Canadian propane producers slow exports to US

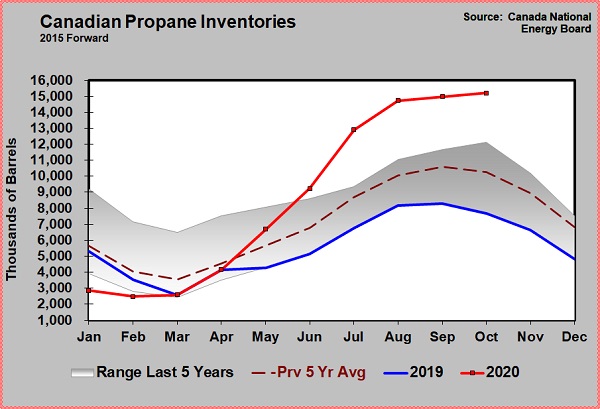

It has been a curious year for us to watch the build in Canadian propane inventory.

Currently, inventory is easily setting new five-year highs at over 15 million barrels – quite the contrast to the beginning of the year when five-year lows were being set. Those lows had many wondering if the U.S. could expect a lot less propane out of Canada this year.

The answer to that question is a resounding yes but not because of a lack of product. It appears there has simply been a decision not to ship propane to the U.S. and hold it in Canada instead.

Canada has been trying to diversify its propane exports for years. Prior to March 2017, all Canadian propane exports were to the U.S. In March of that year, trains of propane started being put together to go to Mexico. The amount of non-U.S. propane exports from Canada more than doubled in 2018. In April 2019, a waterborne export option came available in western Canada.

With the new export options and low inventory to start 2020, it certainly looked as if product available for U.S. export would be very limited. Again, it has been but not from a lack of product. The chart below showing the detail of Canadian export activity is very interesting indeed.

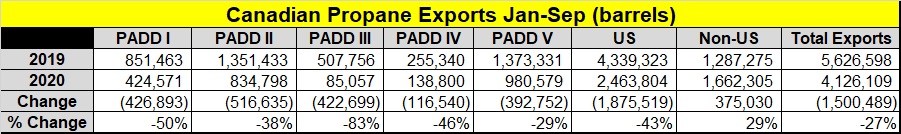

The latest export data is through September 2020. The table compares January through September export activity in 2020 to the same period in 2019. The data shows that Canadian producers did indeed substantially slow exports to the U.S.

The chart shows the export volumes by U.S. Petroleum Administration for Defense District (PADD). All PADDs have received less Canadian propane this year than last, with drops ranging from 29 to 83 percent. In total, the U.S. has received 43 percent less propane from Canada over the first nine months of this year, a drop of 1,875,519 barrels.

The first thought is that the producers are simply exercising their other export options, but that has not been the case. Exports to non-U.S. destinations are up just 29 percent this year, offsetting only 375,030 barrels of the reduced U.S. exports. That leaves a total of 1,500,489 less exports for a drop of 27 percent, resulting in the sharp rise in Canadian propane inventory through the summer and fall.

It is hard for us to say what the producer strategy might be. Perhaps this is just a matter of COVID-19 impacts that limited exports to non-U.S. destinations far more than Canadian producers expected. They may anticipate moving the barrels to non-U.S. destinations when economic activity improves post COVID-19.

One thing is for sure: A strong motivation to move the excess barrels to the U.S. has yet to occur. If winter remains mild, there could be motivation later this winter to move some of the excess out of inventory.

Perhaps there will be calls coming to retailers to take tank cars of propane at discounted prices, but we haven’t gotten any feedback that has started or any indication it will.

We do know that Canadian producers are very good at playing the long game. We also know they would love to send their propane to a better-priced market than the U.S. Midwest. Perhaps the waterborne export market did not work out as well as expected in 2020. But with the lack of motivation to move barrels into the U.S. so far this year, we suspect producers are anticipating much better activity in 2021.

Call Cost Management Solutions today for more information about how Client Services can enhance your business at (888) 441-3338 or drop us an email at info@propanecost.com.