Winter fuels, LPG exports, market trends and more

A wealth of propane-specific information came out of this year’s Winter Fuels Outlook, released earlier this month by the U.S. Energy Information Administration (EIA).

Several nuggets of information are worth noting, including details about the propane pricing and supply side of the industry.

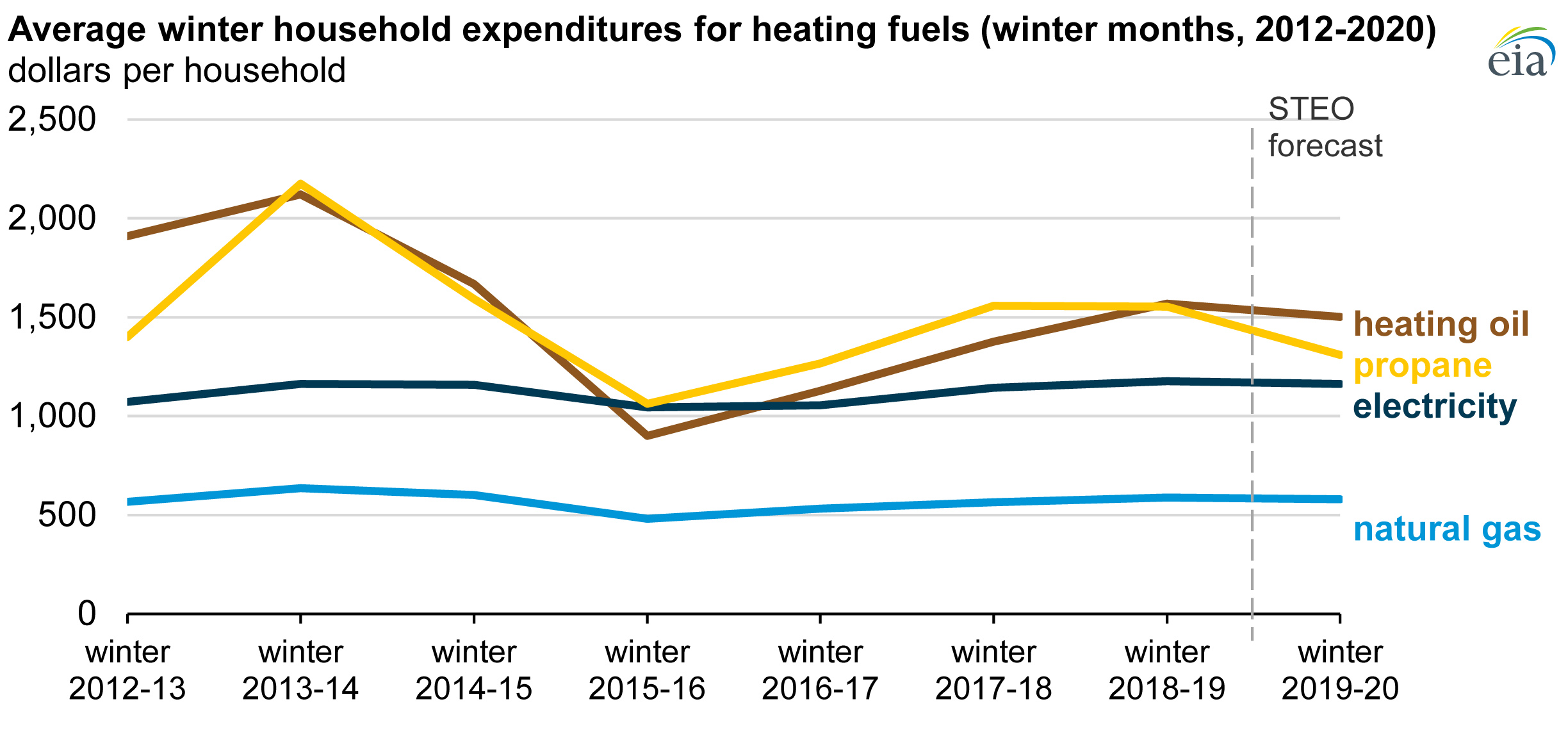

- For instance, U.S. households heating with propane will spend 15 percent less this winter on average compared to last year. That’s the largest year-over-year decline among winter heating fuels covered in the outlook. On a national average, no winter heating fuel’s expenditures are expected to increase, owing to warmer forecast temperatures across much of the country. That’s not necessarily the case on a regional level, however. Natural gas bills in the South, for example, are likely to rise significantly, by about 4 percent, primarily as a result of higher regional natural gas prices, the EIA says.

