Crude inventories down as refineries roar

Trader’s Corner, a weekly partnership with Cost Management Solutions, analyzes propane supply and pricing trends. This week, Mark Rachal, director of research and publications, tries to figure out what the deal is with crude inventories.

Catch up on last week’s Trader’s Corner here: Propane inventories helped, not fixed

Although the Energy Information Administration (EIA) reports that it believes U.S. crude production may have peaked this year and will begin declining, U.S. crude production has been high, not far off its record of 13.631 million barrels per day (bpd). Production last week was 13.428 million bpd. And even though production has been inching higher recently, the EIA believes that U.S. crude production has reached its peak. It now believes production will average 13.4 million bpd this year and next. It had projected production to increase next year in previous outlooks.

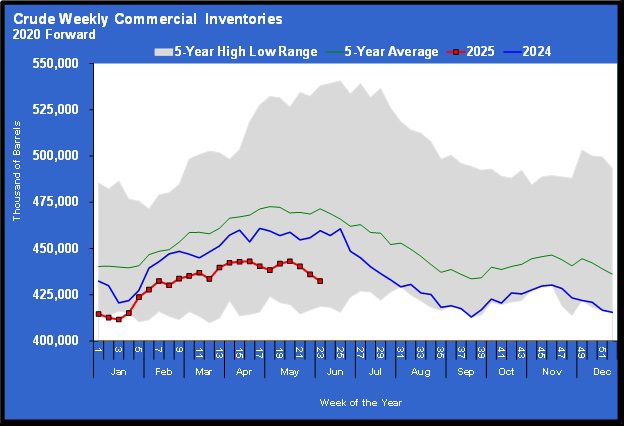

Despite elevated production levels, U.S. crude inventories are down compared to last year and the five-year average.

U.S. crude commercial inventories (not including inventory in the Strategic Petroleum Reserve) were at 432.415 million barrels for the week ending June 6. That was 3.644 million barrels down from the previous week. In their current position and trajectory, crude inventories are on track to reach five-year lows by mid-to-late summer.

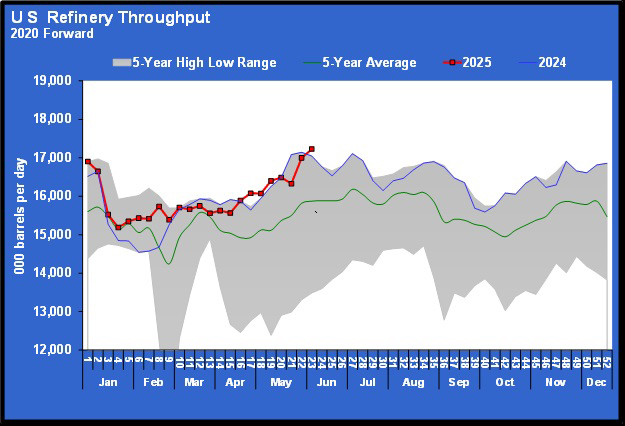

Part of the reason for the low crude inventory position has been robust refinery activity.

U.S. refinery throughput hit its highest level in the last five years for the week ending June 6. Throughput was up 670,000 bpd from the previous week and stood at 16.998 million bpd as refineries used 94.3 percent of their available capacity. U.S. peak refinery throughput was set in December 2018 at 17.760 million barrels. Many believed we would never come close to that throughput rate again, but it is now just 534,000 bpd off that mark.

If U.S. refineries are roaring, then one would assume that U.S. refined fuels inventories must be in great shape. But that is not what we found.

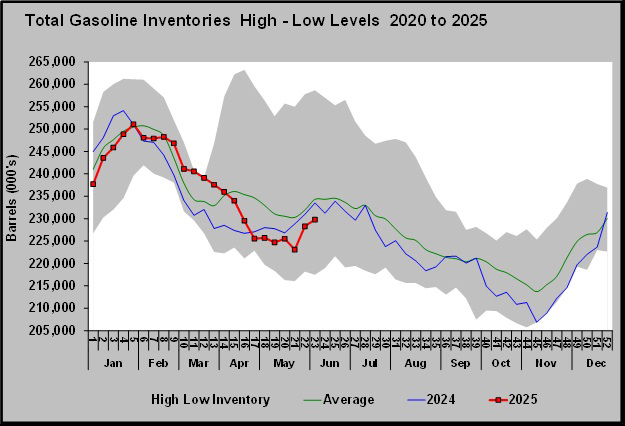

U.S. gasoline inventories are below last year and the five-year average.

