Back to the benchmarks: The latest in crude, propane pricing

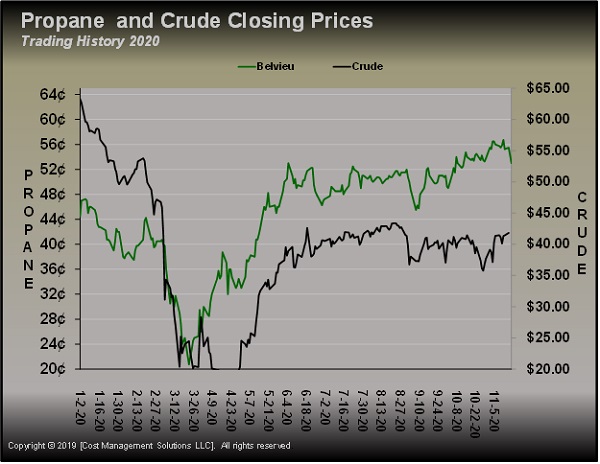

Those of you who are regular readers of Trader’s Corner will remember that we set benchmarks on crude and propane early this year. We discussed in several Trader’s Corners the reason for the benchmarks and the times we considered adjusting them. The benchmarks were 50 cents per gallon for Mont Belvieu (MB) LST propane and $42 per barrel for West Texas Intermediate (WTI) crude. That put propane’s relative value to WTI crude at 50 percent. We later upped the benchmark for WTI crude to $43 per barrel because a price of $42 per barrel was not causing an increase in U.S. drilling activity. That gave us confidence that we could raise the benchmark to $43.

Those benchmarks held up very well through the summer months. Both crude and propane deviated from those marks during the fall, but we never changed the benchmarks as they remained logical. We believed the deviations from the benchmarks were more rooted in events rather than significant changes in either crude or propane’s fundamentals, though fundamental changes did occur.

As we write, MB LST is trading at 51 cents per gallon. WTI crude is trading at $41.67, putting MB LST valued at 52 percent of WTI crude. Both markets have gravitated back to very near our benchmarks. Let’s explore some of the reasons for the deviations since August. On Aug. 27, WTI crude was at $43.04 and MB LST at 51.5 cents, putting propane’s value to crude at 50 percent – all comfortably near our benchmarks.

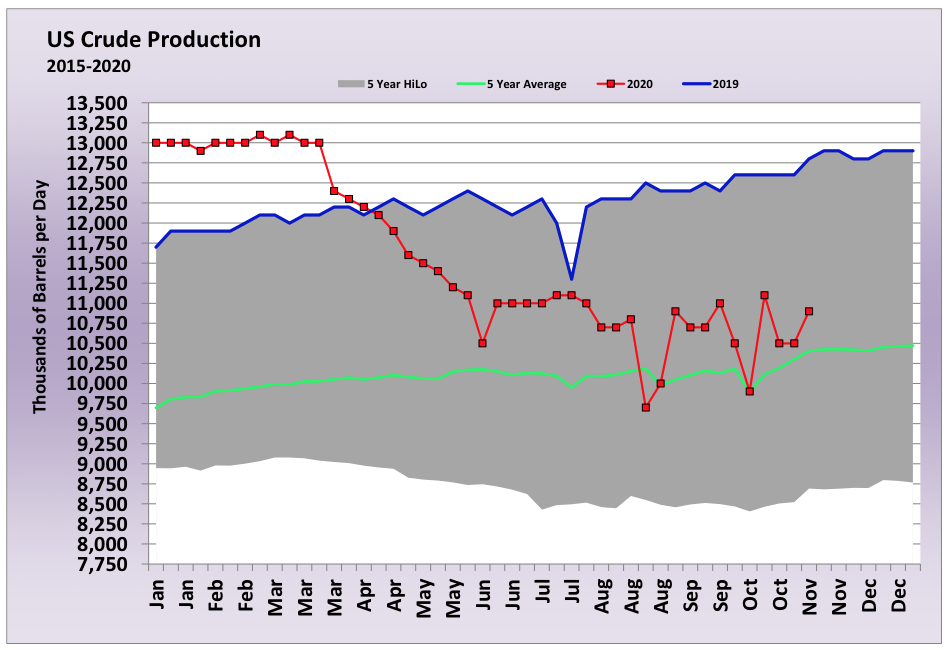

Crude demand plummeted in March due to COVID-19. The fall in demand was accompanied by a sharp fall in U.S. crude production.

At the same time U.S. production was falling, production from Libya was down to 100,000 barrels per day (bpd) from 1.5 million bpd due to political issues. Iran exports were, at times, near zero – rather than its normal 2.5 million bpd – due to strictly-enforced U.S. sanctions. The producer group known as OPEC+, which includes OPEC members and other large crude-exporting nations like Russia, cut 9.7 million bpd of production from their benchmark rates.

All of these production limitations helped crude’s price recover from historic lows. WTI had dropped to below $20 per barrel due to slumps in demand caused by COVID-19. At one point in early April, WTI actually went negative. With the production limitations, crude’s price recovered in the early summer months, and by early July, we had set our benchmarks. For two months, prices held very close to our benchmarks, but crude fell in early September.

OPEC+ had raised its production by 2 million bpd while new cases of COVID-19 began to surge again. Crude prices recovered some in late September and October but stayed below our benchmark. By this time, propane was getting seasonal influences and separated from crude, moving higher as crude stayed mostly flat.

Then near the election, crude prices came under pressure again, falling well below our benchmark price to $35.76. Propane separated even more at this point. As crude fell, propane prices moved higher. By Nov. 6, propane was 63 percent of WTI crude at 56 cents per gallon – obviously well above our benchmark. That brought us to our topic for last week, which was the producer hedging that drove propane prices back down in the last couple of weeks. The producer hedging was an indication that producers saw propane overvalued relative to crude and other energy sources and took the opportunity to capitalize.

There was a little more producer hedging after last week’s Trader’s Corner, but traders are now telling us that has played out as prices near our 50-cent benchmark again. This tells us that our benchmark remains a good barometer of where prices should be.

There are some buyers that are holding positions that are being forced out of those positions. They are now sellers, essentially taking the place of the producers that had been selling. Once the panic selling is over, we think propane may once again settle in around 50 cents per gallon.

There are a lot of moving parts in the crude market right now, but we think the risk is more to the downside, in the short run, with upside risks increasing in 2021.

Call Cost Management Solutions today for more information about how Client Services can enhance your business at (888) 441-3338 or drop us an email at info@propanecost.com.