Year-over-year increase in inventory, but prices on uptrend

In recent Trader’s Corners, we have looked at fundamental trends in propane. We have focused a lot of our attention on the slowdown in domestic propane production. That decrease is a result of a decrease in U.S. crude and natural gas production and reduced refinery throughput. So far this year, domestic propane production is running 114,000 barrels per day (bpd) higher than during the same period last year. That is compared to supply growth of 179,000 bpd during the same period between 2018 and 2019. Over the past five weeks, propane production has been less than it was during the same weeks of 2019.

We think it is time to look at the scoreboard, so in this Trader’s Corner, we are going to focus on U.S. propane inventory levels.

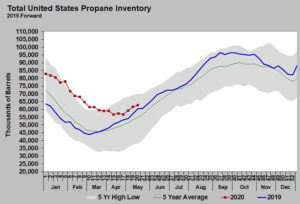

Currently, U.S. propane inventory stands at 64.240 million barrels. That is 3.731 million barrels above the 60.509-million-barrel mark at this point last year. That is a 6.2 percent year-over-year increase in inventory. At first glance, that feels like it should be bearish for propane prices. Yet propane prices have been in an uptrend. If traders were only looking at current inventory levels, that might not be the case.

But traders focus more on trends. At the beginning of the year, U.S. propane inventory was 82.784 million barrels. That is 19.160 million barrels higher than the beginning of 2019 and represents a 30 percent year-over-year increase in inventory.

In less than five months, inventory has gone from 30 percent higher than last year to just 6 percent higher. Over the last few weeks, the rate of drawdown in the excess inventory level has slowed. Propane export rates slowed down for four weeks, and production inched back up some.

The high inventory levels and the collapse of crude’s price had Mont Belvieu LST at a year low of 20.75 cents and Conway at a year low of 20.5 cents on March 23. By May 21, the changing fundamentals that drew down inventory had Mont Belvieu LST at a year high of 48.25 cents and Conway at a year high of 47.5 cents.

Propane prices slipped from those year highs, but the fundamental trends still suggest more upward price pressure is likely. There are situations out there that could change the trends and turn price outlook for propane from bullish to neutral or even bearish.

One we are watching closely now is the tension between the United States and China. There has been a lot of negative rhetoric between the two nations over the COVID-19 outbreak. The United States has accused China of not being forthcoming with information that could have helped contain the outbreak and avoided the pandemic. Of course, China has been very defensive on the matter, even blaming the United States for releasing the virus.

Now the relationship between the world’s two largest economies is getting more tense. China recently passed a security law that makes it illegal in Hong Kong to disrespect the national anthem of China. Violators will be fined and imprisoned for up to three years. Much of the rest of the world, led by the United States, says the measure violates the laws governing the relationship between China and Hong Kong.

The United States and China have engaged in a trade war that hurt the global economy through much of 2019. A partial trade agreement just before COVID-19 had reduced tensions and helped economic growth.

As part of this move toward better trade relationships, China had waived tariffs of around 28 percent on U.S. propane for some of its companies. Traders confirmed propane exports from the United States to China had resumed as a result. That kept propane exports high at the start of this year. Exports have been 125,000 bpd higher through the first 20 weeks of 2020 than the same period in 2019.

Should the relationship between the two countries deteriorate to the point that those tariff waivers are rescinded, exports directly from the United States to China will end. If that happens, it could change the trajectory of the inventory trends and jeopardize the bullish inventory trend for propane that has been occurring so far in 2020.

Call Cost Management Solutions today for more information about how Client Services can enhance your business at (888) 441-3338 or drop us an email at info@propanecost.com.