Midwest propane supply issues have wide-ranging impacts

There has been a shift in the price relationship between Mont Belvieu propane and Hattiesburg propane over the past year. Historically, product moved from Mont Belvieu, Texas, to Hattiesburg, Mississippi, and from Hattiesburg to other points along the Dixie Pipeline system. The line goes across the southern states, ending in Apex, North Carolina. This movement was consistent when the East and North were net short of supply year-round.

But the tea cart was upset with the development of the Marcellus and Utica shale plays, which added significant amounts of propane production in New York, Pennsylvania, Ohio and West Virginia. Last year, producers expected to move excess supplies to Marcus Hook, Pennsylvania, on the East Coast for export. The plan was to move the propane along an expanded Mariner East pipeline system. But, those plans were foiled by numerous issues in completing the Mariner East expansion and even with the legacy Mariner East 1 pipeline.

Producers didn’t have a plan B when the system was unavailable to them last year, causing propane prices to come under intense pressure. In fact, some sources told us that producers started moving product to Apex to inject into the Dixie Pipeline, essentially reversing the line flow and upsetting the traditional pricing relationships. Certainly, product was being railed from the Midwest to Hattiesburg.

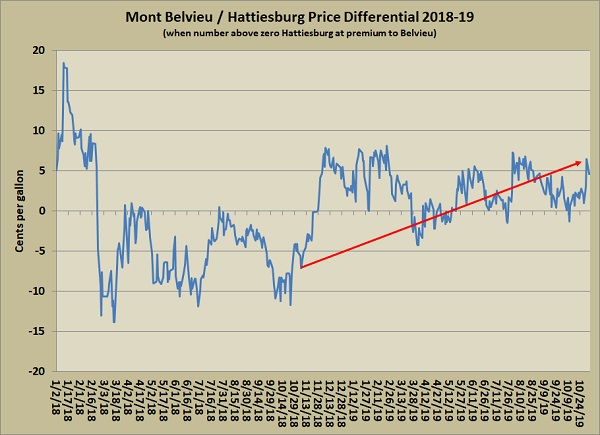

The chart above shows that Hattiesburg was trading below Mont Belvieu last year, upsetting the typical pricing dynamics. Now issues with the Mariner system are being ironed out, and it is more consistently delivering propane to Marcus Hook for export. This has taken much of the excess supply out of the region. We are already seeing issues with tight supply, as crop drying kicks into gear in the Midwest. Further, Hattiesburg is once again trading mostly at a premium to Mont Belvieu, as less rail and truck shipments move to Hattiesburg and Apex. Apex is trading about 14 to 18 cents above Mont Belvieu LST.

The change in dynamics on the Dixie last year, due to excess supply in the Midwest, is indicative of why producers have been so desperately looking for ways to consistently deal with the propane oversupply issues in the Midwest. The fact is that much of the infrastructure that used to bring propane to the Midwest, when crop drying and winter weather spiked demand, is now being used to take excess NGLs out of that market. Very little is happening or has been happening in recent history geared toward meeting the needs of propane retail markets in the Midwest.

The problem with the Midwest retail market is that it is extremely seasonal. Yet producers are processing natural gas and yielding propane 24/7/365. That necessitates them accessing more consistent demand markets and adjusting infrastructure accordingly to deliver propane to meet that demand, often at the expense of the retail propane market.

The consequence is that the Midwest is struggling with propane being where it needs to be when it needs to be there. Make no mistake, there is plenty of supply in the Midwest; the issues are with infrastructure and commitments to less seasonal demand customers. As a result, many propane retailers are having to go far and wide to find wet barrels to fill crop-drying demand, which is running up costs.

There are reports that some farmers are delaying harvest or simply putting up wet crops due to a lack of propane for drying. That is a crying shame, given that U.S. propane inventory stands at over 100 million barrels. But that inventory does no good if it isn’t accessible. Unfortunately, the answer to this problem is unlikely to come from producers as they do what they must to improve netbacks on their propane by accessing higher-volume, more demand-consistent markets.

Propane retailers and propane consumers in the Midwest will likely have to tackle this problem together. Let’s face it: Much of the Midwest is a very low-margin propane area, making it very difficult for retailers to invest in the storage and assets necessary to deal with the new supply paradigm. That may have to change. Retailers will likely have to invest in more storage to help them avoid 30-cent, 50-cent and even higher spikes in transportation costs.

Consumers that have consistently punished retailers that didn’t have the lowest price may have to take supply reliability into account in this new paradigm. It may be that low-price retailers may no longer be king of the mountain in the Midwest as they are supplanted by those that are making the investment and building the supply relationships requisite to being a reliable supplier. We have no doubt this transition will come only after much tearing of clothes and gnashing of teeth, but it may nonetheless have to transpire.

Propane consumers may have to invest in more storage of their own and do a better job of working with their retailer to make sure supply is in place ahead of time. This would especially be true when crop drying is delayed as it is this year.

While refineries have the cheapest price in the summer, they actually have more propane available in the summer than in the winter months. In fact, many of them go down for maintenance at crop-drying time. It may be hard for propane retailers and consumers to wean themselves from those deliciously distressed propane prices in the summer months, but it may be necessary while building a more diversified supply mix.

One of our first jobs in the propane industry was marketing propane out of refineries in the Midwest. We were green behind the ears to say the least. We went to our first convention and met the prospective retail customers. We foolishly suggested that we would like to sell to them in a certain fashion. A retailer looked at us rather curiously and then said, “You will sell to me like this and be happy to do it.” I was taken aback, but truer words were never said.

Back then the retail propane market was the only game in town. Everything we did as a company was to build relationships with retailers. Frankly, we miss those times, but times have changed.

Call Cost Management Solutions today for more information about how Client Services can enhance your business at (888) 441-3338 or drop us an email at info@propanecost.com.