Inventory grows as supply outpaces demand

April is when we make the transition from monitoring heating-degree days and the impact of winter weather to more closely monitoring propane inventory to see how it is accumulating for the coming winter. In 2019, it looks like we should have made that transition much sooner as high rates of propane production and problems with propane exports started the inventory build period early and with higher than normal builds.

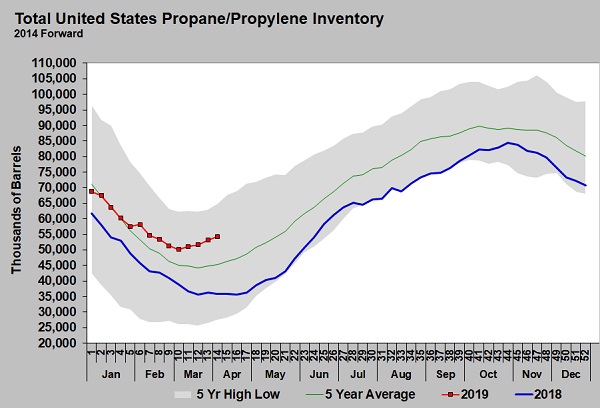

The blue line above is 2018. Note how U.S. propane/propylene inventory continued to draw through April. Relatively slow build after had inventory very near the five-year low in late May. Contrast that with 2019 (red line). Inventory started building in early March, consistently moving higher with solid builds each week.

A major chemical spill and fog on the Houston Ship Channel limited propane exports for several weeks. But, over the last three weeks, exports have been over a million barrels per day (bpd). Inventory continued to rise, though. Exports are going to have to remain over a million bpd — given current production levels of over 2 million bpd — or inventories could rise at an above average pace through the summer.

Another 175,000 bpd of export capacity will come on line sometime during the third quarter of this year. But between now and then, it looks like a substantial cushion in inventory could be built. On April 5, U.S. propane inventory was 48.134 million barrels. That was 15.094 million barrels, 45.68 percent higher than last year.

It looks like export economics are favorable, and at least for now, Asian buyers are said to need the supply. That could slow the inventory build, but historically, it has been difficult to maintain exports above 1 million bpd for long.

Propane inventory reached 80.8 million barrels as a high, ahead of the 2018-19 winter. That was up from the 78.8 million bpd at the start of the 2017-18 winter. From the first week of April 2018, until inventory hit its highwater mark at the end of October 2018, inventory built 47.760 million bpd. Just a repeat of that build would put inventory at 95.894 million bpd to start next winter.

It is hard to see much of a break in supply growth. Crude production remains high, and just this week, the Energy Information Administration says it expects record high natural gas production of 91 billion cubic feet per day in 2019, up 83.39 billion cubic feet from 2018’s average. That is about a 10 percent increase.

Percentage gains in propane supply have been higher than gains in natural gas supply as producers target liquids rich formations. But, even a 10 percent increase in propane supplied from natural gas processing would be about a 139,000 bpd increase in propane supply this year over last.

Enterprise’s 175,000 bpd export capacity expansion, due to be completed in the third quarter, is for both propane and butane. Roughly, there should be enough propane capacity to account for the lowest possible growth in propane supply. That assumes the world wants the supply and there are not logistical issues or slack in using export capacity.

In reality, it appears it will take more than this export expansion to fully absorb growing propane production. The additional demand could come from more propane dehydrogenation (PDH) activity. PDH is a process of turning propane into higher valued propylene for use in the petrochemical industry. These PDH plants can use a lot of propane. For example, there were reports at the end of the week that a PDH plant operated by Flint Hills Resources, which had been having operational issues, is back on line. That plant alone uses 30,000 bpd of propane. Other PDH units are coming on line or slowly building to their operational capacities.

The bottom line is that production is out ahead of counterbalances on the demand side to start 2019. The demand side is going to be playing catch up this year, and it remains to be seen if it can keep pace. The degree it is able to do so will have much to do with inventory positions and thus propane values to start next winter. Right now, it is probably best to bet on the front runner (supply) and be cautious with speculative propane buys. But, we can’t go to sleep on dark horse demand with export capacity expansions and PDH plants under development. Down the road, there could still be a need to place a bet on the longshot.

Call Cost Management Solutions today for more information about how Client Services can enhance your business at (888) 441-3338 or drop us an email at info@propanecost.com.