How retailers are solving the insurance puzzle

Obtaining the right insurance can be a confusing task for any business. Propane marketers, though, face a special challenge.

With heavy trucks on the road, volatile fuel in transit and active employees juggling heavy tanks, the industry operates in an environment subject to a variety of costly incidents.

No single policy can cover it all.

“Propane marketers must obtain insurance in the areas of property, fleet and automobile, workers’ compensation, general liability, management liability, and excess,” says Gary McLean, president of Jamerson-McLean Corp. “They must also review their exposures in these areas annually and update their policies so they are insured to value in the event of an incident.”

If the perils are many, it’s clear that incidents involving employees or the public can create the greatest financial pain.

“Liability takes the No. 1 slot as the most important insurance category in the propane industry,” says Raymond White, an insurance adviser at Roark & Sutton.

The type of liability protection varies by operating sector, adds White.

“For transporters, it’s going to be auto liability,” he says. “For retailers, it’s going to be the liability of delivering propane to the home.”

While it’s true that retailers also have auto liability exposure, the greater risk is that a homeowner might hire a handyman to make site alterations. This can lead to an incident, bringing the marketer into a claim.

Rising premiums

A good safety program is a propane marketer’s first line of defense to control increases in premiums. (Photo by LP Gas staff)

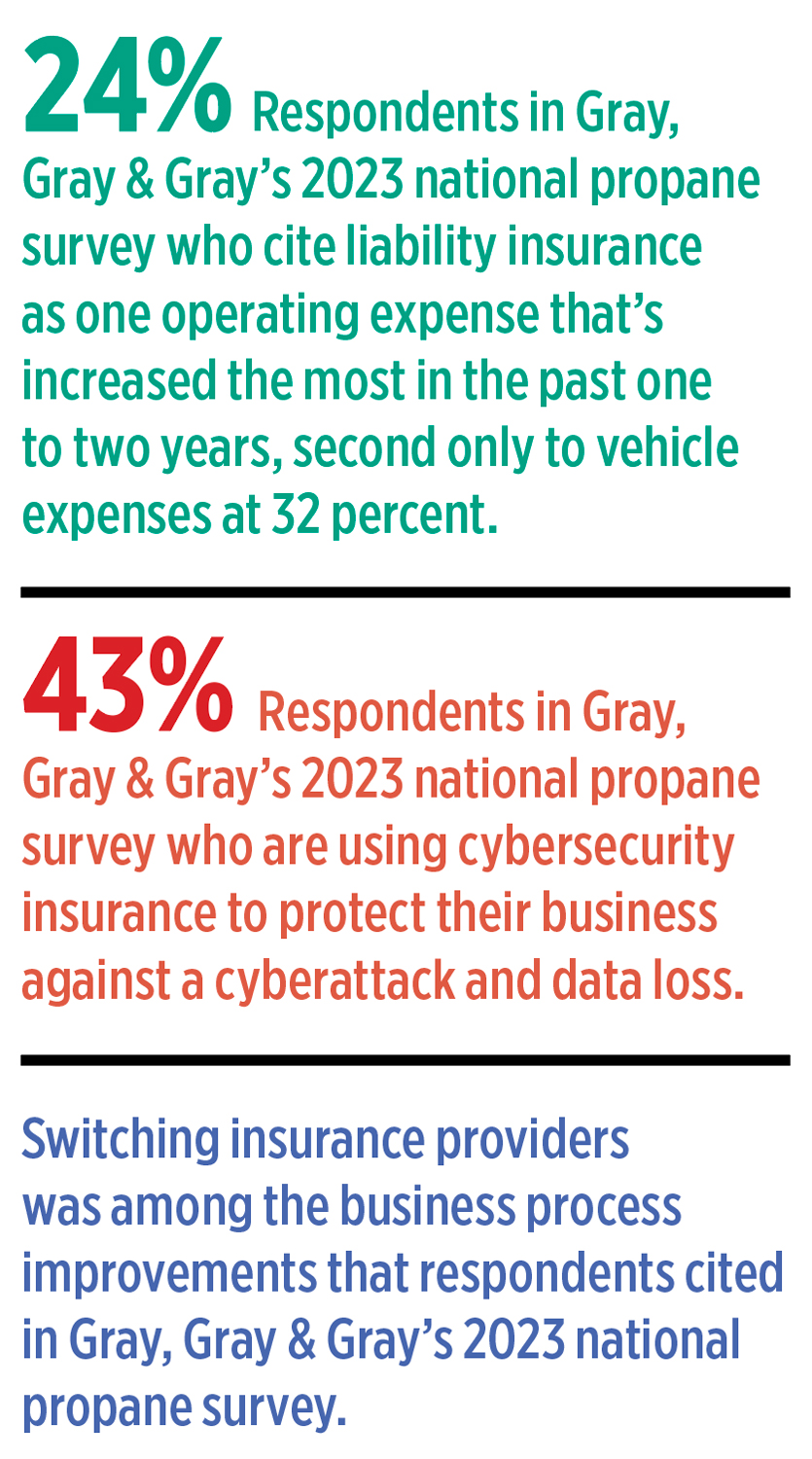

So, what’s all that insurance cost? More every year.

“On the retail side, many businesses are getting increases of 5 percent to 8 percent annually for liability insurance, and I think that will remain the normal going forward,” says White. “It’s frustrating for businesses to have to go out every couple of years and shop for insurance to keep costs down.”

The picture is more complicated on the trucking side, adds White. For that sector, rate increases typically vary according to the larger risk picture that includes elements such as the company’s loss records, along with its Federal Motor Carrier Safety Administration (FMCSA) and Department of Transportation (DOT) roadside inspection scores.

“If they have had a couple bad years of claims or their scores with the DOT do not look very attractive, the cost could go up by a dramatic 30 percent to 40 percent,” he says.

Reports from the field reinforce the agent’s analysis.

“Our premiums have increased every single year,” says Cecilia J. Waggle, CEO of HD5 Transport. “Part of the reason is that we have grown very quickly as a business, adding additional vehicles. Today we have 18 trucks and trailers. A second reason is that insurance prices in general have been going up. And third, many of our newer customers are requiring that we carry higher minimums on our excess.”

That last item can cause its own brand of pain. Waggle ensures she has sufficient umbrella coverage to satisfy the often-higher standards of new customers.

“Some customers require $10 million, while others require $2 million. The norm seems to be $5 [million],” she says.

