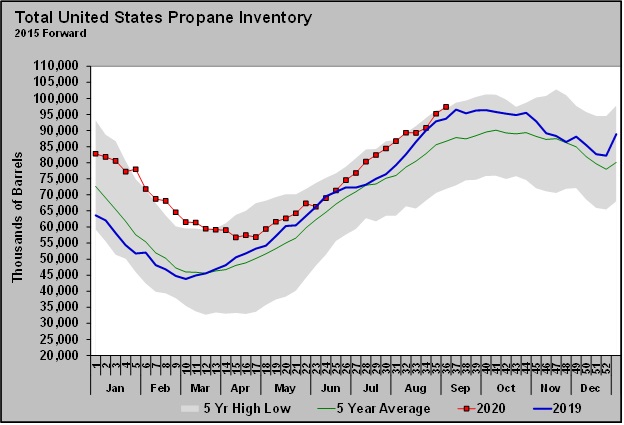

Propane inventory builds to record high for this time of year

The Energy Information Administration (EIA) reported in its Weekly Petroleum Status Report on Thursday that for the week ending Sept. 4, U.S. propane inventory was at 97.380 million barrels. That put inventory at a record high for this time of year and 5.424 million barrels below its all-time high.

The highest propane inventory level on record was 102.804 million barrels in November 2015. The EIA has taken propylene out of inventories, so that may make the all-time high inventory seem lower than you recall. When propylene was included, the record high was over 104 million barrels.

Inventory builds should start slowing down at this point in the year. For example, the five-year average inventory build for week 36 of the year, which will be reported this week, is 1.082 million barrels. But in the last two weeks alone, inventory has been up 6.547 million barrels. A test of the record high is not inconceivable, unless the build trend changes abruptly.

There was a stretch in early August when it looked like inventory just might start this winter lower than last winter. However, that two-week stretch of tighter propane supply and demand ended as quickly as it began.

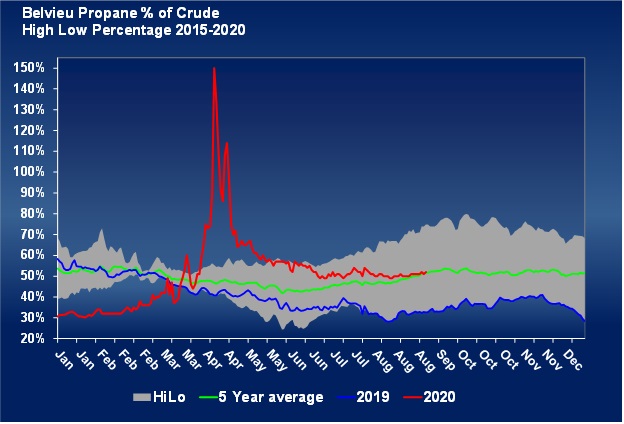

At the same time that propane inventory started building at an above-average pace again, a long-running uptrend in WTI crude’s price ended. We spoke of that in Trader’s Corner last week. Crude started on a fairly steady, though shallow, uptrend on June 15, which ended on Aug. 26. Rising crude prices helped lift propane prices, and the more supportive propane fundamentals helped lift propane prices during that stretch.

But, with fundamentals weaker, propane has not been able to put up any resistance to a fall in crude’s price.

As the chart shows, propane’s relative value to crude has been holding fairly steady at around 50 percent through the whole period being discussed. This simply shows the movement in propane’s prices have been mostly tied to crude’s price movement, with propane fundamental changes playing a more minor role.

Our benchmark prices for Mont Belvieu LST propane and WTI crude remain at 50 cents per gallon and $42 per barrel, respectively. But as we write, Mont Belvieu LST is at 47.5 cents per gallon, and WTI is at $37.35 per barrel. This is putting a lot of pressure on us to lower the benchmarks.

As we discussed last week, the uptrend in crude was based on an assumption that crude demand would continue to increase as the world worked its way out of economic disruptions related to COVID-19. The uptrend ended because traders believed the economic recovery, and thus the recovery in crude demand, was stalling.

The EIA sees 2020’s global demand for crude down 8.32 million barrels per day (bpd). That drop is 210,000 bpd more than forecasted last month. The EIA has cut its 2021 oil demand growth by 490,000 bpd from its last forecast, now predicting demand will increase 6.53 million bpd from this year. It revised its U.S. supply-side estimate as well. It is expecting U.S. crude production to fall 870,000 bpd this year to 11.38 million bpd. That is less of a decline than the 990,000 bpd it forecasted last month due to more production and less demand for crude than previously expected. This is the kind of forecast and analysis that is hampering crude markets, causing the latest weakness.

With propane fundamentals weak, it appears any bullish case for propane prices needs the help of rising crude prices. As we write, crude is struggling to break out of its current downtrend that began Aug. 27. Though we are tempted to lower our benchmarks, traders are telling us that buying interest for propane is picking up. Crude is also attempting to put in a floor to this latest downtrend. So we are going to hold off on changing our benchmarks. Still, it won’t take much weakness to have us lowering our benchmarks.

Call Cost Management Solutions today for more information about how Client Services can enhance your business at (888) 441-3338 or drop us an email at info@propanecost.com.