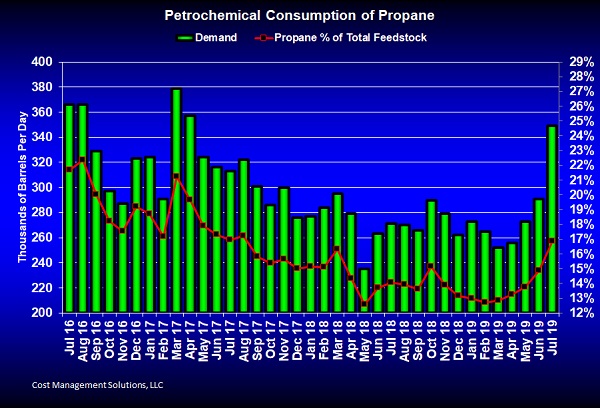

More petrochemical demand for propane

A rise in petrochemical company demand for propane as a feedstock is helping tighten the supply and demand balance for propane. The resulting increase in domestic propane demand, along with strong exports, is finally impacting propane inventory builds. There have been inventory draws or below-average builds the last few weeks.

Industry data shows U.S. petrochemicals are on pace to consume 349,000 barrels per day (bpd) of propane this month. That is 58,000 bpd higher than June’s 291,000 bpd. Petrochemical demand increased in each of the last four months, putting propane consumption 97,000 bpd higher than the 252,000-bpd rate in March. Propane increased from 12.84 percent of the total petrochemical feedstock stream in March to 16.87 percent currently.

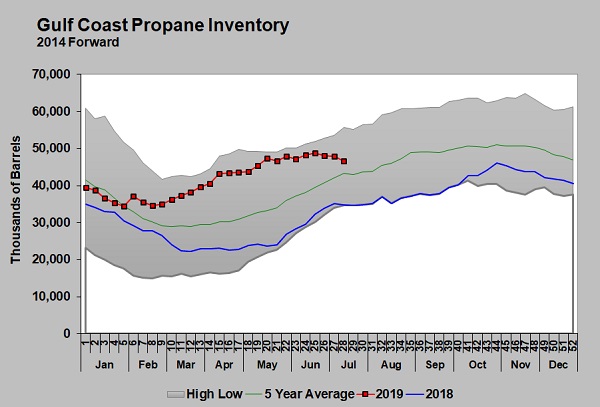

Propane exports had already been robust with rates in excess of a million bpd for 16 straight weeks prior to the week ending July 12. Exports were only 967,000 bpd that week, down 298,000 bpd from the previous week. It is possible that export activity was affected by Hurricane Barry at the tail end of that week. At this point, we would expect exports to resume the million-plus per day rate after the disruptions from Barry sort themselves out. Those impacts are likely to show up in the next EIA data as well. It’s not surprising that the increased petrochemical demand is impacting Gulf Coast inventory the most since that is where the U.S. petrochemical industry is concentrated.

Gulf Coast propane inventory declined for three weeks in a row. It’s rare to get any decline in inventory this time of year, but three weeks in a row is very unusual.

Gulf Coast inventory is still 12 million barrels higher than this time last year, up 34.6 percent year-over-year. But the market seems to now be reacting to the declining inventory trend rather than the actual inventory level. If the current trend were to continue, the inventory surplus on the Gulf Coast would decrease dramatically by the start of winter.

But if propane prices firm up too much, petrochemicals will very likely reduce their consumption, ending the downward trend in Gulf Coast inventory levels. For now, petrochemicals are filling a void on the demand side as the industry awaits more propane export capacity that could further balance supply and demand. Enterprise will open a new export facility by the end of this quarter or early fourth quarter that would add 175,000 bpd of NGL export capacity. More than half of that capacity would likely be used for propane exports.

A combination of petrochemical demand over 300,000 bpd and exports over a million bpd has the potential to balance with current supply to slow inventory accumulation. Both will have to continue to hit on all cylinders as propane supply was 2.247 million bpd for the week ending July 12 – that was up 303,000 bpd from the same week last year.

Call Cost Management Solutions today for more information about how Client Services can enhance your business at (888) 441-3338 or drop us an email at info@propanecost.com.