Inventory builds begin lighter than previous year

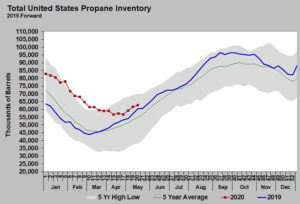

For the week ending May 15, the Energy Information Administration reported U.S. propane inventory increased 1.072 million barrels. The build was less than industry expectations for a 1.6-million-barrel build, with the five-year average build for week 19 of the year being 1.647 million barrels.

Inventory builds were late in starting this year, and now that they have, last week’s data showed they can be lighter than normal. In March, inventory was setting new five-year highs, well above last year and the five-year average. Now inventory is just 4 percent, 2.385 million barrels, above last year. The Gulf Coast was carrying the largest inventory surplus a couple of months ago and has now fallen 767,000 barrels below last year.

Obviously, we have already seen propane prices swing higher from their recent lows. Both Mont Belvieu LST and Conway are trading at their highs for the year, and their values relative to crude are running at five-year highs for this time of year. Mont Belvieu LST propane traded as low as 20.75 cents in March. Conway fell to 20.5 cents during that time. It felt like a real bargain then, but now that the price is back to setting this year’s highs, perhaps not so much.

It’s not much of a surprise that buyers are becoming a little more cautious. History generally shows buying when propane is at a high relative value to crude and near the year highs doesn’t work out so well. But one can still make a fairly bullish case for propane, despite its more than doubling in value in less than two months.

First of all, the prices from where this rebound started were historically low. More than doubling from around 20 cents per gallon is not a huge leap. Still, it is a logical time for propane retailers to ask if there is enough upside price risk to justify price protection for this winter and perhaps beyond. Propane no longer feels like a bargain, but is there a reason to buy it?

There is a lot of economic uncertainty, so suggesting that current trends will continue runs some risk. But sometimes we simply have to respond to the way things are going and adjust if they change. The quick cleanup of so much excess propane inventory is certainly a reason to believe that propane prices have not reached their peak.

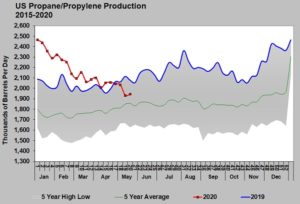

The other data point that stands out is domestic propane/propylene production.

Production was up 13,000 barrels per day (bpd) last week, but it has now run below last year for four weeks in a row. Production is running 519,000 bpd less than the record high of 2.464 million bpd reached at the beginning of the year. In addition to domestic production, propane imports are down 41,000 bpd from last year. That is a large hit to propane supply and supportive of prices.

The question is whether propane supply is likely to recover quickly. Most propane comes from natural gas processing, but natural gas supplies have grown in association with crude wells. When a crude well is drilled, it generally produces natural gas along with the crude. The crude and natural gas are separated. Then, the natural gas is further processed, breaking out the various natural gas liquids so they can be marketed. So much of our outlook for propane comes from our outlook on crude.

Crude production has fallen about 1.6 million bpd from its peak. It is well documented that drilling activity is dramatically lower as a result of the collapse in crude prices. For the week ending May 15, the number of active rigs drilling for crude in the United States was at 258. That is down a remarkable 544 from this same week last year.

In many cases, less drilling means that depleted wells are not being replaced. Production lost for this reason could be much slower to return. Producers need at least $40 per barrel to break even in most shale plays and as much as $46 in others. Crude’s price is likely to have to get higher than that for a period of time to encourage companies to resume drilling programs.

We also must take into consideration that as oil prices recover, lower-cost producers, such as OPEC nations, have nearly 10 million bpd of production shut. They aren’t likely to keep all of that production shut just to see prices get high enough to encourage more U.S. drilling and production. If that is correct, we are likely to see more natural depletion of U.S. production as rigs remain idle.

But not all lost production in the United States is due to decreased drilling. Prices got so low this time that producers actually shut producing wells. While new drilling may require significantly higher than break-even values to resume, we would suspect most any price above breakeven will bring shut production back online.

When crude rises above $40 per barrel, we would expect a rebound in U.S. crude production with a corresponding rebound in natural gas and propane production. Some producers are obviously in a cash flow crunch, so they may be willing to open up production before breakeven is reached simply because they must have the revenue to stay afloat. It is not impossible to believe we will see an uptick in production even before $40 crude is reached. The opportunity to open shut-in crude production sooner than later is present. If it happens, there will be an improvement in propane supplies.

We remain uncertain about what price point will cause any significant gains in crude drilling. Until that happens, well depletion will occur. We can certainly see a scenario where we could get a jump in crude, natural gas and propane production in the short term due to shut crude wells opening again. Subsequently, it isn’t hard to imagine a slow decline in production until prices are high enough to once again encourage drilling.

Some propane price protection is warranted now since we cannot know exactly how all of this will play out and since fundamentals are obviously more supportive right now. But one may want to keep some dry powder just in case propane production jumps when crude prices approach the $40 mark. If it occurs, such a jump in production just might bring down prices while allowing for another buying opportunity. But the longer we see crude below $40, the tighter propane supplies are likely to get and the need for price protection will grow.