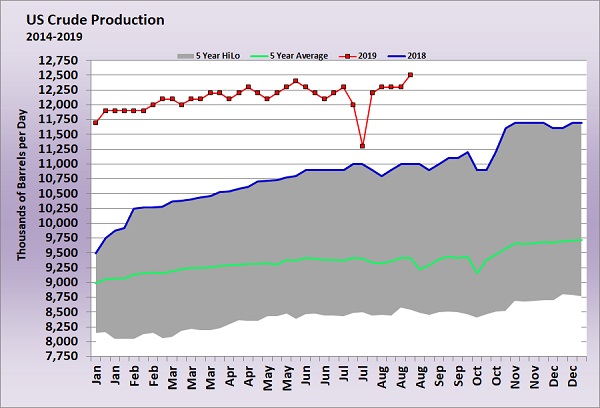

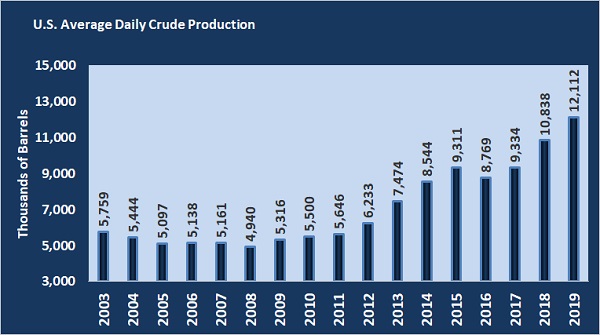

US crude production continues to rise

U.S. crude production reached a record high of 12.5 million barrels per day during the week that ended Aug. 23, according to the latest report from the U.S. Energy Information Administration (EIA). U.S. production has been on a steady rise for years due to growth in production from shale formations.

In 2008, U.S. crude production slipped to a daily average of just 4.940 million barrels.

Production increased unabated from 2009 to 2015, after which the Organization of the Petroleum Exporting Countries (OPEC) opened the spigots in an effort to drive higher cost producers out of business.

Though U.S. production fell briefly due to lower prices, many shale producers survived. Ultimately, it was OPEC members that suffered the greater financial harm due to dependence on crude revenue to maintain government programs.

Nowadays, OPEC is simply getting out of the way of new shale production by limiting its own; it is giving up market share in order to keep the price of crude supported.

One day, OPEC is likely to be back in the driver’s seat, depending on the viability of the shale phenomenon. Depletion rates of wells in shale formations are very high.

Shale producers are struggling to balance the necessary capital to maintain or grow production while trying to keep investors satisfied. Last year, only seven of 23 production companies primarily operating in shale formations had positive cash flow. Drilling is already slowing due to these financial pressures.

Production will stay up for a while longer with a major backlog of wells that have been drilled, but uncompleted (DUC). The DUC count was 8,108 in July, down 100 from June. DUCs appeared to have peaked in February at 8,286.

If U.S. crude drilling activity continues to decline and the inventory of DUC wells keeps coming down, crude prices are likely to improve some, but OPEC will slowly try and recover its market share. It will be cautious, so as not to drive prices lower again, but should slowly regain its market share over the long run.

SUPPLY RELATED NEWS FROM LP GAS:

Canadian NGL producers challenged by market access limits

Strong natural gas liquids production in western Canada over the past two years has underscored the need for Canadian producers to seek demand outlets, particularly for propane.

Targa Resources tabs CEO, makes other management moves

Targa Resources Corp. made several management moves, including naming Matthew Meloy CEO and member of the company’s board of directors.

GPA Midstream tabs president, CEO

Joel Moxley succeeds Mark Sutton as president and CEO of the GPA Midstream Association once Sutton retires after 37 years of service to the association.

Enbridge, state of Michigan extend Line 5 battle into courts

Enbridge and Michigan’s attorney general have exchanged lawsuits in an escalating battle over the company’s Line 5 pipelines.

UGI subsidiary to expand midstream portfolio with acquisition

UGI Energy Services agreed to acquire the equity interests of Columbia Midstream Group from a subsidiary of TC Energy Corp. for about $1.275 billion.

Enterprise eyes 1 million bpd of LPG loading capacity in Houston

Enterprise Products Partners will invest in three additional expansion projects that will increase the partnership’s capacity to load LP gas, polymer grade propylene and crude oil.

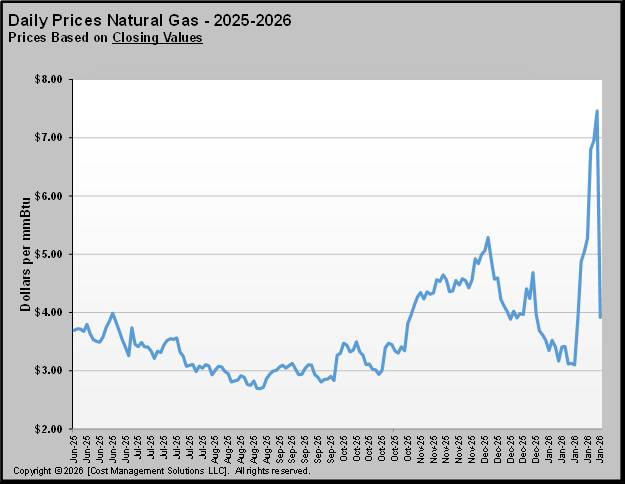

Call Cost Management Solutions today for more information about how Client Services can enhance your business at (888) 441-3338 or drop us an email at info@propanecost.com.