Reacting to a surprisingly light US propane inventory build

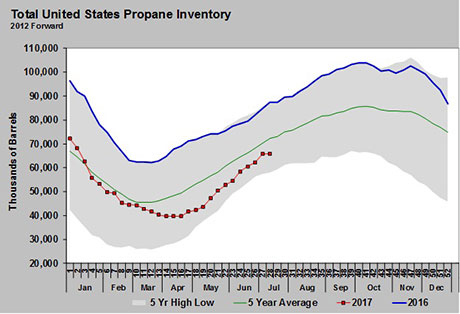

For the week ending July 21, the U.S. Energy Information Administration (EIA) surprised markets by reporting just a 200,000-barrel build in U.S. propane inventory. The light build put inventory 21.504 million barrels behind the same point in 2016.

Regionally, during the same period, Gulf Coast propane inventory declined 462,000 barrels. Propane had already been showing strength throughout July, and the light build continued to support the rally.

U.S. propane prices rising at this point may not be a bad thing if it helps back out more spot export cargoes, which would allow domestic inventories to build. However, much of the export volume is contracted, according to some industry sources.

This means higher prices now may only result in deferred liftings of cargoes, not an absolute cancellation. If that is the case, then higher prices now may only result in a bigger squeeze on supplies when winter begins in the Northern Hemisphere. In other words, the recent jump in prices can cause a U.S. retailer to delay a supply purchase and it may also cause an Asian buyer to delay a cargo. However, that doesn’t change the fact that they will both need supply this winter.

A lot is at stake here, which means we all need good information to evaluate what needs to be done. There is enough uncertainty in the market without the possibility of bad data causing more week-to-week volatility. We think that could be happening with some of the recent EIA reports.

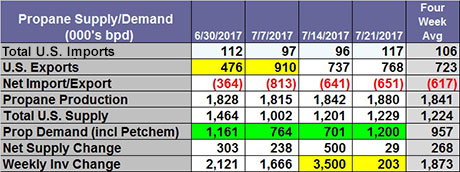

The table above is built from part of the report we send to our readers each week after EIA releases its Weekly Petroleum Status Report. It shows propane’s supply and demand balance. We have strung several weeks together to make a point about the data.

Before we begin, it is important to note that the data released by EIA may be spot on. We will simply be pointing out data points that seem odd to us. Ultimately, the data does not change the overall supply and demand situation. However, inaccurate data could cause buyers and sellers to overact and make decisions they otherwise would not have made.

It is important to know that domestic propane demand (highlighted in green in the table above) is a calculated, or implied, number. There are no reports submitted to EIA on domestic demand from which EIA builds its report. Instead, it collects data on imports, exports, production and inventory changes. Then, using the results of those four inputs, domestic demand is calculated, or implied.

Of course, any mistake in the input sources results in domestic demand being skewed. We have highlighted export data reported by EIA for the weeks of June 30 and July 7 in yellow in the table above. The week-to-week change is quite dramatic. The week prior, June 23, exports had dropped to 471,000 barrels per day (bpd) from 701,000 bpd, presumably due to Tropical Storm Cindy. The market was surprised exports didn’t recover.

If we assume the impact of Cindy lasted two weeks and the export number is correct, the logical place to see the impact would be in a higher inventory build. Instead, the impact seemed to be mostly on domestic demand, which increased from 916,000 bpd to 1.161 million bpd. This was somewhat of an odd increase in the middle of summer.

The next week, exports jumped to 910,000 bpd. Again, the expectation would be that would draw down inventory at an even faster pace, but according to EIA, it was U.S. domestic demand that tumbled to 764,000 bpd. In fact, inventory decreased week over week, but not as much as expected if exports were truly 910,000 bpd.

Now drop down to inventory change for the weeks of July 14 and July 21 and note the big week-to-week swing. Exports dropped to 737,000 bpd for the week of July 14, and domestic demand continued to decline, the inverse of the way things moved the previous week. The result was an inventory build of 3.5 million barrels, which was a surprise to the market.

Then the next week, exports remained fairly steady, but domestic demand surged 499,000 bpd week over week. Again, this was an odd change in the middle of the summer. The result was propane inventory built just 203,000 barrels. It was a build that was well below industry expectations and the five-year average change for the week reported.

If this light inventory build caused a propane retailer to buy propane for winter, it might not be a bad thing with inventory so far below normal. In fact, the jolt that caused a decision to be made could have been a blessing in disguise.

Our point here is that it is not always good to immediately react to the headline inventory change number, especially if it looks odd. We believe it is wise to look at the other four data points – imports, exports, domestic demand and production – and ask if those numbers look logical.

If they don’t, it might result in an opportunity if the general market goes into panic mode in reaction to the headline inventory number. If the number doesn’t look logical, it could mean an adjustment is coming the next week that could work in favor of those who did not overreact. The EIA data may have been perfect over the last four weeks. However, it appears that there may have been some data adjusting going on this month. If so, it can result in unnecessary volatility and regretful decisions.

Call Cost Management Solutions today for more information about how Client Services can enhance your business at (888) 441-3338 or drop us an email at info@propanecost.com.