Propane price pushes past previous benchmarks

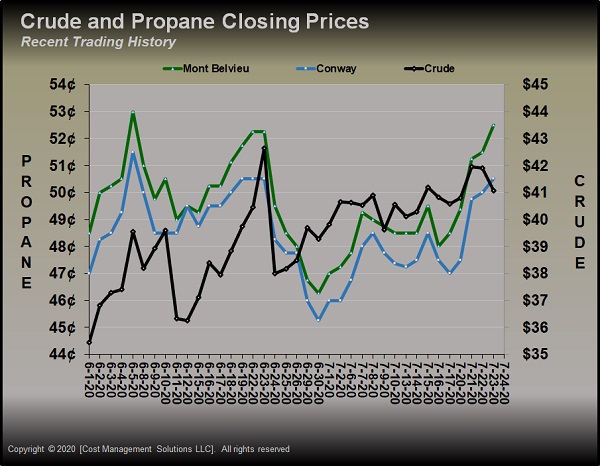

In last week’s Trader’s Corner, we looked at a couple benchmarks that propane had recently established. We plotted the recent prices for propane, which showed that it was tending to trade right around the 50-cent-per-gallon mark. At the time, propane had traded at an average price of 49.3714 cents since June 1.

We then showed that Mont Belvieu LST propane had settled into a relative value to West Texas Intermediate (WTI) crude of around 50 percent. In other words, propane was trading around half the value of crude. At that point, propane had averaged 50.2 percent of WTI crude during the month of July.

It is good to establish long-term and short-term benchmarks for propane to help evaluate the current price. Does that price represent an opportunity, or is it something that should make us wary?

As fate would have it, propane pushed above these recent benchmarks over the past week. The last Trader’s Corner was written on July 17. The last closing price on July 16 was 48 cents. As the chart shows, propane prices have shot up since then. Mont Belvieu LST had gone from 48 cents on July 16 to 52.5 cents on July 23. That is a 4.5-cent gain (9.28 percent) in just five trading days.

There are a couple of other pieces of information we can glean from the chart. Note that Conway propane’s price is also going up with Mont Belvieu. That tells us the jump is not specific to the Mont Belvieu location, which means the strength of propane is broad based. In other words, the run-up is not due to some specific logistical issue at Mont Belvieu. The traders are seeing something about propane overall that justifies a higher price.

Second, note that propane moved up without crude going up in three of the five days of this bounce. That increased propane’s relative value to crude from 49 percent to 54 percent. This tells us that crude isn’t the driver, which it oftentimes is. Again, this suggests the market is seeing something fundamentally different that warrants a higher price for propane. It lets us know the market has some fresh demand – or perhaps some specific threat to propane supply – that is being factored in. With our benchmarks in hand, it is easy to see something is changing. The challenge is uncovering what that change could be. The market in general is being moved by some fundamental force, but we may not be privy to that source. Large industrial players or foreign buyers could be making moves that are impacting the market of which we would not have firsthand knowledge. Our benchmarks allow us to see the effect, but they don’t help us identify the cause.

The Energy Information Administration (EIA) data last Wednesday was more supportive than the week before. The inventory build was average, propane production dropped and exports improved slightly. But we note that the start of the bounce was before this data. The EIA data supported the rally, but it did not trigger it.

There are times we see these moves but never uncover the catalyst. We will ask around and note if traders or other industry analysts are observing a change. Sometimes it seems the market just gets to moving and no one knows the reason, leaving everyone to speculate on the cause or causes.

This time, though, there appears to be a more overt cause. Traders told us the “arb” is wide open. What does that mean? “Arb” is short for “arbitrage.” The definition of arbitrage is: the simultaneous buying and selling of securities, currency or commodities in different markets or in derivative forms in order to take advantage of differing prices for the same asset.

In this case, the value of propane in foreign markets was improving more than the value of propane in the U.S. This “opened the arb” to move propane from the U.S. to foreign markets. There was a run-up in propane prices from Saudi Arabia, which competes with U.S. product. We saw an increase of 114,000 bpd in propane exports for the week ending July 17. It’s possible we could have at least another week or so of more robust exports. So we have a good idea now of the cause of the run-up and we have seen the effect against our benchmarks.

Now the final question is the really hard one to answer: Will the “arb stay open,” continuing to push propane prices higher? We have noted that the Saudi CP price is coming down in the last few days, and we know U.S. prices are up over the last few days. That should be closing the arb, but it may not necessarily shut it. Still, the market is doing what the market does. It detects an imbalance, an arbitrage, and moves to take advantage of it. Those actions in turn often close the arbitrage. It is actually quite amazing to see how quickly free markets respond to these imbalances and move to correct them.

At this point, we would conclude that this was a short-term situation. We suspect the arbitrage window is closing. We will see the impacts of this – perhaps in export and inventory data – for another couple of weeks, but the actual cause may already be behind us when we see the effect in the EIA data. Still, the effects could support prices a while longer, but for now we can’t conclude this is a longer-term trend changing situation. We can’t be sure that the conditions that caused the run in the Saudi CP prices will continue. Early indications show it is already correcting.

At this point, we still believe overall fundamental conditions will tend to draw propane back to 50 cents per gallon, 50 percent of crude benchmarks. These are short-term benchmarks and we know they are going to move, but for now we are still comfortable with them.

Call Cost Management Solutions today for more information about how Client Services can enhance your business at (888) 441-3338 or drop us an email at info@propanecost.com.