Reviewing natural gas’ relationship to propane

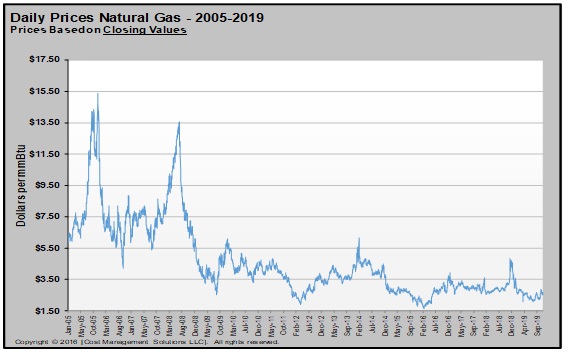

Natural gas fundamentals are very important for propane retailers to monitor, since 80 percent of propane supply comes from natural gas processing. When a natural gas well is in production, many different hydrocarbons can be produced. Methane is the lightest and is generally referred to as natural gas. The chart shows the history of methane prices since 2005 at the key distribution center known as Henry Hub.

Methane is distributed to consumers by natural gas utility companies.

Ethane, propane, butanes and natural gasoline are referred to collectively as natural gas liquids (NGLs). NGLs are valued relative to crude rather than natural gas/methane. Butanes and natural gasoline are blended in the refining process to make gasoline, thus the reason that NGLs are valued relative to crude rather than methane. The reason we follow crude so closely is that it generally sets the base value of propane and other NGLs.

The lightest NGL, ethane, is oversupplied and can be rejected at the natural gas processing plant. That means instead of being separated into a fungible product, which is sold to petrochemical companies, it is left with the methane and is part of the Btu (British thermal units) delivered by the natural gas utility company to its customers.

Before methane prices fell in 2008, propane would sometimes also be rejected to some degree for distribution with methane and ethane to natural gas customers. Today, with methane values so low relative to crude’s value, this would only happen due to operational issues.

The high value of methane and crude made producing natural gas from shale formations profitable, despite a much higher production cost from shale formations than traditional methods of natural gas and crude production. A lot has been learned from producing in shale formations over the years, driving production costs down. But the new production caused an abundance of natural gas supplies, driving both methane and NGL values lower.

NGLs started losing value relative to crude. Before production from shale formations became so prolific, propane normally traded around 70 percent of the value of West Texas Intermediate (WTI) crude and would spike much higher during high demand periods. The abundance of propane drove its price down below 30 percent of the value of WTI crude at one point. Price spikes are now very unlikely, except when caused by local market logistical issues such as those faced in the Midwest this year.

The collapse of methane and NGL values has not slowed natural gas production. Inventories are holding around five-year highs as domestic demand and exports take up the new production. The low value has finally started to slow drilling activity, which should eventually slow the growth in supply if not reduce the amount of supply.

IN CASE YOU MISSED IT

Propane demand in the Midwest has soared, as farmers face an extremely wet harvest combined with an early blast of winter-like weather. Read the LP Gas report here.

Call Cost Management Solutions today for more information about how Client Services can enhance your business at (888) 441-3338 or drop us an email at info@propanecost.com.