US propane inventory builds lighter than average

U.S. propane inventory increased very lightly last week to 734,000 barrels, according to the Energy Information Administration’s (EIA) Weekly Petroleum Status Report. The light build occurred in a week that averaged a 1.775 million-barrel build over the last five years, and the industry expected an even higher build of 1.85 million-barrels.

Official data shows exports are below the previous year’s December 2017 through February 2018 data. EIA weekly estimates show March and April 2018 exports are below the previous year. So far, May 2018 weekly estimates are averaging 840,000 barrels per day (bpd) of exports compared to weekly estimates of 828,000 bpd in May 2017. There will be more data for May 2018, so there is no guarantee this month’s exports will exceed May 2017.

Of course, the industry would like to see a heavier propane inventory build, but inventory is not as light as this weak inventory gain seems.

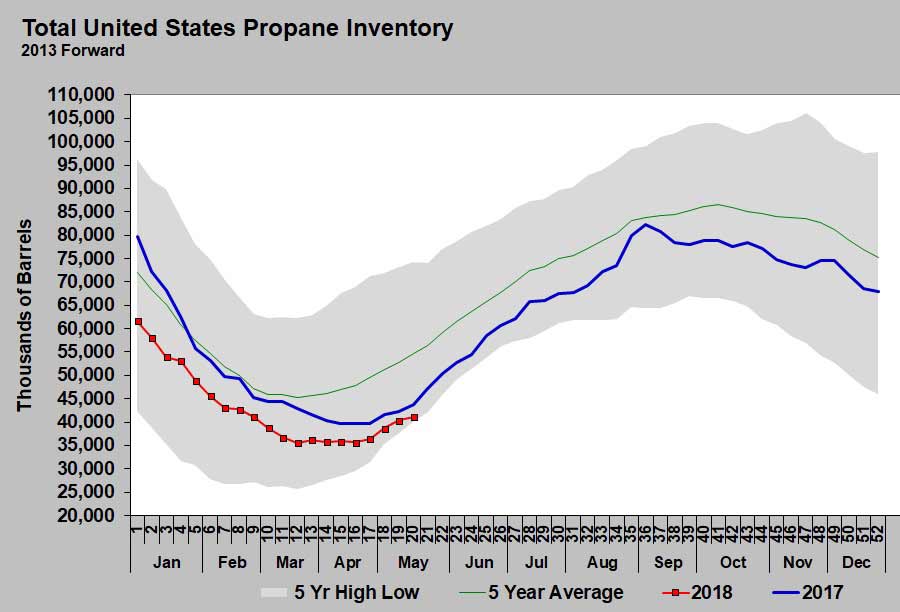

U.S. propane inventories hit a low of 35.603 million barrels in the third week of March 2018. Inventory has been up and down since then, but that was the season’s low. Between the low in March and the third week of May, inventory has increased 5.489 million barrels.

In 2017, inventory hit its low of 39.643 million barrels during the second week of April. From then until the third week of May 2017, inventory increased 4.043 million barrels. From the 2018 season low until the third week of May, inventory increased about 1.4 million barrels more than 2017. This year’s build occurred with more domestic propane demand than 2017. From March to present, this year’s demand has been 190,000 bpd higher than last year.

When looking at overall higher production and lower exports, inventory builds substantially above average are expected, in reality, inventory builds have not been. Last week, inventory builds were substantially below average, yet when we look at the inventory change since the 2018 low, it has gained more than last year.

It appears propane traders are fairly well on top of this trend, considering Mont Belvieu LST propane is trading at about the same relative value to West Texas Intermediate crude as it was last year at this time. If propane traders were concerned about inventory, propane would be trading at a higher relative value to crude.

In fact, the higher Mont Belvieu propane price is directly related to higher propane prices, not market participants seeing some ominous sign for propane fundamentals – at least not yet. High exports could damage that calculus.

Call Cost Management Solutions today for more information about how Client Services can enhance your business at (888) 441-3338 or drop us an email at info@propanecost.com.