Major jump in propane demand decreases inventory

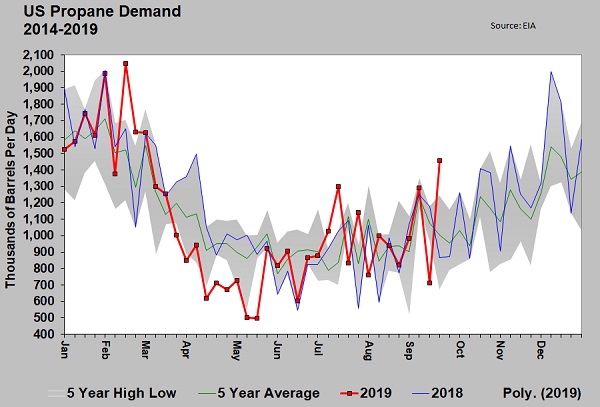

For the week ending Sept. 20, the U.S. Energy Information Administration (EIA) reported a major jump in U.S. propane demand of 743,000 barrels per day (bpd). That put domestic demand at 1.457 million bpd, which was a new five-year high for the 38th week of the year. The major jump in domestic demand resulted in a surprising 1.024 million-barrel decline in US propane inventory.

As the chart shows, domestic demand is quite volatile. Note that in week 37, demand was at a five-year low, and then this week it is at a five-year high. We must be aware that domestic demand is an implied number, as the EIA does not collect specific data on domestic demand. Instead, it collects data on production, imports, exports and inventory levels. Based on the data collected in those four areas, domestic demand is implied or calculated. That means that a reporting error in any of the four collected areas can also impact domestic demand.

For example, if one contributor to the inventory data understates their position, then propane demand will be overstated. If the data is corrected the next week, then domestic demand might be understated. We believe this could be a key reason domestic demand numbers can be so choppy, swinging widely from week to week.

The demand number from weeks 37 and 38 that swung from a five-year low to a five-year high may be perfectly correct. However, it would seem the things that could increase or decrease domestic demand are slower moving, like crop drying demand or weather-related demand. Ultimately, the data released by the EIA on domestic demand is only as good as the reporting it receives in the other areas.

In this particular case, there is a potential explanation of why demand swung so much from one week to the next outside of a possible reporting variation. The data for the last EIA Weekly Petroleum Status Report was collected on Sept. 20. On Sept. 14, Iran attacked crude gathering and processing facilities in Saudi Arabia, resulting in a major spike in crude and propane prices. The attack had the potential for not only disrupting crude supplies for months, but NGL supplies as well. In fact, NGL prices actually outpaced crude prices higher the first trading day following the event on Sept. 16.

We had conversations with customers immediately following the event, and we believe that there was a decision by many retailers to buy physical loads of propane during the week of Sept. 16 in a defensive strategy to guard against the potential for a substantial run higher in prices.

If that is the case, since crude and propane prices adjusted lower again soon after the event, it is possible physical liftings slowed down during the week starting Sept. 21. It is probable that inventory gains resumed during that week if the above theory is correct. The data the EIA will release on Wednesday should give us some better insight.

Call Cost Management Solutions today for more information about how Client Services can enhance your business at (888) 441-3338 or drop us an email at info@propanecost.com.