Waggle, whose operation hauls propane, butane and y-grade, notes that a bad claims event can also spark higher costs.

“In our 11 years of operation, we have had a squeaky-clean record, except for one unfortunate year when we had two accidents,” she says. “That resulted in a significant increase in our insurance – not for liability but for auto.”

Covering employee injuries can be particularly costly for propane marketers. People are moving heavy tanks on terrain that can be uneven, wet, frozen or riddled with holes. Little wonder that accidents abound.

“Workers’ comp is our most expensive coverage,” says John Ell, president of New England Propane. “That’s because injuries can result in huge expenses. If one person gets hurt on the job, an insurer can end up on the hook a long time for bills or a large settlement.”

While employees never expect things to go wrong, a minor condition can turn into something big – and quickly.

“It doesn’t take much to cause an accident,” says Ell. “People can slip on ice, hurt their backs, twist their ankles or injure their knees. We’ve even had people stung by bees and get rushed to the hospital,” he says. “You name it; we’ve seen it.”

Cost drivers

What’s driving higher insurance costs? Macroeconomic events play a role when it comes to protecting equipment.

What’s driving higher insurance costs? Macroeconomic events play a role when it comes to protecting equipment.

“Supply chain disruptions during the pandemic, and the economic rebound that came afterward, caused equipment values to soar,” says White. “Machinery was also getting more expensive because of technological innovations. As a result, many insurance companies were not getting sufficient premiums for the claims they were paying. So, they’ve gone through a correction.”

Natural disasters such as wildfires, tornadoes, floods and damaging other weather events have led to increases in property insurance.

“The markets are very cognizant of these exposures and use catastrophic modeling to help them properly price coverage,” says McLean.

As for the cost of umbrella protection, it has been affected by an industry-wide rush to safety.

“More insurers have decided to accept less exposure,” says White. “As a result, a propane marketer may need to get four or five insurance companies involved to get to a $10 million protection level. And the more insurance companies you bring in, the higher the cost.”

A spike in cyber incidents also has led to increases in excess coverage.

On the supply side, a dwindling of market choices is exerting upward pressure on pricing for most categories of insurance.

“The number of carriers that will take on propane customers seems to have contracted a bit,” says Ell. “And not every carrier can service the propane market. It takes a knowledgeable, experienced company to underwrite a policy. So, I always worry about where this industry is going to go, long term, in terms of availability of coverage and pricing.”

Those insurers that remain in the field are redistricting, becoming more selective about the regions they service. This, too, can exert upward pricing pressure. So can the re-insurance markets, which dictate increases insurers must pass on to customers.