- Lower wholesale propane prices and higher U.S. propane inventories also are worth noting with the heating expenditures forecast. As of Sept. 30, wholesale propane spot prices at the Mont Belvieu hub were almost 60 percent lower than at the same time in 2018. EIA expects residential propane prices to be lower this winter compared with last winter because of lower crude oil and natural gas prices that feed into lower prices for retail propane and because of more abundant propane supplies nationally.

- U.S. propane (including propylene) inventories were at 100.6 million barrels on Sept. 27, the EIA reports. This was 15 percent higher than the five-year average for that time of year. (Inventories dipped under 100 million barrels in mid-October.) The high U.S. inventories are primarily the result of inventories in the U.S. Gulf Coast that were 23 percent higher than the five-year average. Inventories were also well above average in all other regions, with the exception of the Midwest, where inventory levels were closer to the five-year average.

- EIA forecasts that U.S. propane production at natural gas plants and refineries will be 12 percent higher this winter than last winter, total U.S. consumption will be 1 percent higher than last winter and net exports will be 32 percent higher than last winter.

- What’s a propane marketer to do with all of this winter forecasting information? Dave Bertelsen of Matheson says everything starts with having a solid propane supply plan. “Be very close with your propane supply partners,” he says. The company also follows a philosophy of “buy what you sell and sell what you buy,” and Bertelsen advises trying to avoid speculating on the market. “The North American continent is flush with propane supply, but world events can move the market based on emotion versus supply-and-demand fundamentals quickly,” he adds. Matheson also utilizes tank monitoring to inform management and its propane supply partners about plant storage levels. Though fundamentals suggest stable supply and pricing this winter, Bertelsen says late crop drying demand, coupled with a sharp, early cold snap, can create some pinch points in the delivery chain.

- During this heating season, the Northeast region will have an additional source of propane supply when Blackline Midstream reactivates the Providence, Rhode Island, import terminal, the EIA reports. In the Northeast, exports leave from the Philadelphia area in the Central Atlantic region, but U.S. imports mostly come into New England.

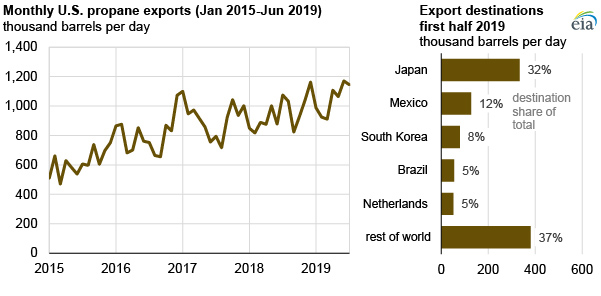

- Expansion of the Enterprise Product Partners’Houston Ship Channel export facility in the fourth quarter of this year could contribute to rising exports in the coming quarters, the EIA also notes.

Propane, distillate exports prevail

Speaking of exports, increased shipments of propane and distillate offset decreased exports of all other petroleum products in the first half of 2019, according to the EIA. Propane was the second-largest U.S. petroleum product export in the first half of 2019, at 1.03 million barrels per day (bpd), an increase of 142,000 bpd (16 percent) from the first half of 2018. Most U.S. exports of propane are destined for use as a petrochemical feedstock, mainly at facilities in Asia and Europe. Get more details here.

Propane market trends

Mike Sloan of energy consultancy ICF is a familiar face in the propane industry, speaking occasionally at meetings and trade shows about the propane market. He spoke earlier this month at the LP Gas Growth Summit and offered these takeaways.

- Domestic propane demand can’t keep up with production. While abundant supply lowers prices and theoretically gives propane an edge against its competitors, it’s too early to call whether low prices will alter market fundamentals in the long term.

- Larger, more geographically integrated companies stand to benefit most from increased production as they can take advantage of a more diverse range of supply sources than smaller companies. This will lead to more industry consolidation.

- Production growth has shifted the focus of large producers, processors and shippers from the U.S. retail market to large, easy-to-serve export markets. This means prices are becoming increasingly dependent on export capacity in places like China and Europe.

- Despite abundant supply, logistical hurdles remain for the U.S. retail market: “Just because there’s infinite supply doesn’t mean it’ll be where you want it when you need it,” says Sloan.