Mild start to heating season shrinks inventory deficit

Trader’s Corner, a weekly partnership with Cost Management Solutions, analyzes propane supply and pricing trends. This week, Mark Rachal, director of research and publications, discusses the propane inventory deficit within the context of the mild start to heating season.

Propane prices were driven high during the summer as inventory levels continued to fall behind last year and the five-year average. Because of this growing inventory deficit leading up to winter, Mont Belvieu LST propane reached a yearly high on Oct. 4 at 152 cents. Conway reached its yearly high a day later at 151.75 cents.

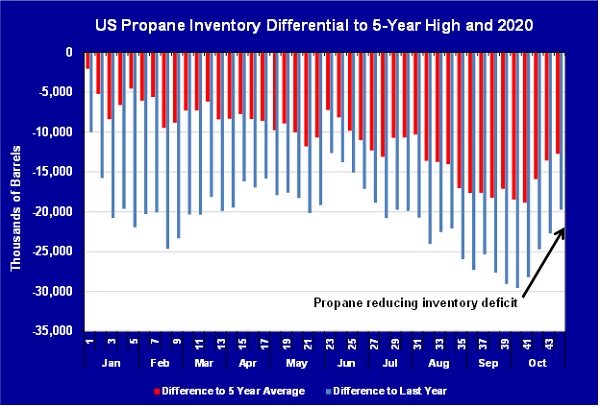

By week 40 of the year, U.S. propane inventory was 29.554 million barrels below 2020. A week later, it bottomed out against the previous five-year inventory average with a deficit of 18.834 million barrels.

Since week 40, a very mild start to the 2021-22 heating season has allowed inventory to dramatically decrease its deficit to both 2020 and the five-year average. As of Oct. 29, the inventory deficit to last year had dropped by a third to 19.730 million barrels. The deficit to the five-year average was down to 12.701 million barrels.

As of this writing, propane prices are moving down. Mont Belvieu LST is at 135.5 cents, down 16.5 cents from its 152-cent high. Conway is at 135.75 cents, down 16 cents from its 151.75-cent high. Propane was trading at 82 percent of West Texas Intermediate crude when it set its highs. It is now trading at 72 percent, a reflection of the market’s sentiment that the fundamentals for propane are less bullish than they were a month ago.

Propane buyers must now ask themselves if the reduction in the inventory deficit is likely to continue or if it is a short-term phenomenon. That primarily means: Do we believe that temperatures will remain above normal most of the winter, or is there a chance they could get back to normal or below normal?

Looking at various weather forecasts, we see a mixed bag. Some have winter weather remaining mild; others have colder weather coming. We gave up trying to predict weather a long time ago, so we just can’t make a decision based on guessing the weather.

The fact is we are going to have to make decisions about propane supply not knowing all that the future has in store.

In World War II during the pivotal naval battle at Midway, U.S. Adm. Raymond Spruance found himself in command of carrier Task Force 16, including U.S. carriers Enterprise and Hornet. He had not commanded a carrier task force before, having been thrust into the role after Adm. Bull Halsey became ill.

To this point, the Japanese navy had dominated the U.S. Navy while rapidly expanding its territory. The surprise attack on Pearl Harbor had decimated U.S. battleships, leaving the U.S. Navy just four carriers to defend the homeland. There were only three carriers operational at Midway, and Spruance was responsible for two of them. He knew he was up against at least four carriers, and there was a large Japanese surface flight assigned to the battle as well.

One of the Japanese carriers was spotted by scout planes. The decision had to be made on whether to attack that carrier with the possibility others could pop up anywhere to threaten the valuable U.S. carriers while Japanese planes were away making the attack. Advisers were telling Spruance all of the things he and they did not know, advocating he should be cautious about the attack. Spruance weighed all he didn’t know, but made the decision based on what he did know: “I know I have one enemy target here,” he said. “Turn her into the wind – we attack.”

The result was the entire Japanese carrier strike force with its four carriers operating in a single diamond formation was caught unprepared to defend the attack, resulting in what was widely considered the most important naval battle of the war. All four of the Japanese carriers were sunk. It turned the tide of the war as the U.S. Navy now became the attackers and the Japanese the defenders.

Perhaps there is something in that story for propane buyers.

There is a lot we don’t know. However, we do know that crude prices are forecast to be where they are now or higher for the remainder of the heating season as demand is expected to be higher than supply during that time. We know that more than half of the winter heating season remains ahead. We know that despite the decline in the inventory deficit, a significant deficit still remains. We know that propane is priced 11 percent below where it was just a month ago. We know that energy supplies are tight all around the world. We know the global economy continues to improve from the pandemic lows.

More specific to propane, we know that propane production is at five-year highs, but the production level has been essentially flat since May. There is a good chance U.S. production of propane is about as high as it is going to be this winter. We know that since the first quarter of the year ended, propane imports have been running below last year.

Perhaps we should be like Spruance and seize upon the opportunity that has presented itself. We really don’t have to be as bold as Spruance. On signs of a turn higher in propane’s price, we could lock down December’s propane price by buying a December swap. We can reevaluate at the end of December what to do in January. Buyers can also protect the remainder of November should the turn in prices come sooner rather than later.

Call Cost Management Solutions today for more information about how client services can enhance your business at 888-441-3338 or drop us an email at info@propanecost.com.