Image: Cost Management Solutions. Click to expand. |

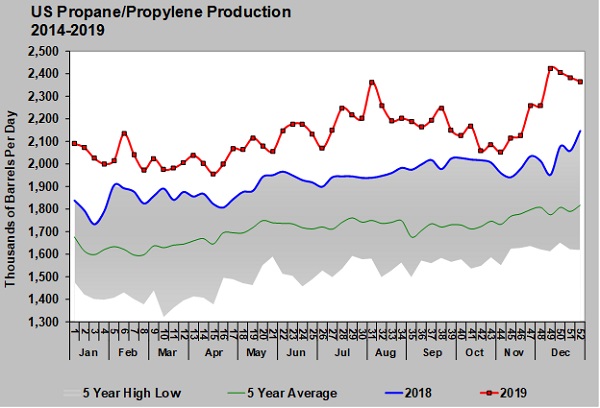

As we look back on 2019 concerning propane, we would have to call it the year of production.

Last week in Trader’s Corner, we looked at the build in propane inventory. High inventory levels, the result of very high propane production, has propane on track to end this winter at a record high.

For the week ending Dec. 27, U.S. propane inventory fell just 212,000 barrels, leaving it at 88.186 million barrels. That puts inventory on track to be about 17.5 million barrels higher than last year or somewhere around 66.5 million barrels. That would easily eclipse the record high of 62.226 million barrels set at the end of the 2015-16 winter. Of course, the high inventory levels keep propane prices depressed.

The build in inventory level is simply a reflection of the imbalance in the supply/demand equation. The part of the supply demand equation that has gotten completely out of whack has been propane production.

Since 2012, there has been a period of extreme growth in propane supply. Prior to this period, U.S. propane supply was stagnant with little growth and some years of declines, making the U.S. dependent of foreign supply. But, even by the high growth production standards set since 2012, 2019 was exceptional.

In 2019, U.S. propane production averaged 204,000 barrels per day (bpd) more than 2018. That overshadowed the previous highest year-over-year growth rate of 168,000 bpd in 2012. It was significantly more than the 139,000 bpd of growth in 2018.

Record high natural gas production is resulting in record high propane production. The natural gas is coming from both crude and natural gas wells. Even when a well is drilled into a formation for the purpose of recovering the crude, there is always associated natural gas production.

The rapid growth in crude production is well publicized, as the United States has become the world’s No. 1 producer of crude. This comes as other producing nations try and cut production so that all the U.S. production does not collapse crude prices. Still it has been a remarkable journey. U.S. crude production averaged just 4.940 million bpd in 2008. The Energy Information Administration has estimated production at 12.292 million bpd in 2019. Production was 12.9 million bpd for the week ending Dec. 27 and is expected to average more than 13 million bpd in 2020.

There have also been plenty of natural gas wells drilled. Those are wells drilled into formations that contain little oil. They are drilled specifically to recover the natural gas and natural gas liquids reserves. With all this drilling, U.S. marketed natural gas production was at a record high 3,176 billion cu. ft. during October 2019, the last official data available. That was 34 percent higher than October 2016. In 2011 (prior to the surge in propane production in 2012), natural gas production had dropped to an average of 2,003 billion cu. ft. per month.

There is plenty of evidence that the rapid growth in crude, natural gas and propane supply is going to begin slowing in 2020. Producers of crude and natural gas in shale formations have been focused almost entirely on growing production. Investors in these companies have been waiting for a decade to see all this growth pay off in returns. That hasn’t happened and patience has run out. Investors are no longer blindly putting their money in oil and gas production companies and that is doubly so for those focused just on developing shale formations.

The production companies are having to cut back on capital spending, which essentially means they have to cut back on drilling programs in order to appease investors and hopefully keeping them from abandoning the sector entirely. But, that may be a tall order.

Wells drilled in shale formations deplete at a very rapid rate. Once the drilling slows, production and thus revenues to pay investors will slow as well. There is a backlog of drilled but uncompleted wells. Once that inventory is gone, without fresh drilling, the production decline is likely to be fairly quick. This puts producers in shale formations in quite the pickle.

We suspect there is going to be handwringing in 2020-21 in the boardrooms of shale production companies and those that have loaned them money and invested in them. These producers have done a heck of a job of lowering costs and making wells in shale formations more productive over the last decade. But, we suspect more will have to be done if we are not to look back at 2020-21 as the pinnacle of the U.S. shale revolution. If that is true, it could also mean the pinnacle of the growth in propane supplies as well. |