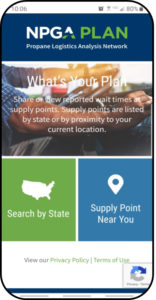

NPGA tool helps drivers estimate wait times at terminals

The National Propane Gas Association (NPGA) launched the Propane Logistics Analysis Network (PLAN) as a centralized tool to help drivers maximize their hours of service by showing the estimated wait times at more than 400 supply points nationwide.

Image: NPGA

Industry members can access PLAN at plan.npga.org and through an update to the NPGAction app, which is available in the Apple App Store or the Google Play Store.

PLAN is a crowd-sourced online tool, which means it relies on active user input. All industry members, including drivers, dispatchers, terminal managers and wholesalers, are encouraged to enter wait times at supply points. Users can search terminals by state or use the device’s location. The tool will also notify users if an emergency declaration exists within a state.

NPGA says PLAN does not represent supply levels, pricing or other market variables, and may be subject to error.

The association developed PLAN with the support of the Propane Supply & Logistics Committee, and with the assistance of state and regional association executives as well as propane businesses.

Industry members can email plan@npga.org with questions.

Supply and logistics presentation

Don’t get comfortable.

That was the message for propane marketers coming out of the NPGA Propane Supply & Logistics Committee fall meeting in Pennsylvania.

“Even though we’ve had a period of being well supplied and inventory levels are very high, let’s continue to work on parts of the system that need to be worked on – the distribution of propane and getting it to where it needs to be,” says Darryl Rogers of IHS Markit, who presented to the group.

The setup in PADD 2 was the only “what if” in the market going into the winter, mainly due to potential agriculture-related propane demand combined with colder temperatures, according to Rogers.

“That probably falls in a realm that could be a little tight,” he adds.

Possible changes exist for next year, with upstream companies facing more pressure to show earnings and revenue, leaving open the potential for production cuts, Rogers says. That possibility, combined with an increase in export terminal capacity, is something for the propane industry to monitor in 2020.