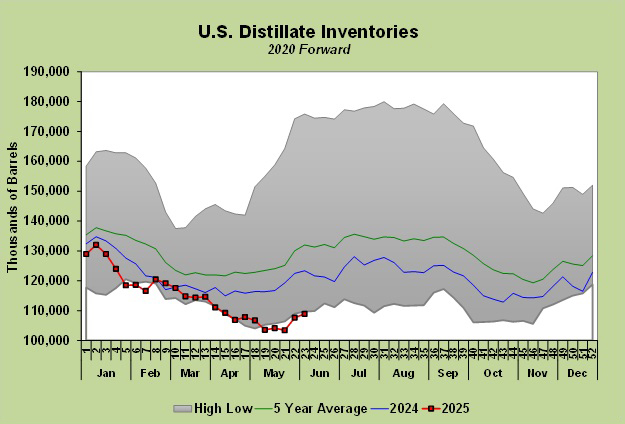

Distillate inventories are not only below last year and the five-year average, but they are also setting five-year lows.

So, if crude inventory is coming down and refinery throughput is strong, but U.S. refined fuels inventories are not building, then the U.S. must be consuming a lot more gasoline and distillates. Yet what we found was that U.S. gasoline demand year-to-date (YTD) is 11,000 bpd lower than last year. We did find U.S. distillate demand is running 148,435 bpd more than last year to this point in the year. That is a 4 percent increase, but that demand has dropped off dramatically recently and is now below last year and the five-year average.

So, this must mean the U.S. is exporting a lot of its refined fuels, right? Not really. Gasoline exports are down 27,435 bpd, and distillate exports are only up 7,000 bpd YTD. Still no answer, and there are only refined fuel imports left to investigate. Distillate imports are minor in the first place, and in the second, they are up from 148,000 bpd to 181,000 bpd YTD over last year.

One last chance: gasoline imports. Gasoline imports are down 28,000 bpd from the same period last year. But again, the volume here is not off the charts. To this point last year, the U.S. had imported 653,000 bpd compared to 625,000 bpd this year.

Let’s summarize all of this. U.S. crude production is high, but crude inventories are low. Increased refinery throughput is the culprit. However, that should mean refined fuels inventories are in great shape, but they are not. If they are not, we must be consuming a lot more domestically or exporting more. We are consuming more distillates but less gasoline. Overall consumption of total refined fuels is up YTD. Net exports of refined fuels overall are down YTD, and net imports are up. Overall, it feels like refined fuel inventories should be in better shape.

The bottom line is we don’t know why U.S. refined fuels are not in better shape than they are, nor do we understand why the market is not more concerned about the situation. It seems to us there should be a lot of upward pressure on refined fuels prices from a fundamental perspective. But the only upward price pressure on refined fuels seems to have mostly come from geopolitical events that have lifted crude.

This is one of those situations where we feel we are missing something, but we can’t quite put a finger on what. What we do know is that we are going to need to keep a much closer eye on refined fuel inventories than we have been. We were wrong to assume high refinery throughput was keeping the U.S. well-stocked in refined fuels.

The lack of upward pressure on refined fuels prices makes us wonder if traders are too focused on pessimistic economic outlooks and not on fundamental data. Prior to the jump related to Israel’s attack on Iran, U.S. distillate prices were lower than they were last year. Fundamentals would not suggest that would be the case. To us, this means if the market becomes less driven by pessimism about the global economy and starts looking at fundamentals, refined fuels prices have some room to move higher.

Charts courtesy of Cost Management Solutions

To subscribe to LP Gas’ weekly Trader’s Corner e-newsletter, click here.