Destinations evolve due to values, infrastructure

The focus of last week’s Trader’s Corner was Canadian propane inventory, which is setting five-year lows for this time of year. As we pointed out, a big reason is increased exports by Canadian producers.

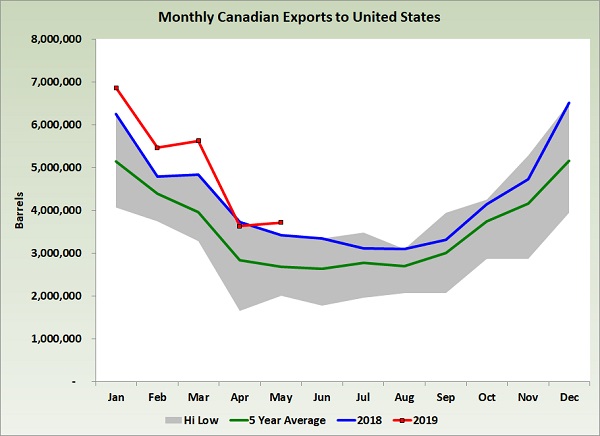

The latest Canadian export data is available through May. It shows that Canada exported about 2.3 million barrels more propane to the United States during the first five months of 2019 than it did during the same period last year.

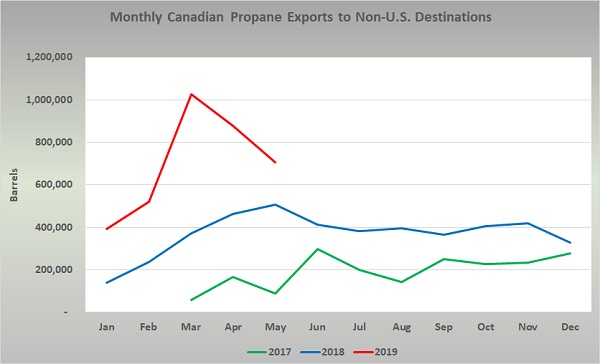

Prior to March 2017, that would have been the end of the story because all Canadian propane exports were destined for the U.S. But, weak values in the U.S. had Canadian producers looking for other markets, which they found in Mexico.

The chart above shows the evolution of those exports over the last three years. In 2017, non-U.S. destined exports tallied 1.9 million barrels. That amount more than doubled in 2018 to 4.4 million. Exports have been 3.5 million through May of this year, putting them 1.8 million barrels higher than through the same five months last year.

Combined U.S. and non-U.S. propane exports from Canada have been more than 4 million barrels higher through May of this year than they were a year ago.

There was a question coming into this year if Canadian producers would continue to be aggressive in moving barrels into the U.S. with a new waterborne export facility coming available. That question has been answered in the affirmative.

The Ridley Island Propane Export Terminal (RIPET) is located in Prince Rupert, British Columbia. The facility is operated and 70 percent owned by AltaGas. AltaGas entered a multi-year deal with Astomos Energy Corp., a Japanese company, to purchase at least 50 percent of the propane shipped from RIPET annually.

The facility started taking propane in mid-April and its first shipment departed on May 23. It is expected that nearly 15 million barrels of propane will be shipped from RIPET to Asian customers each year. Those exports should start showing up in the next data released by Canada’s National Energy Board (NEB).

Fifteen million barrels of exports represents about 27 percent of last year’s 55.8 million-barrel total. So now the question becomes will the new export facility simply open the door for more propane production in Canada such that the exports to the U.S. and Mexico will be unchanged or will the new waterborne exports take barrels from either Mexico, the U.S. or both?

It will take a few months of data from the NEB to start answering that question. What is certain is that the flexibility will be good for Canadian producers and potentially increase their netback if increased production does not offset all of the new capacity. That would mean values in the U.S. Midwest could have to improve to compete for Canadian supply in the future.

Call Cost Management Solutions today for more information about how Client Services can enhance your business at (888) 441-3338 or drop us an email at info@propanecost.com.