Upcoming election results could change tax policy

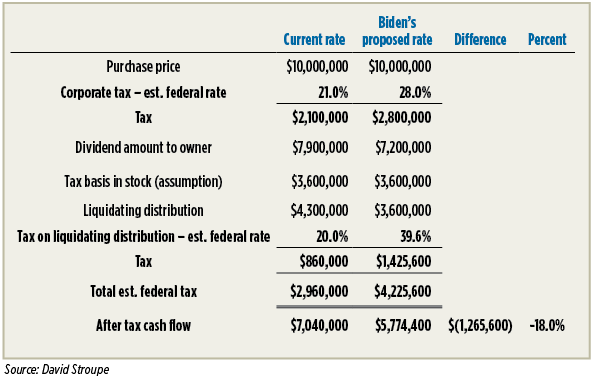

In this example, a business owner who sells the business under the Trump administration would save more than $1.2 million in taxes versus Biden’s proposed tax plan. Source: David Stroupe

Many of us longtime propane industry veterans have lived through challenging times in the past, but what we’re experiencing in 2020 may “take the cake.”

In addition to pandemic-related challenges, the past six months have also brought a struggling economy and a stock market that’s on a roller coaster ride.

To top it off, we’re in an election year, the outcome of which could have a major impact on many of you, especially those of you who own retail propane operations.

For the past several weeks, election polls have shown that the two presidential candidates are in a fairly close race. That means we could see a new administration take over in January. If that happens, there could be a significant change in tax policy.

According to the Tax Policy Center,* a Democratic administration would likely bring the following changes to the current U.S. tax policy:

- Capital gains tax: increase from the current 20 percent to 39.6 percent.

- Corporate tax: increase from the current 21 percent to 28 percent.

- Personal income tax: increase across the board.

Let’s look at a hypothetical business that is considering an asset sale transaction. In this example, we’ll assume that it is a C corporation with no tax basis remaining. The example above (see disclaimer**) shows what the tax implications could be for that business, both under the current administration and former Vice President Joe Biden’s proposed plan.

In this case, a business owner who sells his business while still under the current administration will save more than $1.2 million in taxes versus Biden’s proposed plan.

Although it’s never smart to rush into a decision as enormous as selling your business, it’s important to at least be aware of the tax implications and how they will impact you and your family.

If you are planning to sell your business in the near future, you should discuss these potential tax policy changes – and the timing of your transition – with a trusted tax adviser.

David Stroupe is the vice president of corporate development at Energy Distribution Partners. He can be contacted at 312-254-5954.

*NOTE: The Tax Policy Center is a joint venture of the Urban Institute and Brookings Institution. For more information, visit taxpolicycenter.org or email info@taxpolicycenter.org.

**DISCLAIMER: Neither the author nor Energy Distribution Partners provides tax advice. The content herein has been prepared for informational purposes only, and is not intended to provide and should not be relied on for tax advice. The high-level examples contained herein are for illustrative purposes only. You should consult your own tax adviser before engaging in any transaction.