Has the change in price trend begun?

For several weeks in Trader’s Corner, we have examined the reasons for the ultra-low price environment that developed for U.S. propane. We explored what happened with propane prices during 2015-16, when fundamental conditions were similar. Then, we looked at how and why propane prices rebounded from January 2016 through October 2018.

Last week, we looked at how a propane retailer could utilize financial swaps to take advantage of the current low prices when it becomes more apparent the downward price trend has ended.

We have noted that for the propane price trend to change, fundamentals related to supply and demand must become more balanced. This past week, there was an uptick in propane prices. Mont Belvieu LST closed at 39 cents on Monday but had jumped to a 42.5-cent close by Wednesday. Conway rallied from 35.25 cents on Monday to 39.5 cents on Wednesday.

Propane prices generally have been falling since the beginning of December, when it became apparent that new export capacity would not be utilized enough to offset record propane supply, leading to inventory builds. So, any uptick in prices has one looking for the reason.

It is often said that the cure for low prices is low prices. This recent uptick simply could indicate that propane buyers have decided the remaining downside price risk is limited enough that they are willing to assume it for the potential opportunity of getting in on the ground floor of a longer-term price uptrend.

Still, the upswing makes it important to look closely at the fundamentals to see if we can detect a shift. Indeed, there are some noteworthy changes. Let’s look at four pieces of the fundamental picture to see how the supply/demand balance is trending:

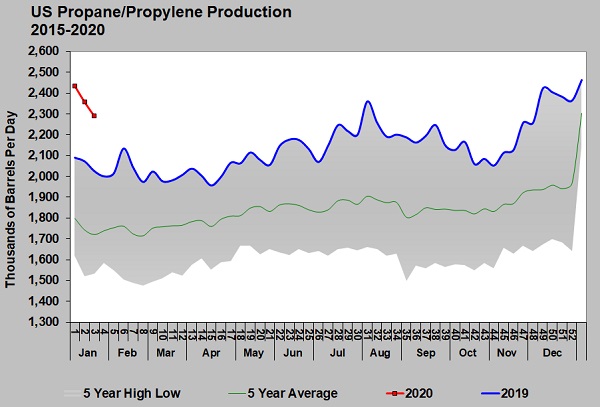

Propane production:

U.S. propane/propylene production is still easily setting new highs for this point in the year. However, the amount of growth in supply has slowed in the first three weeks of 2020. We noted that production did slide during the same period last year, though not as dramatically. But we can’t help but wonder if a slowdown in drilling activity, ultra-low natural gas prices and reduced refinery throughput is finally starting to slow down the growth in propane supply, which has been the key reason for the low-price environment now present in propane.

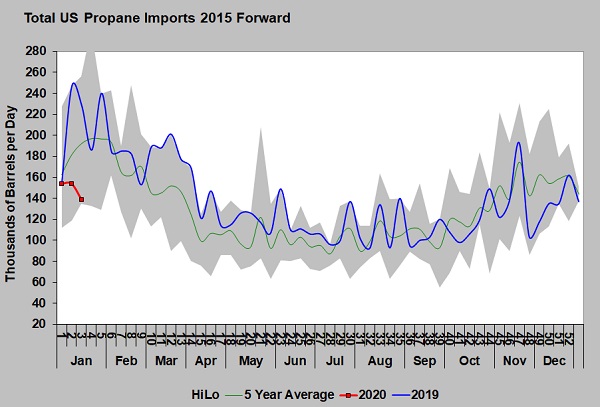

Propane imports:

The other piece of the supply side of the supply/demand equation is propane imports. All U.S. propane imports come from Canada. It was reasonable to expect that propane imports from Canada would slow when a new waterborne export facility was completed on Canada’s west coast toward the end of the first half of 2019. But propane imports from Canada were 167,000 barrels per day (bpd) in 2019, up from 139,000 bpd in 2018. In 2020, imports to the United States are down from last year. Is it possible the waterborne export facility in Canada is finally having an impact?

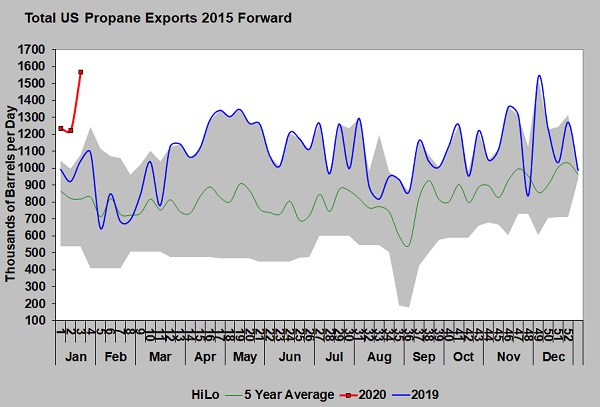

Propane exports:

Propane exports have been consistently high in the first three weeks of 2020, with the week ending Jan. 24 holding a record at 1.569 million bpd. Exports have averaged 1.342 million bpd in the first three weeks of 2020 compared to 986,000 bpd over the same period last year. Is the world starting to demand more U.S. propane? Will the new export capacity now become fully utilized?

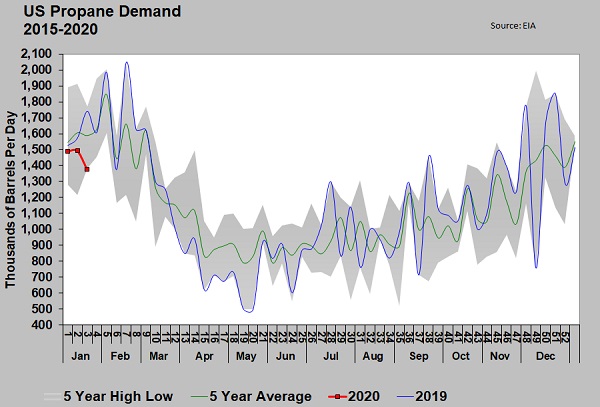

Domestic demand:

The one area that has not been supportive of propane prices during the early weeks of 2020 is domestic demand. Heating degree-days this year are fewer than last year and below the five-year average. A lack of growth in domestic demand continues to make producers more focused on the export market to improve their netback. A big surge in domestic demand to close out the winter could make things interesting, but there is little indication that is coming at this point.

Certainly, a few weeks of fundamental data that are more supportive of propane prices do not offset the months-long trend of bearish fundamentals. The first few weeks of 2020 could be an anomaly, and the bearish trends could resume. Still, it’s important to note the changes and to follow these data points closely for an indication that the price trend for propane could be changing.

It may still be early to take a hefty dose of long-term speculative positions on propane. But it may not be too early to consider shorter-term management of the upside price risk. We will discuss how that might look in next week’s

Trader’s Corner.

ANNOUNCING HEDGING SEMINAR: Please note that Cost Management Solutions will be conducting a two-day hedging seminar on March 19-20 at the Houston Airport Marriott. This seminar will provide tools and strategies for helping propane retailers navigate the changes in propane pricing in the coming months. Please contact Dale Delay at 888-441-3338 for more details.

Call Cost Management Solutions today for more information about how Client Services can enhance your business at (888) 441-3338 or drop us an email at info@propanecost.com.