EIA: COVID-19 response to boost propane consumption this winter

The U.S. Energy Information Administration (EIA) is anticipating more space heating demand this winter due to more people working or attending school from home.

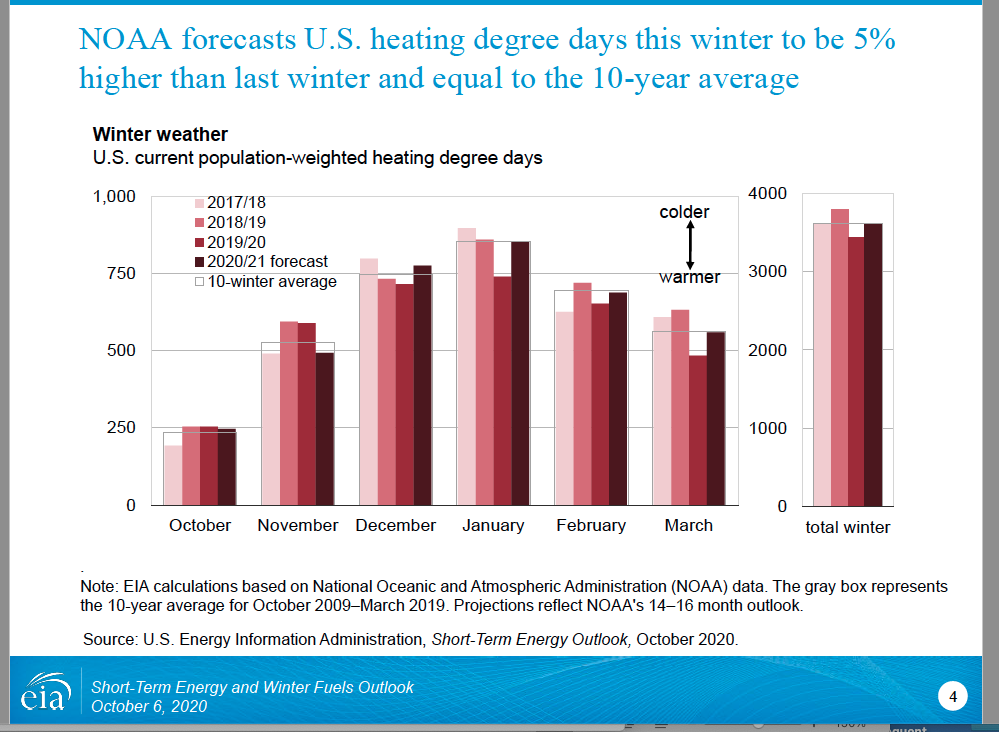

The nation’s social distancing response to COVID-19, with more people at home, and relatively colder weather led EIA to forecast a 4 percent increase in total U.S. propane consumption this winter. U.S. heating degree-days will be 5 percent higher than last winter and equal to the 10-year average, EIA says.

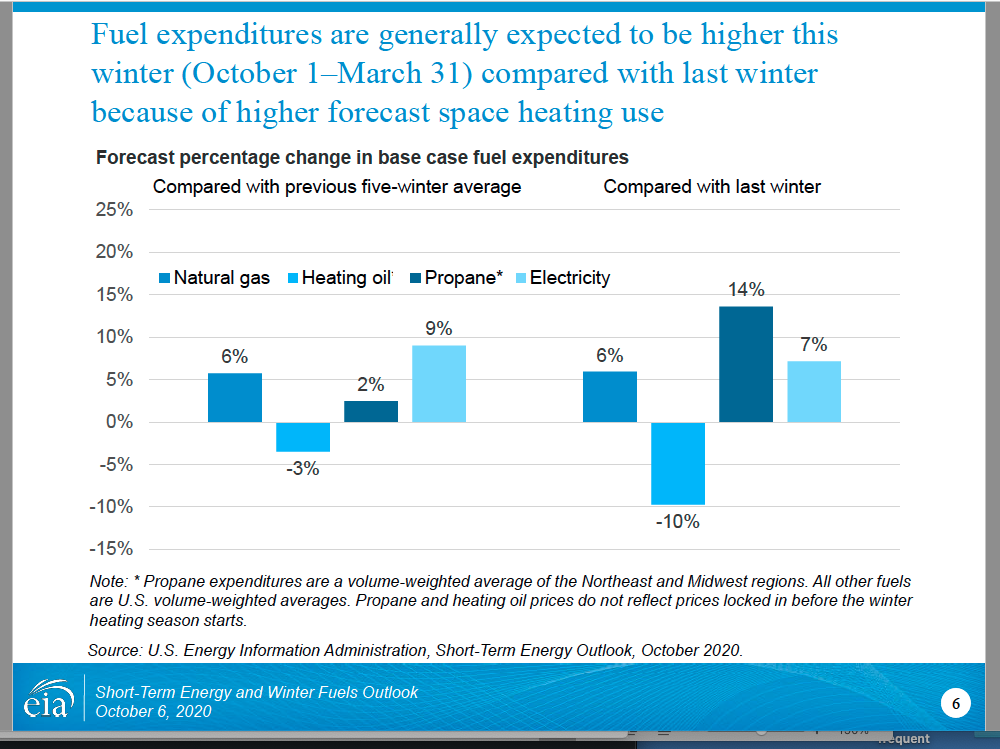

With residential prices also expected to be higher than last winter due to higher prices at Mont Belvieu, household expenditures for propane will rise 14 percent compared with last winter and 2 percent compared with the previous five-winter average, EIA reports.

EIA also expects homes that heat primarily with natural gas and electricity will have more demand for space heating, contributing to higher forecast heating expenditures this winter compared with last winter. For homes that heat primarily with heating oil, EIA expects that price declines will offset the effects of higher consumption and lead to a decrease in expenditures.

The agency presented the numbers in its Winter Fuels Outlook.

A closer look at propane

About 5 percent of all U.S. households use propane as their primary space heating fuel, according to EIA, and many of these households are in the Midwest and Northeast.

EIA expects that households heating with propane in the Northeast will spend 18 percent more this winter than last winter, a result of forecast propane prices that are 7 percent higher and average household consumption that is forecast to be 10 percent higher than last winter. EIA expects households in the Midwest to spend 12 percent more this winter, reflecting average propane prices that are 4 percent higher than last winter and consumption that is 7 percent higher.

U.S. and most regional propane inventories enter winter at the high side of the five-year average. Only the Midwest, the region most reliant on propane for heating, is at the five-year average. A market that appears well supplied should help mute the seasonal increase in propane prices this winter, the agency adds.

EIA forecasts that total U.S. propane production at natural gas plants and refineries will be 7 percent lower this winter than last winter, total U.S. consumption will be 5 percent higher and net exports will be 15 percent lower. U.S. consumption and export growth depend on demand for propane as a heating fuel, as petrochemical feedstock for petrochemical plants and as an agricultural fuel.

Current propane inventory levels in western Canada, which are above the five-year average, may allow for higher imports into the Midwest as heating demand rises, EIA points out. Development of a second marine export terminal from Canada’s Pacific coast has been delayed, resulting in higher-than-expected levels of supply becoming available for export to the U.S. by rail this winter.

Featured image: ehrlif/iStock / Getty Images Plus/Getty Images