Rebound in crude prices unlikely; retailers can ‘wait for a signal’

Last week’s Trader’s Corner explored the separation of propane from crude during July 2017 through November 2017. Since April 2018, propane prices have been inextricably linked to the fortunes of crude. Unless something dramatically changes for propane fundamentals, it is difficult to picture a rebound in propane prices without a rebound in crude prices.

Traders appear to be comfortable with Mont Belvieu LST propane valued at 57 percent of WTI crude, which has been the average relative value since April. Propane will sometimes briefly rise above or fall below that valuation, but the market conditions seem to be pushing it back in that direction rather quickly.

Propane bought for short-term price protection will tend to work best when the buyer catches Mont Belvieu LST propane valued at less than 57 percent of WTI crude. Purchases above that relative valuation have more downside price risk, based on the relationship between Mont Belvieu LST and WTI crude since last April.

Reducing risk on longer-term purchases can be mitigated by allowing an uptrend in crude’s price to be established. Since October, the collapse of crude’s price has provided attractive propane prices. We are an advocate of buying future supply during this pullback when prices reach a point where a retailer is confident it will work in their market, even if the price bottom has not been entered. More times than not, buyers wait too far into the rebound to enter the market. Buying supply as the market steps down generally results in a lower overall supply cost.

With crude so beaten up now, though, it may make sense to wait for a signal that a sustainable uptrend in crude prices is established before making major long-term commitments on supply. Even a cautious buyer will probably be able to buy propane at an attractive price, letting an uptrend in crude get firmly established beforehand.

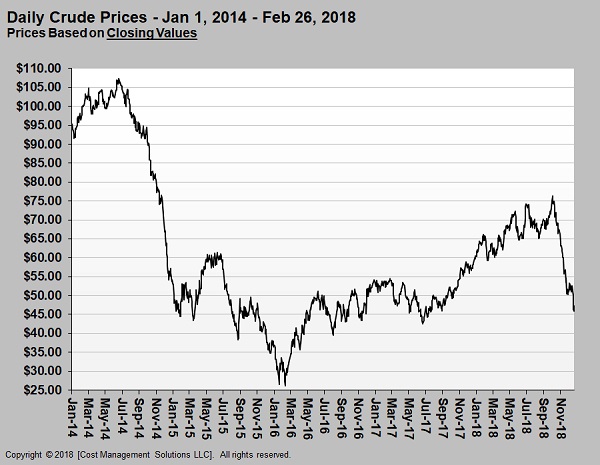

The chart above shows WTI crude’s closing prices since January 2014. Prices rose into the summer of 2014 as global demand exceeded supply, but, that summer, the growth of U.S. crude supply from shale formation began to undermine the value of crude. The situation was exacerbated in November 2014 when Organization of the Petroleum Exporting Countries (OPEC) said it would no longer cut production to support prices.

Its plan was to allow crude prices to drop low enough to force higher-cost U.S. shale producers out of business. The plan failed when the collapse in prices hurt OPEC and other countries dependent on revenue from crude more than it did U.S. producers. U.S. producers were hurt, but not defeated.

WTI finally bottomed out in early 2016 when OPEC said it was going to start controlling production once more to support prices. It took until the end of the year to form a large enough coalition of producers to attain enough cuts to support prices. OPEC and producing nations allied with them pledged to cut 1.8 million barrels per day (bpd) from October 2016 production levels, and maintain that production rate starting in January 2017.

Ultimately, producers cut even more because of unplanned drops in production from countries suffering from geopolitical issues, such as Venezuela, Libya and Nigeria. The cuts became even more effective when changes in economic policy by the United States stimulated the global economy and increased demand. It resulted in crude prices nearly doubling from March 2016 lows to between $45 and $50 per barrel.

Crude prices rose another leg higher from mid-2017 to October 2018, after the United States pulled out of its nuclear agreement with Iran, threatening sanctions to reduce Iran’s crude exports to zero. The U.S. also entered into a trade war with China, which was a key component of a slowdown in global economic growth.

At that point, the market’s perception of crude supply was no longer the key driver of crude’s price. The market’s perception of crude demand evolved over the last few months as the primary driver of crude’s price. The worries on the demand side for crude started turning prices lower at the beginning of October. At the same time, global producers were ramping up production to offset lost Iranian production due to the U.S. sanctions, set to begin in early November.

With the global economy slowing and crude production outside of Iran ramping up, crude supply was suddenly outpacing demand. Then, the U.S. compounded the situation by providing waivers to allow buyers of Iranian crude to continue buying a reduced amount of Iranian crude for another 180 days beyond Nov. 4.

That was the final piece needed to put crude into an accelerated decline. WTI crude’s price gave up all of last year’s gains that were made when the outlook on the global economy was upbeat and supply seemed inadequate. Not even a pledge by producers to cut 1.2 million bpd from production in 2019 has been enough to erase the bearish grip on crude markets.

We have reached a point of pure panic in commodities and equities markets. As one trader said, “We are just going to keep selling until it stops,” meaning this no longer is a market swayed by fundamentals or logic. It is a stampede that simply isn’t going to stop until the cattle are exhausted.

WTI crude’s price already is well beyond the point where it would cause a slowdown in U.S. drilling activity next year. It really doesn’t need to go any lower to accomplish a slowdown in crude output. Producers are already announcing cutbacks in capital expenditures and drilling programs for next year. That might matter in a logic-driven market. In a fear-driven stampede, it doesn’t.

Crude shouldn’t drop much lower, but it might. It probably is best to step to the sidelines, get out of the way of the stampede and wait for calm to be established before considering longer-term propane positions. When that calm comes to the market, it could be an excellent opportunity for propane retailers to lock very good values for their customers.

Call Cost Management Solutions today for more information about how Client Services can enhance your business at (888) 441-3338 or drop us an email at info@propanecost.com.