Slowing production may impact pricing, inventory levels

In this week’s Trader’s Corner, we are going to take a closer look at U.S. propane production. Quite simply, too much production has been the reason that propane prices are under 40 cents at the hubs and near modern-day lows in relative value to WTI crude.

The U.S. Energy Information Administration (EIA) provides weekly updates on energy industry fundamentals, including propane. However, official data is released a couple of months later. At this point, December data is being released, which allows us to compare full-year data for 2019 with previous years.

Just under 85 percent of propane supply comes from processing natural gas and separating the various natural gas liquids into fungible components. The remaining propane supply is a byproduct of refining crude.

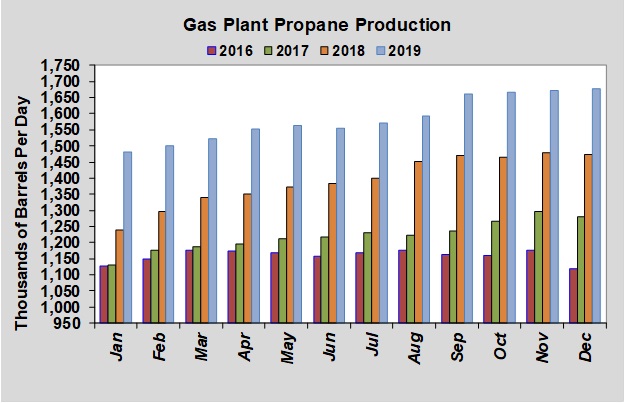

Propane supplied from natural gas processing averaged 1.585 million barrels per day (bpd) during 2019, up 191,000 bpd from 2018, or 13.73 percent.

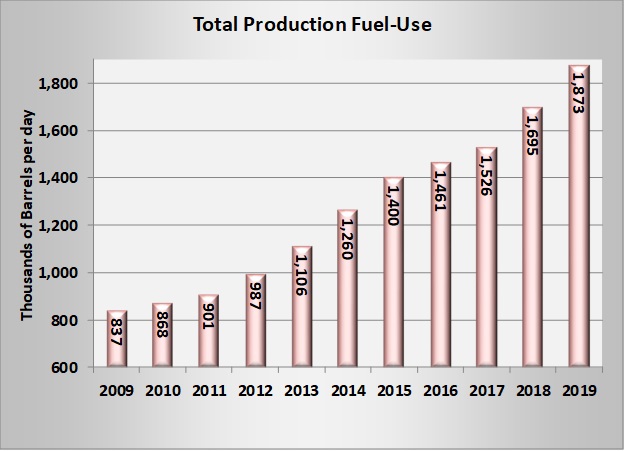

Fuel-use propane supply from refining operations declined in 2019. Refineries provided 288,000 bpd of fuel-use propane last year, down 14,000 bpd, or 4.56 percent, from 2018. Total fuel-use propane was at 1.873 million bpd, up 178,000 bpd, or 10.51 percent, from last year.

If that kind of growth in supply were to continue, it would almost certainly prevent any increase in propane prices. Natural gas and crude prices are down now, and there has been decreased drilling activity, which could result in less propane supply going forward.

The middle chart to the right shows the monthly breakdown of propane production from natural gas processing during 2019.

It shows that production leveled off over the last four months of the year. But that is not particularly unusual as a look at past years shows. Winter cold can cause a decrease in natural gas production, and refineries can be in turnarounds during the winter months. Both impact the amount of propane supply.

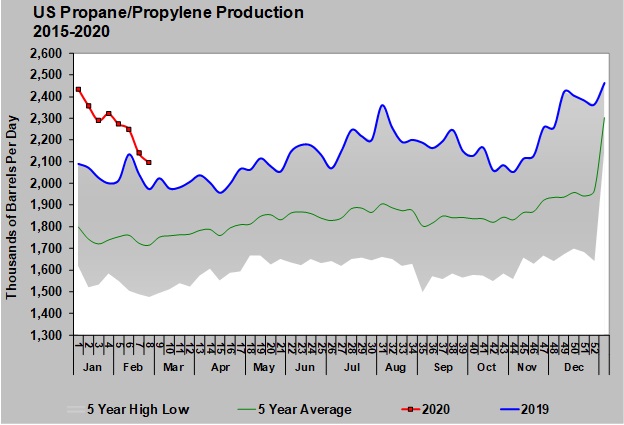

Perhaps more interesting are the weekly estimates from the EIA for 2020. Those estimates show production still setting five-year highs, but the rate of production has been coming down dramatically.

The bottom chart to the right shows total U.S. propane/propylene production. Production started the year at 2.435 million bpd but was down to 2.095 million bpd last week. Using last year’s propylene production rate of 282,000 bpd, that would put fuel-use production at around 1.813 million bpd.

Though this is still a lot of propane production, it is actually 60,000 bpd less than last year’s average fuel-use production.

We would expect production to bounce back in the summer, but early indications show there won’t be anywhere near the growth in propane supply in 2020 that there was in 2018 and 2019. That could give propane exports a chance to catch up in the process of eliminating some excess propane inventory.

ANNOUNCING HEDGING SEMINAR: Please note that Cost Management Solutions will be conducting a two-day hedging seminar on March 19-20 at the Houston Airport Marriott. This seminar will provide tools and strategies for helping propane retailers navigate the changes in propane pricing in the coming months. Please contact Dale Delay at 888-441-3338 for more details.

Call Cost Management Solutions today for more information about how Client Services can enhance your business at (888) 441-3338 or drop us an email at info@propanecost.com.