Why June is the month propane retailers should watch

A late-season cold snap that stunted the beginning of the summer-build period in some regions of the United States. Propane export activity and infrastructure developments. COVID-19 and its impact on oil and gas markets.

Propane retailers have had a lot to unpack coming out of the winter heating season and preparing for the next. It’s that preparation for the 2020-21 winter that has received much of the attention from energy market analysts. Anne Keller is one of them.

The founder and managing director of Midstream Energy Group, Keller did a double take on the natural gas liquids (NGL) supply outlook for 2020 amid turmoil in the crude oil markets.

“Some of the numbers weren’t making sense to me – how much associated gas is supposed to disappear from the world,” she says in late May. “If those numbers were right, the impact to NGLs would be tremendous.”

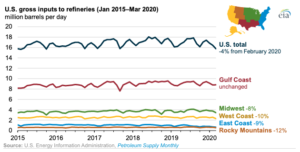

What once seemed like a sure thing with no issues around winter supply now looks like less of one, Keller says. Demand destruction for transportation fuels, owing to COVID-19-induced stay-at-home orders, has led to crude oil production cuts and reduced refinery runs.

Whereas oversupply headlined crude oil and gas markets, uncertainty became the theme for NGLs, including propane. Producers and refiners don’t set out to make propane specifically. LPG’s status as a byproduct of crude oil refining and natural gas processing places it at the mercy of these upstream processes.

“The cutbacks we’re seeing on the gas and oil side may hit the LPG side harder than it does them [gas and oil] because of the fallout of losing this product,” Keller says.

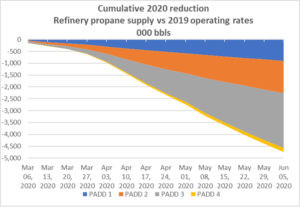

If Keller’s estimates on U.S. crude oil production cuts and lost associated gas supply hold true, total gas plant NGL supply could fall by an average of .6 million barrels per day (bpd) in 2020 from March to December – with December 2020 ending 21 percent lower than February, she says. Keller’s forecast cites significant propane supply reductions in PADDs 2 and 3, resulting primarily from oil production declines in North Dakota and the Permian Basin.

“Even as we are seeing some signs that the oilfield is coming back to life with higher crude prices, refinery propane supply has also taken a downturn since shelter-in-place orders took people off the roads,” she adds.

An update of the year-to-date deficit in refinery propane production due to reduced operating rates (as low as 50-60 percent in some areas in April and May) stands at 4.7 million barrels as of June 5, Keller says. This decrease is based on comparing the estimated actual propane yield so far this year to the yields that would have been seen had refinery run rates remained at 2019 levels. According to IIR Energy’s Global Refining Report, utilization has moved up significantly in June, but rising gasoline and diesel inventories may slow the ramp a bit.

You’ve worked too hard

That’s why Keller doesn’t want the propane industry to be lulled into a false sense of security. Propane retailers have worked hard over the years to build business and become the preferred energy provider for customers. Now the focus for retailers should be even sharper: How can I ensure that my customers have a reliable source of supply?

“Everybody is conditioned to believe we’re just awash in this stuff,” due in part to the oil and gas oversupply dynamics created by the coronavirus, and propane retailers feeling a sense of comfort during these summer months when propane inventory builds for the next winter, Keller says.

The situation has changed this year.

“Price will be something to think about, but if I’m in locations where the winter hits pretty hard and I was concerned my inventory will be at or below five-year levels, I would be looking at my stock strategy,” Keller says.

The Upper Midwest/Bakken region, the midcontinent and areas of the Rocky Mountain region, such as Colorado and Wyoming, are areas to watch for oil and gas production, says Keller.

Drilling rig counts are down to 279 as of June 12, she says, continuing a downtrend to the lowest levels seen in the number of active U.S. crude oil and natural gas rigs in operation. “Frac spreads,” the equipment used to fracture wells after they’re drilled to bring them online, have their own count. Although it’s turned up a bit in the past two weeks, it’s also near all-time lows at 58, she adds.

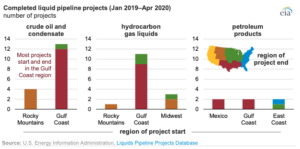

In addition, propane marketers are facing increased competition for propane supply as a result of infrastructure improvements geared to gather and transport NGLs to hub storage and export outlets, according to CHS. Much of this supply has traditionally served the Midwest market.

“If these supply points have contracts to deliver a minimum volume into pipelines to support takeaway capacity additions agreed to in better times, they’ll be honoring those even if it means less available locally,” Keller says. “So multiple sourcing is something that needs to be taken seriously.”

June will provide a better sense of where crude oil markets are headed, she adds. Early this month, crude was down 2 million bpd from its record output of 13.1 million bpd before the coronavirus pandemic hit, EIA data shows. Keller is watching whether that production decline will continue.

On June 10, EIA reported that stronger-than-expected consumption and production curtailments have contributed to a more balanced market than the agency had forecast in May.

“If production continues to fall in June, it’s a signal to make sure you check up on your contracts and commitments, and plans to handle winter demand,” Keller says. “If things slack off, oil prices come up and the news starts to be that North Dakota is in gear again, it won’t be a physical issue as much as you want to go ahead and start locking in prices.

“Definitely June is the month to watch.”

Sailing away

We’ve reported in Trader’s Corner how more of Canada’s propane is destined for international markets. New information from CN Railway shows just that.

Three vessels carrying Canadian propane departed in May from AltaGas’ Ridley Island Propane Export Terminal, located in British Columbia, beating the previous record by 50 percent, CN reports.

The Ridley Island Propane Export Terminal exclusively uses CN’s transcontinental rail network to transport propane from Alberta and British Columbia for export to global markets. Since its launch in May 2019, the terminal has moved over 1 million tons of propane.

AltaGas is a North American energy infrastructure company with a focus on regulated utilities, midstream and power.