In the Know: M&A tax implications

In the Know is a monthly partnership between LP Gas and Propane Resources. This month, consultant Cooper Wilburn offers his take on potential tax changes and how mergers and acquisitions in the propane industry will be impacted.

QUESTION: What tax laws impact the mergers and acquisitions field?

ANSWER: Over the past several years, sellers in the propane industry have had tremendous opportunity to take advantage of the market environment. Tax rules and interest rates have helped drive this environment.

With a new administration in place and the exponential growth of U.S. debt, retailers need to assess the ideas circulating in Congress.

The big-ticket item being discussed now is an increase in the capital gains tax. President Joe Biden’s tax proposal includes hiking the capital gains tax for households making more than $1 million. Currently, capital gains are taxed at 20 percent. The proposal aims to tax these gains at an individual’s highest tax rate: 39.6 percent.

Take a company that sold for $5 million. At the old tax rate, the business owner would net approximately $4 million. With the new tax proposal, that same deal would net the seller $3.02 million, or 24.5 percent less.

Bonus depreciation, like Section 179 of the IRS tax code, allows immediate depreciation of 100 percent of certain assets. One major difference between Section 179 and bonus depreciation is the limit at which you can depreciate. Section 179 is limited to just over $1 million, while bonus depreciation isn’t capped. Bonus depreciation amounts were changed in 2017 from 50 percent as part of the 2017 Tax Cuts and Jobs Act. A buyer could purchase a company and write off nearly 100 percent of the purchase, reducing tax liability.

This tax incentive will begin to phase out. Only 80 percent can be depreciated in 2023, 60 percent in 2024, 40 percent in 2025 and 20 percent in 2026 before being fully phased out.

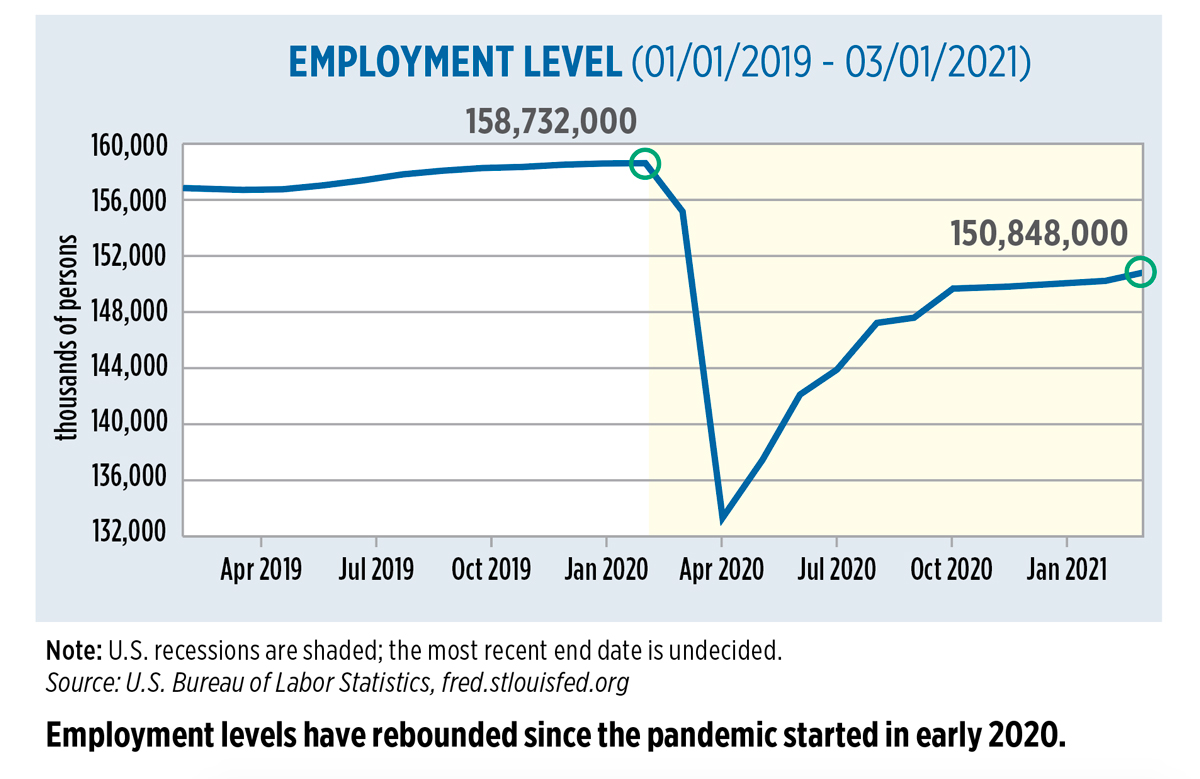

According to seasonally-adjusted employment levels provided by the Federal Reserve Bank of St. Louis, about 150.8 million people were employed in March 2021. Prior to the pandemic, in February 2020, employment levels were about 158.7 million. While major progress has been made, there is still a way to go.

As for inflation, Statista projects annual inflation of 0.62 percent in 2020 and 2.24 percent in 2021. The consumer price index (CPI) was 264.793 in the first quarter of 2021 versus 257.989 in the first quarter of 2020, an increase of 2.63 percent. Second-quarter 2021 should see a significant hike compared to the lowest CPI figure during the pandemic.

The Federal Reserve has stated rates will stay the same until employment is back to pre-pandemic levels and the U.S. experiences moderate inflation above 2 percent for a period of time.

Many sellers ask us if now is a good time to sell their business. It isn’t a bad time, but it depends on your goals. Buyers have access to cheap capital because of low interest rates. Currently, tax rates remain low, and investors are seeking to acquire propane companies.

At some point, tax rates will go up. If not in 2021, there is a good chance it will happen in 2022 or 2023.

Cooper Wilburn is a consultant at Propane Resources. He can be reached at 913-262-0196 or cooper@propaneresources.com.