Drivers of higher insurance costs are supply chain disruptions and more expensive equipment. (Photo by LP Gas staff)

Controlling costs

In the battle to control increases in premium costs, a marketer’s first line of defense is a good safety program. Fewer accidents mean lower premiums.

“We try to be very conscious of safety, for our customers, our employees and our property,” says Ell. “We tell our employees to always err on the side of caution and not to proceed with an activity if they feel unsafe. That’s a decision they must make in the field, so we work hard to help them identify potential hazards before they arise.”

Waggle also keeps an eye on safety procedures.

“We maintain our trucks well,” she says. “If a safety suggestion from one of our drivers makes sense, we do it. Anything that comes up we put something in operation to fix it.”

The company’s drivers are required to perform truck and trailer inspections before their first trip and at the end of the day.

“They make sure there are no leaks, check the tires and perform other checks to make sure everything is safe,” she says.

Driver behavior is subject to a watchful eye.

“All of our ELDs (electronic logging devices) have cameras that go to the cloud,” says Waggle. “At any particular time, anywhere, we can pull up what a driver is doing and also access a history of where they’ve been. We can see if there has been any tailgating, speeding, harsh cornering and so on. In the event of an accident, we can immediately download the relevant data from the cloud, making it accessible to DOT, the insurance company and whoever else may want to see it.”

Incentives also play a role.

“In a one-month time frame, if a driver meets all the safety requirements we have in place, we pay a bonus,” says Waggle. “On the other hand, if a driver was found speeding, we deduct a certain amount from that bonus.”

“We watch for anything that comes through that would affect our rating when insurance carriers or new customers look at us.” –Cecilia J. Waggle, HD5 Transport

Keeping score

Waggle also monitors the company’s score at the FMCSA.

“We watch for anything that comes through that would affect our rating when insurance carriers or new customers look at us,” says Waggle. “And if I see something that is not correct, then we take steps to get it removed.”

White praises this concentration on safety procedures as an essential element of the industry. Plaintiffs’ attorneys make a special effort to review a company’s safety records.

“The retail propane business has a low claim frequency,” he says. “But any claim is typically at the level called high severity, which means it’s large. That puts pressure on the company to operate with best practices, recorded with good documentation.”

As for the transport side, notes White, there is special pressure to maintain their status with the DOT and their basic scores with the FMCSA. “Anything negative will be used against them.”

Maintaining a great safety program is one thing. Getting the word out about those efforts is another.

“Marketers need to make sure their agents properly present them to the insurance markets underwriting their company,” says McLean. “That means informing the insurer of their diligent work in areas such as regulatory compliance, employee training, fleet and equipment maintenance, and driver selection. This will make their operation as defendable as possible in the event a claim arises.”

Waggle concurs, adding that open communications can position a business more favorably when insurance shopping.

“We share all of our safety policies and procedures with the agency, and that helps them get coverage for us at lower cost,” she says. “We’re a lot more attractive to insurers than another business might be because of the safety procedures we have in place.”

The right agent: Linchpin to quality coverage

An effective agent does far more than connect a propane marketer with an insurance company.

“We rely on our agent to make sure we have sufficient coverage,” says Cecilia J. Waggle, CEO of HD5 Transport. “I like it that ours brings us the best insurance company for our needs at the most reasonable price available.”

It’s critical that an agent possess a deep knowledge of the propane industry.

“The agent needs to understand not only the insurance marketplace but also the exposures we face and what our customers expect,” says John Ell, president of New England Propane. “And the agent needs to be responsive to our customers if there’s an issue at a residence or job site.”

Effective agents make sure no important risks are excluded from a policy and that no trucks or vehicles are omitted. They also select insurance companies that know enough about the industry to understand what claims to fight, the nuances of possible causations for claims and the importance of not settling frivolous ones.

Ell relies on his agent’s experience and expertise to complete challenging tasks such as working on certificate requirements for a demanding customer or providing special coverages for custom work. And an agent’s long-term relationships with insurers can work to the customer’s benefit.

“The agent can go to bat for us with the carrier, attesting that we are an experienced and qualified operator, and helping to resolve any problems that come up,” says Ell.

Little wonder propane marketers see their insurance agents as part and parcel of a successful enterprise. Says Ell: “I see my agent as more of a business partner than a vendor.”

Featured image: Serts/iStock Unreleased/Getty Images (cube); Yongyut Chanthaboot (sign), Koksikoks (stripes), BlueJay (dollar sign)/iStock / Getty Images Plus/Getty Images