Weighing the risks associated with locking in propane prices

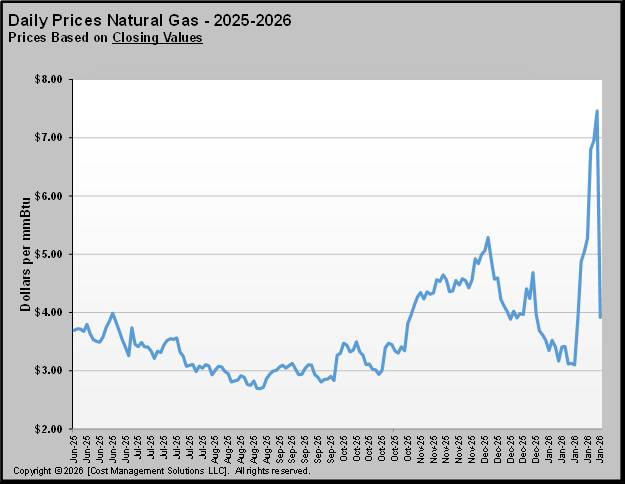

Mont Belvieu propane is currently trading at more than $1 per gallon. Conway is not far behind at 96.75 cents. Relative to West Texas Intermediate’s (WTI) crude price, Mont Belvieu is valued at 76 percent, while Conway is valued at 73 percent.

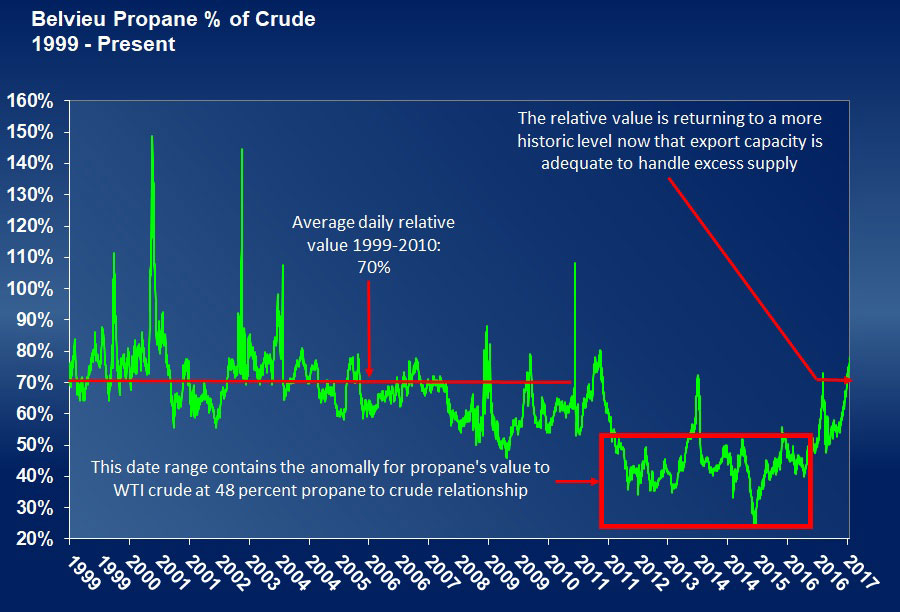

One year ago, propane prices were at half of where they are trading today. On Nov. 16, 2016, Mont Belvieu propane closed at 51.625 cents and Conway propane closed at 47 cents. Relative to WTI crude, Mont Belvieu propane was trading at 48 percent and Conway was trading at 44 percent.

Such a value change makes it difficult for retailers to decide to lock in these prices and protect customers from the potential of higher prices.

It wasn’t long ago that we used the chart above to show that propane’s relative value to crude is not the anomaly. The low valuation over the last five years was the anomaly. To have propane trading at the mid-70 percent of crude is not out of line for this time of the year, based on long-term history. That is especially true, given propane inventory declined 64 million barrels last winter and started this winter at just over 82 million barrels.

Knowing that fact does not alleviate the feeling of locking in propane prices around $1 per gallon seems like a terribly risky proposition. However, not getting price protection means prices will spike from here. Isn’t that the way it always seems to go? Whatever decision we make will be wrong.

Let’s just go ahead and accept we are going to make the wrong decision. What would be the “best wrong decision” a propane retailer could make in this environment? In our opinion, the best wrong decision would be to have price protection and see market prices fall. The opposite would be to not buy price protection and see prices rise.

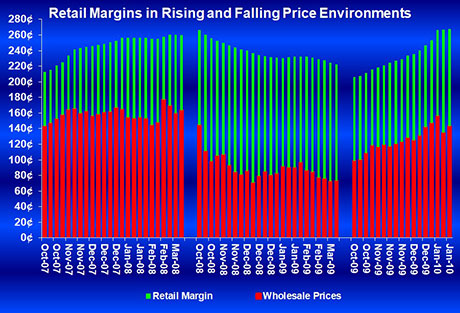

The chart above is from a study Cost Management Solutions conducted years ago, but the situation remains the same today. In the chart above, an entire column represents the national average retail propane price for the given months. The red lines show the national average for wholesale prices, and the green lines represent the margin for the propane retailer.

Note that in the rising price environment (first and last sections), the retail margins are shrinking. Propane prices at the hubs change by the second, and wholesale prices change daily. Yet, propane retailers are more hesitant in raising prices for customers. Price spikes could mean dimes-a-day hits to margin.

Of course, in a falling price environment (middle section of the graph), the slowness to lower prices works in the retailer’s favor. History shows that if a lot of propane retailers buy price protection, the lag will be more pronounced. Given this knowledge, the outcome is almost certainly going to be better, since retailers have price protection against rising prices.

However, with today’s argument, our assumption is the retailer is going to be wrong. The retailer is going to buy price protection and lock in prices that are higher than what market prices turn out to be down the road. The data shows a retailer’s tendencies toward prices for customers makes that the “best wrong decision.”

A major fall in prices in a retailer’s market over an extended period of time could cause margins to shrink as competitive pressures mount. However, at this point, we do not anticipate a major collapse in wholesale market prices this winter. Fundamentals would have to dramatically change for that to occur.

Call Cost Management Solutions today for more information about how Client Services can enhance your business at (888) 441-3338 or drop us an email at info@propanecost.com.