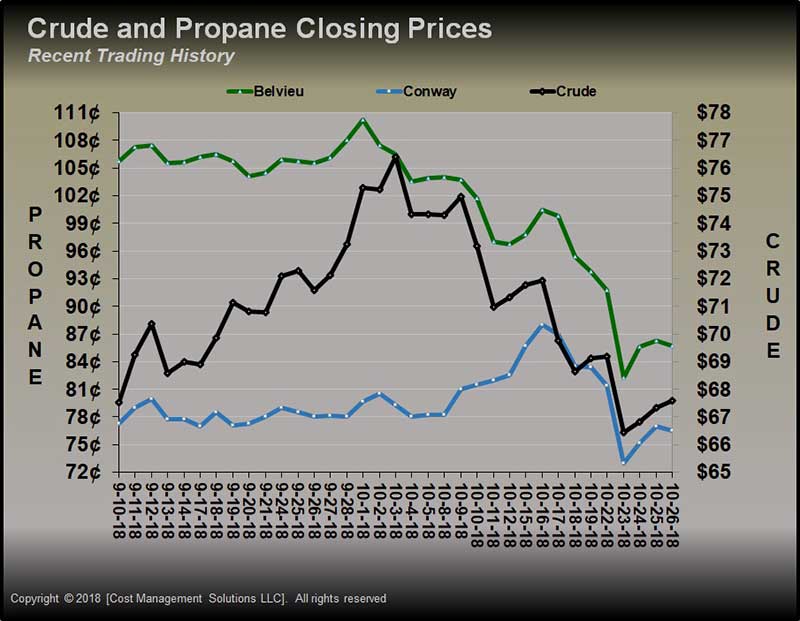

October sees major correction for propane and crude

October has turned out to be quite frightening for crude and propane bulls. The upward momentum that had been prevalent since April came to a screaming halt.

The horror show for crude bulls came when investors lost confidence in the global economy. Crude had been well supported all summer by a strong global economy. The strong economy raised expectations for growth in crude demand.

At the same time, there was consternation about the impact of U.S. sanctions against Iran on crude supplies. Throughout the summer, Iran’s crude exports dropped about 800,000 barrels per day, and this comes before sanctions specifically targeting Iran’s exports take effect Nov. 4. Visions of limited supply and high demand haunted crude traders, causing them to push prices higher. Through the summer, propane prices eagerly followed.

However, when the bell tolled to start October, the carriage carrying crude and propane prices higher turned into a pumpkin – one with angry eyes and spiked teeth. Many factors converged to strike fear in the hearts of traders: higher interest rates and rising inflation in the U.S; a slowdown in China’s economic growth, at least partly related to the trade war with the U.S; a debt crisis in Italy; a currency crisis in emerging economies that made crude and other commodities expensive for those nations; uncertainty over Great Britain’s exit from the European Union; higher energy prices; and uncertainty about how the U.S. midterm elections will change the pro-growth policies of the Trump administration.

All of those factors crushed investor confidence, causing commodities and equities markets to tumble toward a dark abyss. Desperate attempts to end the plunge have not succeeded. U.S. equities markets have given up their gains for the year and are now firmly in bear market territory. West Texas Intermediate has also fallen into official bear territory. It is below its 200-day moving price average. Several attempts by crude to claw its way out of the abyss have now failed, leaving it vulnerable to more downslide.

Propane followed crude up all summer, and it has followed crude downward this month. However, propane’s decline has actually been stronger than crude. Since the beginning of October, Mont Belvieu propane has dropped 25 percent of its value to crude’s 12 percent decline. Even Conway – which was already trading at a relatively low value to Mont Belvieu – has lost 16 percent of its value. The steeper fall than crude suggests weakness in propane’s own fundamentals.

On Oct. 24, crude and propane prices turned higher. Just like it outpaced crude lower, propane outpaced crude higher on the rebound. However, the rebound lasted only two days. Prices were once again heading lower on Oct. 26.

The uncertainty over whether a bottom has been put in for the October crude and propane price corrections makes buys rather scary. Just like a good spook house, markets have a way of getting our attention on one thing and scaring the heck out of us with something on our blindside.

Let’s try and take our eye off the gyrations in the market. Let’s not try to determine if this is the bottom of the downtrend or not. That is probably a fool’s errand at this point. Rather, let’s try and take some of the fright out of the decision by looking at what this October pullback has provided.

Last winter, Mont Belvieu’s propane’s average price was 90.2772 cents. This pullback has allowed some propane buyers to lock in this winter at prices below that price point. Generally, if we can provide our customers prices at or below the previous year, we are not going to scare them away. We may not want to go all in on this pullback, but it still appears to be an opportunity, especially for those that had not gotten price protection to this point.

If we worry too much about what is around the next corner, it may paralyze us from seeing an opportunity. A 25-percent drop in a commodity’s value usually ends up being an opportunity, even if the overall environment still feels ominous. Just remember that scary October will soon end, and November brings Thanksgiving.

Call Cost Management Solutions today for more information about how Client Services can enhance your business at (888) 441-3338 or drop us an email at info@propanecost.com.