecost.com.